Euro dollar opened the week at the low ground it dropped to last week. Negative headlines over the weekend caught up with the growing chance that Greece will announce bankruptcy. Participation in the “voluntary haircut” is expected on Thursday, with a final EU approval for funds on Friday. Any delay will be worrying as the unmovable deadline of bond payments is getting close. Important US releases begin this very busy week, that culminates in the Non-Farm Payrolls.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

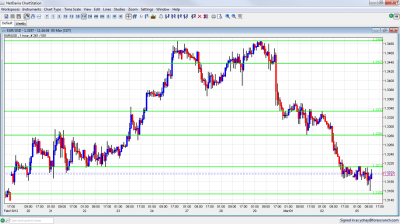

EUR/USD Technicals

- Asian session: Quiets session for a Monday sees the pair under 1.3212.

- Current range: 1.3150 to 1.3212.

- Further levels in both directions: Below: 1.3150, 1.3050, 1.2945, 1.2873, 1.2760, 1.2660 and 1.2620.

- Above: 1.3212, 1.3280, 1.333, 1.3430, 1.3486, 1.3550 and 1.3615.

- 1.3212 is getting stronger as resistance

- 1.3150 isn’t strong support. 1.3050 is stronger.

Euro/Dollar capped under resistance – click on the graph to enlarge.

EUR/USD Fundamentals

- 9:00 Euro-zone Final Services PMI. Exp. 49.5. Actual 48.8 points.

- 9:30 Euro-zone Sentix Investor Confidence. Exp. -5.4 points. Actual -8.2 points.

- 10:00 Euro-zone Retail Sales. Exp. 0%. Actual +0.3%.

- 15:00 US ISM Non-Manufacturing PMI. Exp. 56.1 points. Big hint towards the NFP.

- 15:00 US Factory Orders. Exp. -1.3%.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment – Details of hurdles

- Greek PSI in focus: The bond swap, in which private bondholders “volunteer” to lose around 74% of the bond value promised by Greece, is planned to end on March 8th. A participation rate of under 75% will be extremely problematic, as the Collective Action Clauses would not be triggered and the whole deal will fall. Headlines over the weekend suggested that there are doubts that there will be enough participants.

- Final final approval: Hopefully assuming that the bond swap will go through, the final approval for the release of EU funds is planned for March 9th or 12th. Euro-zone finance ministers noted that Greece made a lot of progress. Nevertheless, they are waiting for the bond swap to finish and for a “final assessment”. ThThe March 20th deadline is getting too close. Here are 5 hurdles that could further delay or cancel the bailout.

- Third bailout?: A report about a troika report says that Greece will need a third bailout by 2015, worth 50 billion euros, as Greece won’t be able to return to the markets by then.

- ISDA Doesn’t Call Default: The international body responsible for deciding if there was a default or not decided not to declare a credit event for now. They left the door open to more questions and a different decision, and noted the “evolving situation” in Greece.

- German ministers wants Greece to go: In a passive aggressive move, German finance minister Wolfgang Schäuble said that he will respect countries who want to leave. Greece doesn’t want to leave, but there’s a growing notion that it is pushed to declare bankruptcy. This joins the words of Hans-Peter Friedrich that said he would advise Greece to leave the euro-zone and said that Greece should be “made an offer it can’t refuse” to leave.

- Spain defies the EU: The Spanish government lowered growth forecasts and presented a budget with a deficit of 5.8%, higher than the EU target of 4.4%. Pessimistic forecasts are good news, but the high deficit won’t go well in austerity focused Brussels.

- ECB LTRO II: Around 800 European banks grabbed nearly 530 billion euros. They are now better equipped for a crash and European leaders can feel safe and let go of Greece. The side effect was that banks accumulated sovereign bonds as collateral for the operation.

- Plan B still possible: Despite the deal, things, such as the IMF contribution or more Greek misses, could still go wrong. There are reports about plans made in Germany and the US for a Greek bankruptcy on March 23rd, when Athens will raise a white flag and a bank holiday will be announced. Here are 5 more ominous signs that Greece is pushed to the corner.

- US Housing still sensitive: The sensitive housing sector has shown minor improvement via the existing home sales figure . Single family houses are still struggling, as well as foreclosures. The trend of falling jobless claims, at least in the 4 week moving average continued.

- US Employment in focus: Friday’s Non-Farm Payrolls could be decisive for QE3. Various important indicators lead up to the NFP. In Bernanke’s latest testimony, he said that the improvement in employment surprised him. This was enough to boost the dollar, big time. Chances for QE3 in March 13th remain low..