Dollar/yen resumed its upwards move after a break. Will this continue? The rate decision is the main event of this week. Here’s an outlook for the Japanese events and an updated technical analysis for USD/JPY.

Last week Average Cash Earnings remained unchanged in December despite forecasts of a 0.3% drop following 0.1% increase in the previous month and final GDP reading for the fourth quarter remained in line with predictions dropping 0.2%. Let’s see what is in store for us this week. The strong US Non-Farm Payrolls certainly helped the pair push higher at the end of the week.

Updates: Core Machinery Orders rebounded strongly, rising 3.4%. This figure was well above the market forecast. Interest rates remained unchanged, at below 0.1%. Tertiary Industry Activity dropped by 1.7%, a ten-month low. USD/JPY crossed above the 83 level, trading at 83.53. BSI Manufacturing Index fell to -7.3, well below the market forcast. Revised Industrial Production rose 1.9%. USD/JPY remains unchanged, trading at 83.50.

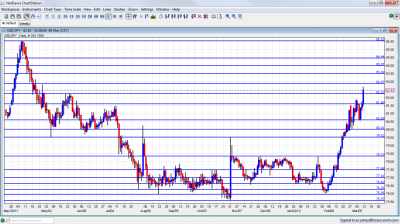

USD/JPY daily chart with support and resistance lines on it. Click to enlarge:

- Core Machinery Orders: Sunday, 23:50.Japan’s core machinery orders plunged 7.1% in December due to the strong yen and global slowdown. The fall was harder than the 4.8 drop predicted following 14.8% gain in November. An increase of 2.5% in machinery orders is expected now.

- Household Confidence: Monday, 5:00.Japan’s consumer confidence rose for the second consecutive month to 40.0 from38.9 in December amid optimism regarding labor conditions and rising inflation. Another rise to 40.8 is expected.

- Tertiary Industry Activity: Monday, 23:50.Japan service sector jumped 1.4% in December, much higher than the 0.9% gain expected by analysts and following 0.6% decline in the previous month. A smaller rise of 0.4% is forecasted.

- Rate decision: Tuesday. The Bank of Japan decided to ease further its monetary policy and pump an extra US$130 billion (10 trillion yen ) into its weak economy, another attempt to fight deflation and boost economic activity. This decision came as a surprise to many analysts. The BOJ has maintained its Overnight Call Rate between 0.0% to 0.10% as predicted. No change in rates is expected.

- BSI Manufacturing Index: Tuesday, 23:50. Large manufacturers inJapan became pessimistic regarding business conditions in the three months to December with a negative reading of -6.1 compared to10.3 in the third quarter indicating concerns over the EU debt crisis and the global slowdown. An improvement to 1.3pts is expected now.

- BOJ Monthly Report: Wednesday, 5:00. In its last report the Japanese government repeated its assessment that Japan’s economy is moderately picking up and increased its assessment regarding consumer spending for the first time in six months. Nevertheless the EU debt crisis and global slowdown were mentioned as possible risks, as well as damage caused by the earthquake and tsunami.

* All times are GMT

USD/JPY Technical Analysis

$/yen dropped at the beginning of the week, but managed to stay above 80.60, a new line that didn’t appear last week. It then moved higher, and after conquering 81.50, it managed to break above 82.20 and close at 82.45.

Technical lines from top to bottom

85.50 is even closer, but lines more dense here. This was a peak after a strong move in March 2011. It held for more than one day. 84.50 capped the pair at the end of 2010 and at the beginning of 2011 and is also an important line.

An important line of resistance is found at 84, which capped the pair back in February 2011. It is closely followed by minor resistance at 83.50.

82.87 was the line where the BOJ intervened in September 2010, and also worked in both directions afterwards. 82.20 was a stubborn peak in May 2012 and is now closer. It is likely to be strong resistance.

81.60 served as a temporary cap in March 2012 and is now a minor support line . 80.60 provided support for the pair around the same time, and served as a bouncing spot for the next moves.

The round number of 80, which provided strong support in June, is the next line, and it is of high importance. 79.50, is now a battleground. This is the line that was reached after the last non-stealth intervention.

78.30 capped a second recovery attempt in November, after the intervention and had an important role earlier as well, working as support. After it was broken, the rally intensified. It now switches to support. 77.50 is weaker now. It worked well also in October and the surge in February 2012 didn’t provide a clear break.

I remain bullish on USD/JPY.

The current account deficit in Japan, together with the recent easing by the BOJ, are in contrast to the improving situation in the US and the high chances of new dollar printing.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand Dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast

- For the Swiss Franc, see the USD/CHF forecast.