Euro/dollar tested lower ground, but managed to stay balanced, in a week that saw the final approval for the second Greek bailout and some dollar bullishness. The upcoming week features forward looking growth indicators, as well as other fiugres. Here is an outlook for the upcoming events and an updated technical analysis for EUR/USD.

Ben Bernanke not only left policy unchanged, but slightly upped the tone of the FOMC statement. The committee now puts more emphasis on inflation, and recognizes the improvement in employment. This certainly helped the dollar against the euro and broke some correlations. The approval from the Eurogroup and the IMF to the second Greek bailout comes despite IMF worries that Greece might exit the euro, and despite a deeper recession than thought in Greece, something that undermines the assumptions of the program. How long will this calm last?

Updates: European Trade Balance dropped to 5.9B, but was within market expectations. Current Account was very strong, recording a 4.5B surplus. This was its best level since September 2009. EUR/USD dropped below 1.32, trading at 1.3193. German PPI rose 0.4%, close to the market forecast. EUR/USD rebounded to climb above the 1.32 line, trading at 1.3249. The markets are awaiting Industrial Production. Industrial New Orders fell by 2.3%, a four-month low. German Manufacturing PMI was down from the February reading, as was German Service PMI.

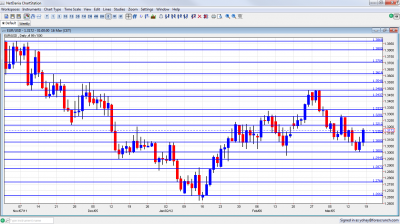

EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Current Account: Monday, 9:00. The overall balance between goods (trade balance), cash, services and more, switched back to positive ground last time, with a surplus of 2 billion. A smaller surplus is expected now: 4.3 billion.

- German PPI: Tuesday, 7:00. Producer prices in the continent’s largest economy surprised with a strong rise of 0.6% last time, correcting a previous drop. Prices will likely continue moving up once again, by 0.5%.

- Flash PMIs: Thursday. Begins in France at 8:00, continues in Germany at 8:30 and ends for the whole continent at 9:00. Recent purchasing managers’ indices have shown that the euro-zone is above the bottom it reached, but still finding it hard to grow. In France, both manufacturing and services sector are at the balance point between growth and contraction, at 50 points. They are expected to tick up a bit higher. Germany’s services sector is enjoying stronger growth, and this is likely to continue with accelerated growth, together with a small improvement in manufacturing. On the other hand, the area as a whole is still contracting, and isn’t expected to return to growth. Manufacturing is at 49 points, while services stands at 48.8.

- Industrial New Orders: Thursday, 10:00. The value of new orders surprised with a leap of 1.9%, correcting a previous drop of 1.1%. A drop of 2% is expected in this volatile indicator.

- Belgian NBB Business Climate: Thursday, 14:00. This wide survey has been in negative territory in the past 10 months, reflecting expectations for worse economic conditions. The upside is that the scores has been on the rise, reaching -7.7 points last month. Another small rise is likely now, to -6.3 points.

- Consumer Confidence: Thursday, 15:00. This official, 2300 strong survey is very stable, albeit at low ground. The score of -20 reflects significant pessimism. No change is likely now.

- Mario Draghi talks: Thursday, 16:00. The president of the European Central Bank also chairs the ESRB (European Systemic Risk Board Meeting). He will hold a press conference at the ESRB meeting in Frankfurt. Draghi is likely to feel satisfied about the achievements of the LTRO, which prevented a systemic risk.

* All times are GMT

EUR/USD Technical Analysis

Euro/$ dropped to the 1.3080 line, but managed to bounce from there at first. A second drop already found support at the round number of 1.30 (mentioned last week. After a new struggle with 1.3080, the pair made a late move higher, and eventually closed at 1.3172, close to last week’s close.

Technical lines from top to bottom:

1.3615 switched from support in October to support in November and is now resistance. 1.3550 capped the pair in November and December and marked the beginning of the plunge.

1.3486 was a distinctive double top in February 2012 and is a strong cap. It’s closely followed by minor resistance at 1.3437. The pair struggled there.

1.3333 provided some support for the pair during December 2011 and remains important despite being fought over at the beginning of March 2012. Quite close by, 1.3280 proved to be strong in both directions, including in recent weeks, over and over again.

1.3212 held the pair from falling and switched to resistance later on. It is the immediate line for now. This was the bottom border of tight range trading in February. 1.3150 is the lowest point recorded in October 2011, and now switches to minor support.

1.308 provided some support in March 2012 and also had a role in early 2011. The round number of 1.30 is psychologically important and is now stronger than earlier. It managed to keep the pair from falling.

The 1.2945 line is stronger once again and still provides support. 1.2873 is the previous 2011 low set in January, and it returns to support once again. This is a very strong line separating ranges.

1.2760 is a pivotal line in the middle of a recent range. It provided support early in the year. 1.2660 was a double bottom during January and the move below this line is not confirmed yet. 1.2623 is the current 2012 low, but only has a minor role now.

The reaction in markets to the strong jobs report resembles a similar move in December 2009, and could point to an avalanche in EUR/USD. See the charts here.

I remain neutral on EUR/USD for another week

The relative bullishness of the Federal Reserve will likely push the dollar higher, but the moves are rather limited. It’s important to note that correlations were broken (see video explanation) and this might help the dollar in the long term. In Europe, the relative calm around Greece support the pair, but the economies of the zone are still struggling. All in all, it’s a rather balanced picture for now.

If you have interest in a different way of trading currencies, check out the weekly binary options setups, including EUR/USD, GBP/JPY and more.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For the Swiss Franc, see the USD/CHF forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast.