Euro/dollar ended the week lower in the week that officially saw Greek entering a state of default. The upcoming week consists of meetings discussing the final aid for Greece by the EU and the IMF, an important survey and inflation data. Here is an outlook for the upcoming events and an updated technical analysis for EUR/USD.

Greece got 85.8% volunteers and passed the 95% figure using CACs. This put it officially in default according to rating agencies and ISDA. The Eurogroup decided on releasing the funds related to the bond swap but not the whole package. Not yet. On the other side of the Atlantic, another impressive jobs report was released. The chances of seeing QE3 now are very slim. When dust settles around Greece, the focus will shift to Portugal, which has little chance of returning to the markets in 2013.

Updates: German WPI came in at 1.0%, slightly lower than February’s reading of 1.2%. EUR/USD is back above the 1.31 line, trading at 1.3113. German ZEW Economic Sentiment sparkled at 22.3, its best reading since June 2010. European ZEW Economic Sentiment was also strong at 11.0, its strongest figures in almost two years. The markets are awaiting a decision by Fed Chair Bernanke. CPI figures showed little change, rising by 2.7%. Industrial Production was up 0.2%, better than February’s figures but below the market forecast. Employment change dipped 0.2%, an eight-month low. FOMC left its interest policy unchanged, as expected.

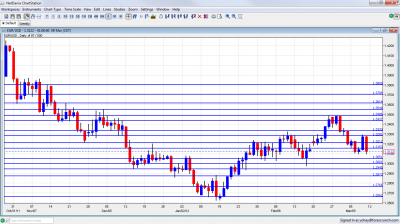

EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Eurogroup discussion on Greece: Monday. Tentative. The finance ministers were impressed by the progress made by Greece, but still need to decide on the full package. So far, they have released the sweeteners, accrued interest portion and other guarantees, but haven’t approved the full package. Regarding the bond swap, there’s still a loophole that could complicate things.

- German WPI: Publication time unknown at the moment. German wholesales prices surprised with a big leap of 1.2% last month, much more than expected. The ECB raised inflation expectations and Draghi was asked about rising German inflation, making this second-tier inflation indicator significant. A smaller rise is predicted now.

- French CPI: Tuesday, 6:30. Europe’s second largest economy saw prices falling by 0.4% last time, more than expected. A rise is expected now, as oil prices are felt.

- German ZEW Economic Sentiment: Tuesday, 10:00. This survey is highly regarded and tends to disappoint, in comparison with the IFO survey. Nevertheless, the trend changed in the past three months, with upside surprises. Last month, it even crossed the 0 line and returned to positive territory, reflecting optimism. A small rise is predicted from last month’s 5.4 points. The less important, all European number will likely follow and tick up from -8.1 points.

- CPI: Wednesday, 10:00. Headline inflation remains stable and above target, at 2.7% according to the first release. This will likely be confirmed, or even seen ticking up to 2.8%. Core CPI, which hit 1.5%, will probably remain unchanged.

- Industrial Production: Wednesday, 10:00.Industrial output is generally weaker in recent months, falling many times. After Germany reported a rise in production, the figure for the euro-area will likely be positive, correcting part of last month’s 1.1% drop.

- IMF Decision on Greece: Thursday, tentative. Assuming that the Eurogroup gives a green light to release funds to Greece to avert default, IMF money is still questioned. It already hinted that the sum will be lower than the previous round, around 13 billion euros.

- Employment Change: Thursday, 10:00. This is a rather late figure, but still provides a good wide picture. A drop of 0.1% was recorded in Q3. A bigger drop is likely in Q4. Spain’s unemployment rate is at 23.3% and is predicted to rise above 24% later in the year.

- Trade Balance: Friday, 10:00. The euro-area’s trade balance surplus surprisingly rose to 7.5 billion last month, and this support the euro. A smaller surplus is predicted now.

* All times are GMT

EUR/USD Technical Analysis

A first attempt to rise failed, and the pair dropped below the 1.3150 line, mentioned last week. When it managed to break higher it found resistance around the 1.3280 line, before turning all the way back and closing at 1.3122.

Technical lines from top to bottom:

We start from lower ground this time. 1.3615 switched from support in October to support in November and is now resistance. 1.3550 capped the pair in November and December and marked the beginning of the plunge.

1.3486 was a distinctive double top in February 2012 and is a strong cap. It’s closely followed by minor resistance at 1.3437. The pair struggled there.

1.3333 provided some support for the pair during December 2011 and remains important despite being fought over at the beginning of March 2012. Quite close by, 1.3280 proved to be strong in both direction, including in recent weeks, over and over again.

1.3212 held the pair from falling and switched to resistance later on. This was the bottom border of tight range trading in February. 1.3150 is the lowest point recorded in October 2011, and is an immediate cap to the pair.

1.3050 was the top border of a very narrow range that characterized the pair towards the end of 2011. It is now serious support on the downside after serving as the bottom border of the range and despite a temporary move under this line. The round number of 1.30 is psychologically important but is much weaker now.

The 1.2945 line is stronger once again and still provides support. 1.2873 is the previous 2011 low set in January, and it returns to support once again. This is a very strong line separating ranges.

1.2760 is a pivotal line in the middle of a recent range. It provided support early in the year. 1.2660 was a double bottom during January and the move below this line is not confirmed yet. 1.2623 is the current 2012 low, but only has a minor role now.

The reaction in markets to the strong jobs report resembles a similar move in December 2009, and could point to an avalanche in EUR/USD. See the charts here.

I turn from bearish to neutral on EUR/USD

The neutral stance assumes that smiles will still be seen in Brussels and Washington regarding the release of funds to Greece. Things will likely temporarily stabilize before turning for the worse, but this could happen sooner than later. The chances of really putting the Greek drama behind remain slim. A Greek bankruptcy announcement on March 23rd are still with us. Read more in the special report for Greece. Join the newsletter below to download it.

In the US, there is very little chance of any policy change right now. QE3 has no justification with the strong jobs report, which is positive also in Bernanke’s preferred figure.

If you have interest in a different way of trading currencies, check out the weekly binary options setups, including EUR/USD, GBP/JPY and more.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For the Swiss Franc, see the USD/CHF forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast.