Dollar/yen continued lower amid safe haven flows, and doesn’t seem to stop. Current account is the highlight of this week. Here’s an outlook for the Japanese events and an updated technical analysis for USD/JPY.

Last week the total average monthly earnings increased for the second consecutive month in March, up 1.3% on a yearly base, following 0.1% gain in February. However the sharp rise does not necessarily point to an improvement in the job market but comes as contrast to the plunge in March 2011 following the Earthquake and Tsunami disasters. Will the job market show areal recovery in the coming months?

Updates: The BOJ released its Monetary Policy Meeting Minutes on Sunday. The report is analysed for clues as to future fiscal and monetary policy and can impact on the direction of the yen. USD/JPY dropped back below the important 80.0 level, as investors looked for safe haven currencies after the election news in Europe. The pair was trading at 0.7982. The markets are waiting for the release of Current Account, a key indicator, on Wednesday. The market forecast calls for a sharp decline from last month, with a prediction of 0.65T. Leading Indicators came in at 96.6%, slightly lower than the market estimate of 97%. USD/JPY is unchanged, trading at 0.7980. The pair continues to trade in a narrow range, with the yen still below the 80 level at 79.66. We could see a break out of range following the release of Current Account, a key indicator, later on Wednesday. Current Account declined in April, but was much stronger than the forecast. The indicator posted a reading of 0.79T, well above the market estimate of 0.65T. Bank Lending slumped to a five-month low, increasing by a modest 0.3%. USD/JPY is unchanged. and was trading at 79.71.

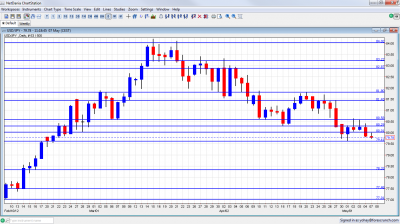

USD/JPY daily chart with support and resistance lines on it. Click to enlarge:

- Monetary Policy Meeting Minutes: Sunday, 23:50. The last minutes released on April 12 the BOJ held active discussions on how to achieve an inflation rate of 1.0%. In the March meeting, a policy board member suggested further monetary easing measures but was outvoted. BOJ Governor Masaaki Shirakawa said he would examine further monetary easing measures to help fight deflation on the next BOJ meeting.

- Leading Indicators: Wednesday, 5:00. The index forecasting future economic activity gained 2.1 points reaching96.6 in February. The rise was in line with economists predictions, suggesting an improvement in economic conditions. A further increase to 97.0 is expected now.

- Current Account: Wednesday, 23:50. Seasonally adjusted current account surplus edged up to 854.1 billion yen in February, from 115.6 billion yen in the previous month. Economists predicted a lower surplus of 660 billion yen. Japanese officials believe that the trade balance may remain low for a while due to downside risks by the European crisis. A drop to 650 billion is predicted this time.

- Bank Lending: Wednesday, 23:50. Japanese bank lending increased 0.8% in March compared to 0.6% gain in February. This is the fifth month of climbs. The main cause for this rise is demand for reconstruction projects.

- Economy Watchers Sentiment: Thursday, 5:00. Business confidence of people sensitive to economic conditions improved significantly in March, reaching 51.8 following a reading of54.9 in February suggesting stronger domestic consumption. A small decline to 52.5 is anticipated.

- M2 Money Stock: Thursday, 23:50. Japan’s M2 money stock increased 3.0% in March from a year earlier, following 2.9% climb in February. The increase was higher than the 2.8% rise predicted by analysts. Another 3.0% jump is predicted.

* All times are GMT

USD/JPY Technical Analysis

$/yen started the week with a drop to 79.60, a new line that didn’t appear last week. It then climbed again, trading within the 80 – 80.60 range before falling and closing under 80 once again.

Technical lines from top to bottom

85.50 is a key line on the far upside. This was a peak after a strong move in March 2011. It held for some time and remains the ultimate peak. 84.50 capped the pair at the end of 2010 and at the beginning of 2011 and is a bit weaker now.

An important line of resistance is found at 84, which capped the pair back in February 2011 and provided some resistance in March 2012. It proved by holding two weeks in a row. The minor line of 83.50, which was a glass ceiling for the pair during March 2012, closely follows.

82.87 was the line where the BOJ intervened in September 2010, and also worked in both directions afterwards. It worked as support when the pair traded higher and remains a cap. 81.80 served as support for the pair at the end of March 2012 and is now strong resistance after capping the pair also in mid April in more than one instance.

Close by, 81.43 is now stronger, after serving as resistance for a recovery attempt. 80.60 provided support for the pair around the same time, and served as a bouncing spot for the next moves.

80.30 worked as a good cushion for the pair in April. The fall below this level isn’t confirmed yet. The round number of 80, which provided strong support in June, is the next line, and it is of high importance.

79.60 was a double bottom in May 2012 and is now key support. 78.30 capped a second recovery attempt in November, after the intervention and had an important role earlier as well, working as support. After it was broken, the rally intensified. It now switches to support.

I am neutral on USD/JPY.

After the pair lost the 80 line without intervention from the BOJ, it might only get minimal support from the central bank at this point, in the form of stealth intervention. As worries in the US and Europe mount, safe haven will likely balance this stealth intervention.

Another note: USD/JPY so far justifies its title as the most predictable currency pair for Q2.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand Dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast

- For the Swiss Franc, see the USD/CHF forecast.