AUD/USD is another victim of the European debt crisis. It fell to its lowest levels since mid December.falling as low as 0.9958. An attempt to regain parity with the US dollar failed so far.

Australia’s economy isn’t doing too well, but this time it’s trouble from other countries hitting the pair. Updates.

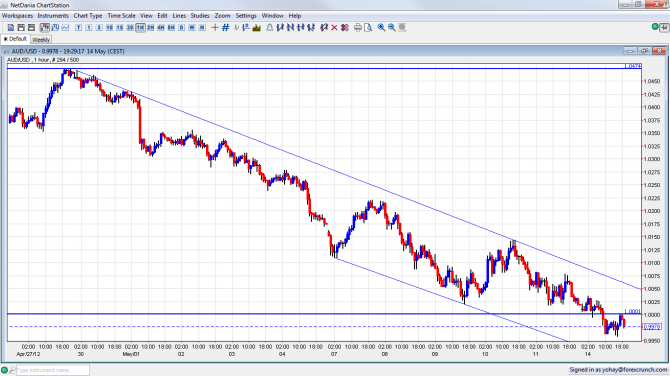

The Aussie is under parity at the time of writing, continuing the gradual slide. Note the downtrend channel that the pair follows. It is in the middle of if now.

- Australia: The Australian mining sector is still booming. Yet its probably alone: housing, retail and also manufacturing are turning lower. Recent job figures showed growth mostly in part time jobs. The RBA made a sharp 0.50% cut in the interest rate, and this probably isn’t the last. See more about the Australian economy in the monthly outlook.

- China: Australia relies on exports to the economic giant – its No. 1 trade partner. Worrying signs such as lower industrial production, falling demand for housing and lower electricity consumption all point to slower Chinese growth. The 50bp cut of the Reserve Ratio Rate shows the Chinese are acknowledging the situation. Yet worries remain.

- Greece: Last minute efforts to form a government will probably end in a failure and with new elections on June 10th or June 17th. The chances of Greece leaving the euro-zone are much higher, and many officials are talking quite loudly about it, including the ECB. This adds to the “risk off” sentiment. The Aussie is a “risk currency” and the US dollar is a “safe haven”. The uncertainty sends money from currencies such as the Aussie to the dollar and the yen.

- Spain: Also in Europe and also adding to uncertainty. Higher Spanish yields raise fears that the euro-zone’s fourth largest economy may need a bailout, especially as it slowly “adopts” more banks. These steps are probably not enough, as Spain prepares a “Plan C” for the economy and the banks.

If nothing dramatic happens, AUD/USD has good chances of falling further within the channel. For more lines, events and analysis, see the AUD/USD forecast.