The pound continued its sharp drop this week, as GBP/USD aiming to reach critical low support. The upcoming week has seven releases, including Manufacturing PMI. Here is an outlook for the upcoming events, and an updated technical analysis for GBP/USD. A weak GDP release in the UK is pointing to a deeper recession than forecast. As well, talk of a Greek exit from the Euro-zone and a lacklustre response to the fiscal crisis in Europe is weighing on the pound, which had a miserable May, losing around six cents against the surging US dollar.

Updates: Concerns of a Greek exit from the Euro-zone eased after a Greek poll indicated that the pro-bailout parties could form a coalition. The pound was up on the news, briefly breaking above the 1.57 level. GBP/USD was trading at 1.5696. CBI Realized Sales will be released on Tuesday. CBI Realized Sales was outstanding, hitting 21 points, which was well above the market forecast of -7. It was the indicator’s best performance since last May. The pound has edged downwards, as GBP/USD was trading at 1.5675. GBP/USD continued to drop, as investors flocked to the US dollar over concerns over funding issues in Italy and Spain. Net Lending to Individuals came in at 0.4%, above the market forecast of 0.2%. M4 Money Supply had a strong showing, posting a three-month high of 0.1%. Mortgage Approvals came in at 52K, slightly above the estimate of 50K. The pound shrugged off these postive releases, and was trading at 1.5582. Consumer Confidence was up slightly, but still deep in negative territory, at -29 points. Manufacturing PMI, a key index, will be released on Friday. The markets are anticipating a reading very close to the 50 level. The pound fell below the 1.55 line in the Asian session, before retracing in European trading. GBP/USD was trading at 1.5512.

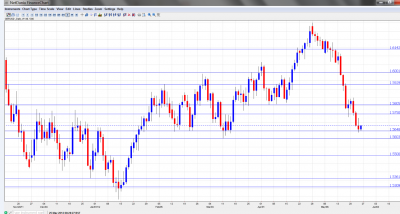

GBP/USD graph with support and resistance lines on it. Click to enlarge:

- CBI Realized Sales: Tuesday, 10:00. This index, based on a survey of retailers and wholesalers, slumped last month. The index recorded a reading of -6 points in April, down from the previous reading of zero. Little change is expected for the May reading.

- Net Lending to Individuals: Wednesday, 8:30. The April reading was 1.4 Billion, the second straight decline. The forecast calls for the downward trend to continue, with an estimate of 1.2B.

-

GfK Consumer Confidence: Wednesday, 23:01. The indicator has been deep in negative territory for years, and posted a reading of -31 points for the past two releases. The markets are expecting a similar reading this month.

- Nationwide HPI: Thursday, 6:00. This housing inflation index has contracted for the past two readings, indicating weakness in the housing sector. The market forecast calls for a flat readging of 0.0%.Will the index rebound and climb into positive territory this month?

-

Halifax HPI: Friday, tentative. This housing inflation index plummeted in the May reading, dropping by 2.4%. This was the index’s worst performance since October 2010. Will the index rebound and climb back into positive territory?

-

Manufacturing PMI: Friday, 8:30. This key indicator fell last month, posting a figure of 50.5. The markets are expecting contraction in the manufacturing sector, with a forecast of 49.7.

-

10-y Bond Auction: Friday, tentative. This indicator measures the average yield of 10-year government bonds sold at auction. The yield at the previous auction was 2.22/1.9.

*All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.5811. After reaching a high of 1.5841, the pound continued to slide, dropping all the way to 1.5639, as it broke through resistance at 1.5648 (discussed last week). The pair closed the week at lower ground, for the fourth consecutive week.

Technical levels from top to bottom

With the continuing sharp drop by GBP/USD, we start lower this week. We begin with resistance at 1.6142. This line has held firm since November 2011. The important line of 1.60 line is next. It has strengthened as USD/GBP trades at lower levels. Next, 1.5930, which was fluid in April, is providing resistance for the pair. Below, the line of 1.5805 which has strengthened as the pound has weakened. The next line of resistance is 1.5750, which was a strong support line since March, but is now in a resistance role. This is followed by weak support at 1.5648. This line was briefly broken this week as the pair dropped sharply. Next, there is support at 1.5603, which has held firm since January. This is followed by the round number of 1.55. The next support level is at 1.5361,which has held firm since January. Below, there is strong support at 1.5309. This line has not been breached since September 2010. The final line for now is at 1.5229.

I am bearish on GBP/USD.

After a strong start to 2012, the pound has taken a beating from the US dollar. How much further can it drop? The recession in Europe and crisis in Greece are sending nervous investors to safe haven currencies such as the dollar, and the greenback is taking full advantage. As well, the UK economy continues to sputter, as seen in indicators such as last week’s sharp drop in Retail Sales. Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.

- For the Swiss franc, see the USD/CHF forecast.