The kiwi enjoyed the relative calm in the markets and managed to recover nicely. The rate decision and Alan Bollard’s speech are the main events this week. Here’s an outlook for the events in New Zealand, and an updated technical analysis for NZD/USD.

Updates: Manufacturing Sales, releases quarterly, fell by 1.8%. This was the first reading in negative territory since December 2009. NZD/USD is trading at 0.7738. HPI rose a healthy 1.7%, indicating a more active housing sector. NZD/USD was trading at 0.7758. The central bank will release the Official Cash Rate later on Wednesday. No change is expected to the current level of 2.5%. NZD/USD edged upwards, as the pair was trading at 0.7789. As expected, the Official Cash rate remained pegged at 2.50%. The Reserve Bank of New Zealand followed up with a press conference, Rate Statement and its quarterly Monetary Policy Statement. The FPI (Food Price Index) came in at 0.3%. This followed two consecutive declines in the index. RBNZ Governor Bollard testified before Parliament’s Finance Select Committee in Wellington. The Manufacturing Index will be released later on Thursday.

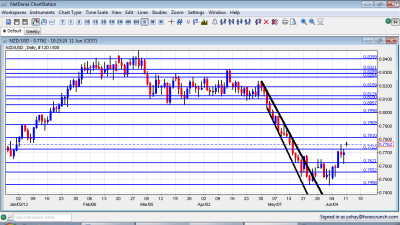

NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- Manufacturing Sales: Sunday, 22:45. Manufacturing sales grew in the last quarter of 2011 by 1.2, way above predictions for a 0.3% gain and following 0.2% increase in the third quarter. Dairy and meat products were the main contributors for this impressive rise. However excluding meat and Dairy products, manufacturing sales declined 0.7%.

- REINZ HPI: Tuesday.New Zealand house prices dropped in April for the first time in 3 months declining 0.3% but rising 2.7% on a yearly base. REINZ’s house price index fell 0.3 pct in April, but was up 2.7 pct from year ago. This rise followed a 1.9% climb in March indicating improves conditions in the housing sector.

- Rate decision: Wednesday, 21:00.New Zealand’s central bank maintained its interest rates at a record low if 2.5% after which RBNZ Governor Alan Bollard announced inflation is contained within the Bank’s target range and domestic economy is showing signs of recovery with improved housing market activity. However Global outlook remains uncertain and may cause downside risks for NZ recovery prospects.

- Westpac Consumer Sentiment: Thu-Mon New Zealand consumer confidence survey results remained soft in the first quarter rising to 102.4 after101.3 in the fourth quarter of 2011 raising concerns over the strength of the economy and inflation pressures. Subdues confidence means less consumer spending and lower growth for NZ economy in early 2012.

- FPI : Wednesday, 21:45. New Zealand’s food price index rebounded from March’s fall of 1.0% dropping a mere 0.1% amid lower prices of grocery food and drink prices. However vegetable prices increased.

- Alan Bollard speaks: Thursday, 1:10. Alan Bollard head of the RBNZ will testify before there Parliament’s Finance Select Committee, in Wellington. His words can cause volatility in the market.

- OPEC Meetings: Thursday. OPEC meetings are held in Vienna attended by delegates from 13 oil-rich nations deciding how much oil they will produce. In the next meeting on June 14 OPEC will elect a Secretary-General.Iran declared they will announcea candidate for this position.

- Business NZ Manufacturing Index: Thursday, 22:30. New Zealand manufacturing activity turned into contraction in April, plunging to 48.0 from53.8 in March, the lowest level in six months. Despite the disappointing score, economists tend to believe the manufacturing sector is on a positive growth trend

* All times are GMT.

NZD/USD Technical Analysis

Kiwi/dollar started the week capped under the 0.7620 line (mentioned last week). After breaking above this line, the pair settled in a range above this line and eventually closed just under 0.77.

Technical lines, from top to bottom:

0.8060 was resistance in October and support beforehand.. It was also tested in January and in March, is much weaker now after only temporarily stopping the fall. The round number of 0.80 managed to cap the pair in November and remains of high importance, especially due to its psychological importance.

Another round number, 0.79, is key resistance, after being a very distinct line separating ranges. 0.7810 was a double bottom in May 2012 and also served as resistance at the end of 2011, and now returns to this role after the crash.

0.7773 was the bottom border of a range at the beginning of 2012, and also in December. 0.77 provided support in December and now switches to support..

0.7620 provided support in May 2012 and is resistance once again, although weaker than in previous weeks. 0.7550 is resistance once again, even after the breakdown. It was a very distinct line separating ranges and had a similar role back in January.

Below, 0.7460 is significant support after working as support at the end of 2011 and also in May and June 2012. This is key support. 0.7370, which was the trough in December is low support. This is a significant line if 0.7460 breaks.

0.7308 is minor support after working as such at the beginning of 2011. 0.72 worked in both directions during the past few years.

0.71 is the last line, after being a distinct trough in March 2011.

Steep Channel Broken

As the graph shows, the breakout of the channel was indeed significant for stopping the downfall.

I am neutral on NZD/USD

The rate decision will likely be balanced at this time, and the optimism from the Spanish bailout announcement will likely manage to keep the pair up for some time before the markets sobers up and sees the holes in this deal.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast

- For the Swiss Franc, see the USD/CHF forecast.