The New Zeland dollar rode on QE3 and hit levels last seen back in March, but couldn’t keep all the gains. GDP growth and Current account are the highlights of this week. Here’s an outlook for the events in New Zealand, and an updated technical analysis for NZD/USD.

Ben Bernanke launched QE3 – an open ended $40 billion in monthly bond buys. This aggressive move hit the dollar across the board.The Reserve Bank of New Zealand kept its benchmark interest rate at 2.50% in light of concerns over Europe’s debt crisis, a slowdown in China and the strong kiwi. Domestically, the Bank of New Zealand expects economic activity to increase moderately over the next few years. Housing market is also on the rise and reconstruction in Canterbury is expected to further advance this sector. Will NZ continue to advance?

Updates: NZD/USD is stable around 0.8270. Tensions between China and Japan as well as European worries weigh big on the kiwi. The Current Account deficit widened in August, reaching -1.80 billion dollars. The market estimate stood at -1.63B. GDP will be released later on Wednesday. NZD/USD is steady, as the pair was trading at 0.8270. GDP climbed 0.6%, beating the forecast of 0.4%. Visitor Arrivals will be released later on Thursday. The markets will be hoping for a rebound from the previous release, a disappointing 3.4% drop. The kiwi is steady, as NZD/USD was trading at 0.8243.

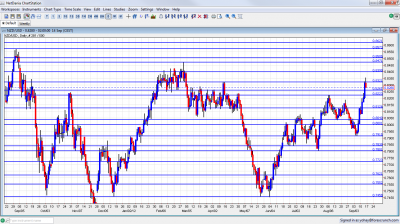

NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- Westpac Consumer Sentiment: Sunday, 22:00.New Zealand consumer confidence declined in the second quarter to 99.9 from102.4 in the first quarter, in light of growing pessimism concerning future economic conditions. However the decline was mild since present conditions came out positive.

- Current Account Tuesday, 22:45. New Zealand’s current account deficit contracted in the first quarter to 1.31 billion from 2.83 billion on the preceding quarter upon rising exports of goods and services. Nonetheless a decrease in imports and a reduction in the revenue of foreign-owned companies can imply on a weakening in the local economy. Deficit is expected to widen in case domestic economy continues to expand. Deficit is expected to grow reaching 1.62 billion.

- GDP: Wednesday, 22:45. New Zealand’s economy expanded at the fastest rate in five years rising 1.1% in the first quarter following a 0.4% gain in the fourth quarter of 2011, well above the 0.5% predicted. Nevertheless, this could be a short-lived event in light of the worsening conditions in Europe. A grow of 0.4% is predicted.

- Credit Card Spending: Friday, 3:00. Credit card billings in New Zealand increased by 0.1% on a yearly basis in July following a 3.9% gain in the preceding month. However Credit card spending dropped 1.5% on a seasonally adjusted level to 2.6 billion New Zealand dollars.

* All times are GMT.

NZD/USD Technical Analysis

NZD/$ started the trading week capped under the 0.8125 line (mentioned last week). After conquering this line, 0.8225 served as a lid. And then, the surge sent the pair as high as 0.8350 before it closed at 0.8280.

Technical lines, from top to bottom:

We begin from a higher point this time. 0.8680 served as support when the pair traded higher during 2011. 0.8620 had a similar role around the same period of time.

0.8573 capped the pair in September 2011 and is distant resistance. 0.8505 served as support as well.

0.8470 was the swing high seen in February and remains important resistance. 0.84 was resistance back in February 2012.

0.8320 was a wing high in April, just before the big dive and remains a tough line. 0.8260 capped the pair during March, and is stubborn resistance and is support once again.

0.8220 worked as stubborn resistance in August 2012 and it also slowed down the rally in September 2012. 0.8125 separated ranges in August 2012 and has renewed strength now after capping the pair in September 2012.

0.8040 capped the pair in August 2012 and also served as support during the same month. It is weak support after temporarily holding the pair down. The round number of 0.80 managed to cap the pair in November and remains of high importance, especially due to its psychological importance. It was hit by the recent moves and somewhat weaker now.

0.7915 served as an important cushion when the pair was falling in September 2012. 0.7840 provided support for the pair several times during June 2012 and also worked as resistance back at the end of 2011.

The round number of 0.78 is significant support after working as such in July 2012. 0.7723 supported the pair back at the beginning of 2012 and also worked in the other direction in June 2012. 0.7620 provided support in May 2012 and is resistance once again, although weaker than in previous weeks.

I am bearish on NZD/USD

The pair failed to close at higher levels despite QE3. Chinese issues remain problematic, and the central bank in New Zealand is nervous about the strength of the kiwi. We could see some correction at these levels.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.

- For the Swiss Franc, see the USD/CHF forecast.