EUR/USD enjoyed hopes for progress in the debt crisis and advanced within its range. With no real breakthroughs, the pair didn’t break critical resistance. Is it set to fall now? Public appearances by Mario Draghi, German Ifo Business Climate and the forward looking Flash PMI’s are the main events . Here is an outlook for the upcoming events and an updated technical analysis for EUR/USD.

The EU Summit didn’t make progress on debt crisis issues: No announcement about a fresh cash disbursement was made. Also regarding Spain, the lack of progress with a banking union probably didn’t help Spain make a decision about a bailout. In addition, Spain successfully sold government bonds with a 10 year, 3 year and 4 year maturity, exceeding its auction targets. The 10-year benchmark bond bailout reached 5.458%, lower than the 5.666% seen in the previous auction. So, a bailout request would help the euro, but Spain is not certain it really needs external aid.

Update: There is a report about a new buy back scheme in which Greek debt would be reduced rapidly. This could improve market mood and lift the euro. Update 2: Spanish Regional Elections: Rajoy’s PP Wins in Galicia, Nationalistic Parties win Basque Country. The Moody’s credit rating agency downgraded five regions in Spain, including Catalonia. Just last week, Moody’s surprised the markets by maintaining the central government’s credit rating. EUR/USD is down on ther news, as the pair has dipped below 1.30. EUR/USD was trading at 1.2999. There are reports of a leaked draft agreement between Greece and the troika. According to the agreement, there would be an extension of two more years to reach a primary surplus, which would likely be 4.5% of Greece’s GDP. In return, Greece is to continue implementing structural reforms, including raising the retirement age from 65 to 67. Euro-zone and German PMIs were a major disappointment, falling below the market estimates. German Ifo Business Climate also failed to meet the market forecast, as the German economy continues to sputter. ECB Mario Draghi held a press conference and addressed a parliamentary committee in the Bundestag in Berlin. M3 Money Supply fell to 2.7%, below the estimate of 0.3%. Euro-zone Private loans fell 0.8%. The estimate called for a smaller drop of 0.4%. Italian Retail Sales rose to 0.0%, but still fell short of the estimate of 0.3%. After testing the 1.30 line, the euro is edging downwards. EUR/USD was trading at 1.2983.

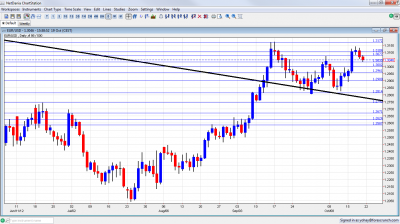

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Spanish local elections: Sunday. Spanish PM Rajoy’s home region of Galicia will go to the polls, which serve also as a test for his leadership. In addition, the Basque Country will also vote, and pro-Basque parties could gain, especially after Catalonia begins drifting away. Achievements for the ruling PP party will be seen as positive, while losses will limit the belief that Spain can take tough decisions.

- German Import Prices: Mon-Fri. Import prices in Germany edged up more than predicted in August, rising 1.3% following a gain of 0.7% in July, The figure was 0.4% higher than anticipated rising mainly due to higher energy costs. On a yearly base, German import prices, increased by 3.2% in August, following a 1.2% increase in July. A small increase of 0.3% is expected now.

- Belgium NBB Business Climate: Tuesday, 13:00. Belgian Manufacturers sentiment improved less-than-expected in September after posting a -11.8 reading in the previous month. Analysts expected Belgium NBB Business Climate to reach -11.1. These weak figures indicate a slowdown in the Belgian economic activity.

- Consumer Confidence: Tuesday, 14:00. Euro zone consumer confidence dropped in September reaching -25.9 from-24.6 in August, due to worsening conditions in the job market and high inflation rates. Household purchases decrease constantly amid the EU debt crisis eating away their savings. Analysts believe a recovery may only come in mid-2013. The reading is expected to remain -26.

- Flash PMIs: Thursday. Begins in France at 7:00, continues for Germany at 7:30 and ends with the all-European numbers at 8:00. The services and manufacturing sectors in the Euro-zone remain below the 50 point line for the 14th month, indicating contraction. The manufacturing PMI shows a slight rise to 46.1 in September from 45.1 in August. The flood of weak data suggests the EU fell into another recession. The situation in France seems worse with the biggest monthly falls in the survey’s 14-year history, and Germany shows modest growth in the service sector rising to 50.6 from 48.3 in August while remaining below the 50 point line in the manufacturing sector. A moderate increase is expected in all Flash PMI’s.

- German Ifo Business Climate: Wednesday, 8:00. Germany’s IFO business climate is one of the country’s key business sentiment surveys and is a major economic health indicator, not only for Germany but for the whole Euro-Zone. The reading in September dropped to 101.4 from 102.3 indicating economic slowdown. However these readings contrast the ZEW survey released earlier, pointing to an improvement in Germany’s economic activity. A small rise to 101.9 is forecast.

- Mario Draghi speaks: Wednesday, 11:45 and 14:00. European Central Bank president Mario Draghi will speak at the Bundestag in Berlin about the EU debt crisis. He will discuss the ECB bond buying option to aid struggling countries, and probably stress that governments have to agree to the ECB’s conditions before implementing this program.

- M3 Money Supply: Thursday, 8:00. The euro zone’s broadest measure of currency in circulation increased less-than-expected in August rising 2.9% after 3.6% gain in the preceding month. Economists expected a 3.3% rise. A further rise of 3.0% is predicted this time.

- GfK German Consumer Climate: Friday, 6:00. German household sentiment remained stable in September reaching 5.9 the same as in August despite a moderate growth in EU consumption. Nevertheless income expectations remain low. The Bundesbank predicts consumer spending will continue to increase in a slower pace due to uncertainty in the market, regarding the EU debt crisis. No change is expected this time.

- Spanish Unemployment Rate: Friday, 7:00. Spanish unemployment surged in the second quarter reaching a record high of 24.6% after posting 24.4% in the first quarter reaching 5.7 million. Nearly half of the unemployed are out of work for more than a year, and the future doesn’t look any brighter. Another rise to 25.2% is expected now.

*All times are GMT.

EUR/USD Technical Analysis

€/$ kicked off the week by rising from the 1.29 support line (mentioned last week). After crossing the 1.30 line, it continued higher but fell short of the critical 1.3170 cap.

Technical lines from top to bottom:

1.3480 is very important resistance: it was the peak seen in February. At the time, it was very stubborn. 1.3437 is of historic significant and is a minor line now.

The round level of 1.34 is a strong cap after serving as such during March. 1.3290 worked as resistance for the pair during April and is also of importance.

1.3170 worked very well as a double top during September 2012 and is now the top frontier. A failure to tackle this line shows that the pair has limited momentum. 1.3105 provided some support in April and is a rather weak line at the moment.

1.3075 worked as a nice separator in mid October and also in September. 1.3030 provided some support at the same period of time. Both are minor in comparison with the next line.

The very round 1.30 line was a tough line of resistance for the September rally. In addition to being a round number, it also served as strong support. It is now becoming more pivotal and a battleground. It is closely followed by 1.2960 which provided some support at the beginning of the year and also in September and October.

1.29 is a round number that also provided support when the euro was tumbling down back in May. 1.2814 was the peak of a recovery attempt in May and also capped the pair in September 2012. A slide lower in October 2012 almost met this line.

1.2750 capped the pair after the Greek elections and also had a similar role in the past. It is weaker now. 1.2670 was a double bottom during January and was the high line of the recovery before the Greek elections in June. It also capped the pair at the beginning of July 2012.

Long Term Downtrend Drifting Away

The line starting from February at the 1.3486 peak was formed in March and April. The rally sent the pair surging through this level, as the graph shows. The pair flirted with this line again and again. the recent move towards this line proved to work again as sending the pair away from the line and high.

I turn from bullish to bearish on EUR/USD

Expectations towards the EU Summit indeed pushed the pair higher. The lack of progress in this event has not been fully digested by the markets. In addition, the pair is still in relatively high ground with the recent range. Hope for the euro could come from a Spanish bailout request, that could have been delayed due to Sunday’s regional elections. However, Spain is really in no hurry.

In the US, no new big bang is expected from Bernanke after the QE-Infinity announcement, and unless GDP makes a huge surprise, the euro debt crisis is expected to stay in the limelight.

If you have interest in a different way of trading currencies, check out the weekly binary options setups, including EUR/USD and more. Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast