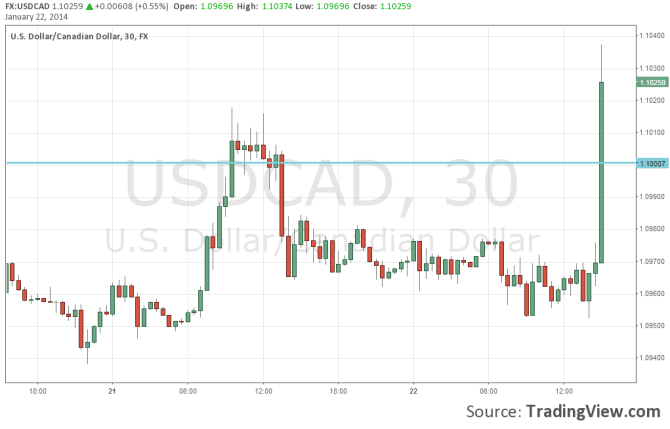

The dovish tone of the Canadian rate decision sent USD/CAD 50 pips higher to 1.1020, and the the move continues.

This is a new level last seen in September 2009. Update: The pair continues rising, setting a new high of 1.1037.

Update: A second move higher sends the pair to a new high at 1.1070. This is around 50 pips away from the important resistance line of 1.1125.

The initial move above 1.10 was made earlier in the week, when the pair topped out just under 1.1020. The chart shows how the move is a clear reaction to the statement:

The Bank of Canada says that downside risks to inflation have grown. This follows up on a warning about low inflation in the previous rate decision. While a rate cut isn’t likely soon, this tone certainly hurts the Canadian dollar.

The next decision move in rates will depend on the data, says the BOC. This could be a hint towards a hint of a rate cut in one of the next statements.

Stephen Poloz and his colleagues did acknowledge that there is a better potential for growth as well: the lower value of the Canadian dollar can help exports and eventually trigger more confidence and investment. They also see stronger US demand in the form of 3% growth in 2014 rather than 2.5% predicted earlier.

The next level looming above is 1.1125, which was a line of resistance back in 2009. For more events, lines and analysis, see the CAD forecast.