The New Zealand dollar continued advancing higher, riding on the weakness of the US dollar. Can it break the multi-decade highs? Business confidence is the main event in a week that marks the beginning of H2. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

There are growing expectations for a fourth consecutive rate hike in New Zealand, coming in the new month of July. This factor helped the kiwi. After a few days of positive figures from the US, the world’s No. 1 economy reported a huge contraction of 2.9% in Q1 GDP and this eliminated any chance of making gains. The kiwi, which had already enjoyed a nice rise in credit card spending, crystallized on this and tackled high ground.

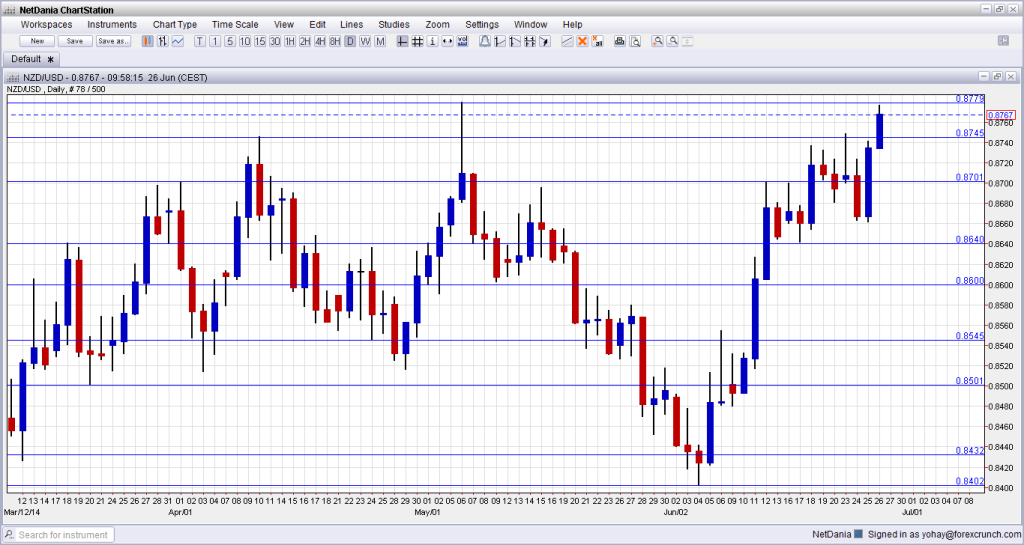

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- Building Consents: Sunday, 22:45. The number of building permits tends to be volatile, but in the month of April it stabilized with a modest gain of 1.5%. A small drop is likely now in this important housing sector indicator.

- ANZ Business Confidence: Monday, 1:00. This survey of around 1500 business has a strong influence on the kiwi. In February, the print above 70 points certainly gave a boost to the kiwi. Since then, the figure deteriorated and reached 53.5 in May. A correction to these falls is likely now, with a small gain.

- ANZ Commodity Prices: Wednesday, 1:00. As an exporter of food, the prices of commodities are critical to the economy. After a drop of 2.2% in May, a gain is on the cards for June.

* All times are GMT.

NZD/USD Technical Analysis

Kiwi/dollar started the week with an initial attempt to tackle the 0.8745 line (mentioned last week). It then retreated and lost 0.87, only to make a comeback, break above 0.8745 and challenged the 2014 peak of 0.8780.

Live chart of NZD/USD: [do action=”tradingviews” pair=”NZDUSD” interval=”60″/]

Technical lines, from top to bottom:

We start from the highest level in decades: 0.8840. This is the ultimate line of resistance. Above this point, only the round level of 0.90 awaits.

The May peak of 0.8780 is a very important line: the kiwi hesitated towards this line in June. The previous 2014 peak of 0.8745 is now weaker resistance after being broken.

The round number of 0.87 proved its strength during May and joins the chart as key upside resistance. The older swing high of 0.8640 worked as a pivotal line but eventually capped the pair.

It is followed by the round number of 0.86, which worked as a cushion during May 2014. The low of 0.8550 served as yet another pivotal line in the range.

0.85 is an important and very round number that looks like a clear separator of ranges. 0.8435 was the peak in September and was retested in January. It was a strong double top.

0.84, a round number, provided clear support in June. 0.8335 capped a move higher in December and also had a role in the past. The pair fell short of this line in January 2014.

I turn from bullish to neutral on NZD/USD

The kiwi certainly rallied nicely and at these levels it might be ready for a break, especially in light of the US Non-Farm Payrolls and the desire of the RBNZ to see a weaker exchange rate. Nevertheless, the pair’s long term direction remains up, especially as another rate hike is expected for July.

More kiwi: AUDNZD Could Trade Into 1.0880 Amid Key Shift

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.