The New Zealand dollar enjoyed more positive data from the local economy and advanced against the USD and the AUD. Does it have more to run? Trade balance and business confidence are among the highlights of a busy week. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

Retail sales in New Zealand came out better than expected, with a gain of 1.7% in Q4 and a 1.5% rise for core sales. Together with another leap in milk prices, 10.1% in the latest bi-weekly auction, the kiwi was well supported and selling AUD/NZD rallies received a recommendation. In the US, data was mixed.

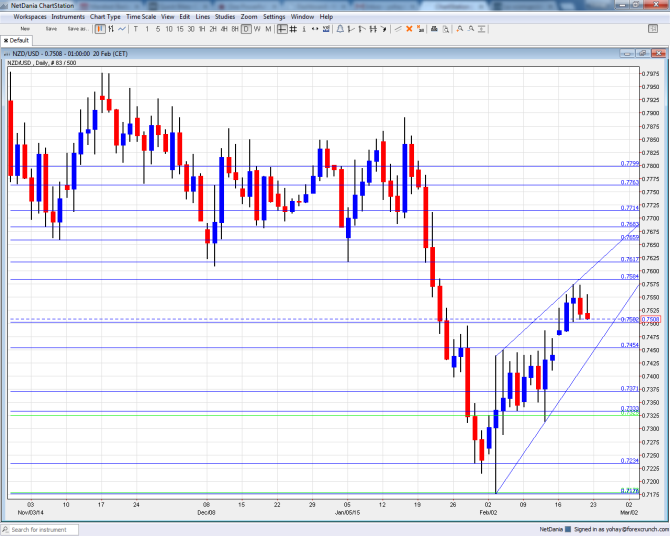

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- Credit Card Spending: Monday, 2:00. With retail sales published only once per quarter and the high usage of cards in New Zealand, this monthly indicator provides an indication on the situation. After a rise of 4.5% for December, a similar number is on the cards for January.

- Inflation Expectations: Tuesday, 2:00. This official publication by the RBNZ gives another look at inflation and the direction of interest rates. Expectations slowed down to 2.1% in Q3, and are expected to tick a bit lower now.

- Trade Balance: Wednesday, 21:45. New Zealand’s trade deficit squeezed to 159 million in December, but came out worse than expected. A very similar number is expected now: -157 million. A much wider deficit was seen in September.

- Visitor Arrivals: Wednesday, 21:45. Tourism plays a significant role in the economy. After a drop of 1.3% in December, a small growth rate could be seen now. Trade balance numbers could overshadow the figure.

- Building Consents: Thursday, 21:45. The RBNZ managed to cool the potential bubble with macro prudential tools. While this indicator is somewhat volatile, it has an impact. The number of consents slid by 2.1% after two strong months of gains. No big changes are on the cards now.

- ANZ Business Confidence: Friday, 00:00. This wide survey of 1500 businesses has stabilized around 30 points in recent months, after long falls from the highs. After 30.4 points in January, a small tick up is on the cards now.

* All times are GMT.

NZD/USD Technical Analysis

Kiwi/dollar started the week with a gap higher and managed to settle above the round number of 0.75 mentioned last week. It continued trading in high range throughout most of the week.

Live chart of NZD/USD:

[do action=”tradingviews” pair=”NZDUSD” interval=”60″/]Technical lines, from top to bottom:

0.7715 was stronger support after serving holding the pair in December. 0.7680 worked as support in December and that is where the pair stopped in early January 2015.

Below this point, we are back to levels last seen in 2012: 0.7615 now works as resistance after providing support during January 2015. It is followed closely by 0.7585 which capped the pair on an initial recovery attempt.

The very round number of 0.75 capped the pair just before the big fall and serves as strong resistance. It is followed by 0.7450 that had a role in the past.

The next line is 0.7370, which was a low point in 2011. It is followed by 0.7325, which capped the pair in the middle of 2010.

The recent 2015 low of 0.7235 is now the next support line. It is followed by 0.7180 that served as resistance back in 2010.

The swing low of 0.71 in 2011 provides further support before the very round number of 0.70.

Below this round number, we have 0.6950 and 0.6810.

I turn bullish to neutral NZD/USD

The kiwi certainly enjoyed the good data, and could now consolidate its gains, even if business confidence and other figures shine. The US dollar could be reminded of the upcoming tightening. Nevertheless, NZD could beat other currencies such as AUD.

In this week’s podcast, we cover Questions for traders, State of Fed, Greek crisis, oil, gold and GBP

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.