A new month begins and it seems that the dollar bulls are ready to rage.

The team at Goldman Sachs highlights the Australian dollar and the euro as major contenders for trades. Here are their views, targets and charts:

Here is their view, courtesy of eFXnews:

As the USD Index appears to be breaking out, a close above 95.86 should further confirm this, notes Goldman Sachs.

“95.86 is 50% of the Jul. ’01 to Mar. ’08 decline. Once the market is able to clearly break through this pivot, chances of it continuing its underlying trend should increase significantly,” GS argues.

“From then on forward, the target should be up at 102.50. This projection is derived from the triangle like pattern which developed from Mar. ’08 to Oct. ’14. Historically, these types of triangle break-outs have worked very well on the DXY (see late-’90s example),” GS adds.

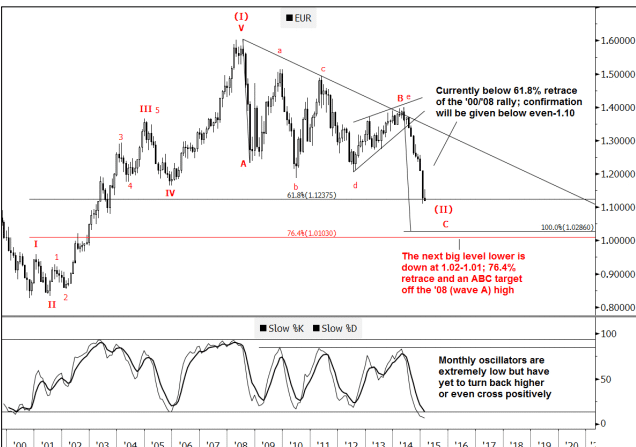

Same for EUR/USD where GS notes that it’s looking heavy again after breaking below 1.1237; 61.8% retrace of the ’00/’08 rally.

“There is very little support remaining below there until ~1.03-1.01. The psychological 1.10 pivot should also be watched as a confirmation level,” GS projects.

“From an Elliott wave perspective, it appears EURUSD is in the final leg of an ABC correction that started in ’08. The ideal target should really be down at 1.0286-1.0103. This is where 76.4% retrace from the ’00 low and an equality target off the ’08 high are converged,” GS adds.

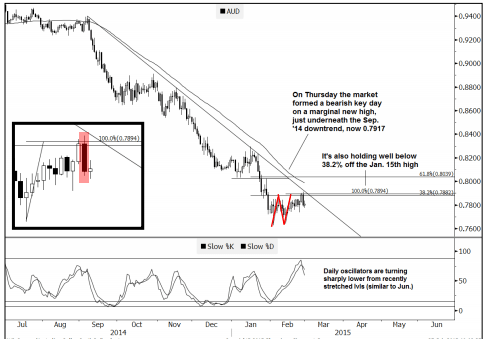

Finally, GS notes that AUD/USD is trading underneath its Sep. ’14 downtrend and 55-dma.

“It has also risen in an ABC manner which again indicates that the move higher is a corrective one. In addition, it formed a bearish key day reversal on Thursday on a marginal new high,” GS adds.

As such, GS thinks that AUD/USD is currently around the ideal level to establish bearish exposure with a daily close stop above the Sep. ’14 downtrend; currently 0.7917.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.