EUR/USD made its way higher, enjoying risk aversion, something unseen earlier in the crisis.

But what lies ahead? The team at CIBC examines:

Here is their view, courtesy of eFXnews:

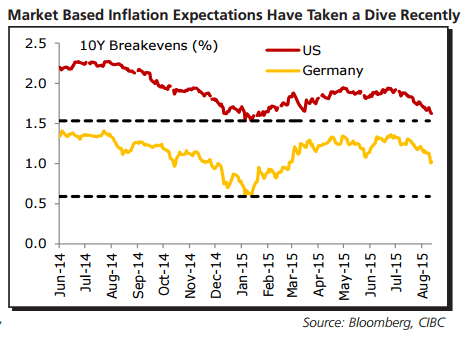

The renewed decline in oil price and uncertainty regarding China’s new currency regime has led to a sharp decline in market-based inflation expectations and led some to question if the Fed will still go ahead and raise interest rates in September, notes CIBC World Markets.

‘But helped by recent comments from the ECB of a turning point in inflation and some stronger readings recently, Eurozone inflation expectations have held up better and the euro has gained over the past week against the US$,” CIBC adds.

“However, once oil finds a new bottom and the Fed does indeed pull the trigger on a September hike, expect the US$ to regain that lost ground and more against the single currency,” CIBC argues.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.