The pound suffered huge losses last week, as GBP/USD plunged some 400 points. The pair closed at 1.3857, its lowest level since March 2009. Here is an outlook on the major events moving the pound and an updated technical analysis for GBP/USD.

US durable goods sparkled last week giving a boost to the surging US dollar. However, consumer confidence reports were mixed and New Home Sales was a disappointment. In the UK, Business Investment recorded a sharp decline, and Consumer Confidence missed expectations.

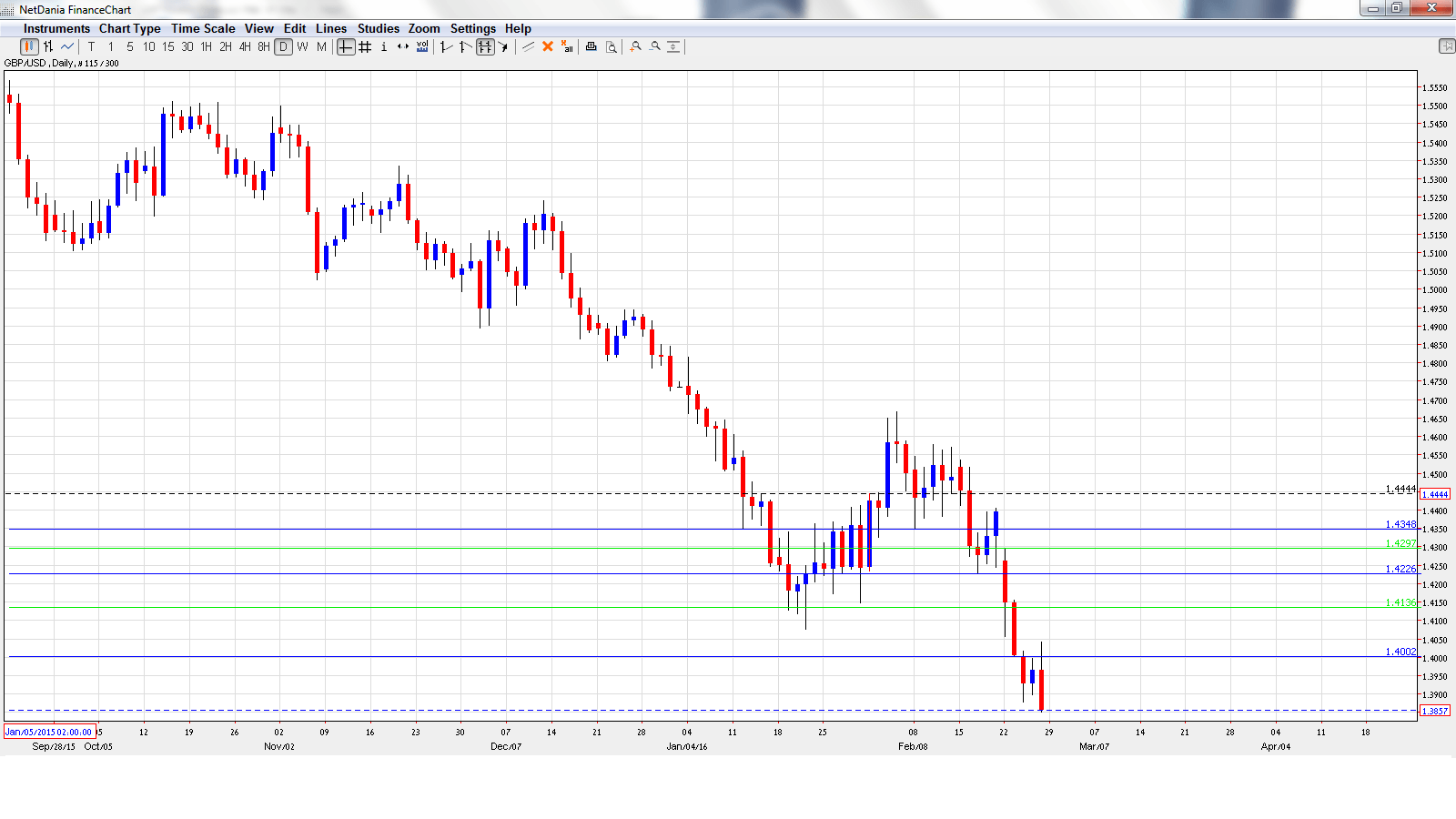

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- Net Lending to Individuals: Monday, 9:30. Lending levels are closely linked to spending levels, which are a key driver of economic growth. The indicator dipped to January in 4.4 billion pounds, short of the forecast of 4.9 billion. The markets are expecting improved numbers in February, with a estimate of 5.2 billion pounds.

- Manufacturing PMI: Tuesday, 9:30. This PMI improved in January to 52.9 points, beating the estimate of 51.8 points. The estimate for the February report stands at 52.3 points.

- Construction PMI: Wednesday, 9:30. The indicator slipped to 55.0 points, in January, compared to the forecast of 57.6 points. The estimate for February stands at 55.5 points.

- BOE Deputy Governor Ben Broadbent Speaks: Wednesday, 10:00. Broadbent will deliver remarks in London. The markets will be looking for clues regarding the BOE’s future monetary policy.

- BOE Deputy Governor John Cunliffe Speaks: Wednesday, 14:00. Cunliffe will speak at an event in London. A speech which is more hawkish than expected is bullish for the British pound.

- Nationwide HPI: Thursday, 7:00. This housing price index provides a snapshot of the strength of the UK housing sector. The indicator dipped to 0.3% in January, compared to a forecast of 0.6%.

- Halifax HPI: Wednesday, 8:30. The indicator has posted two consecutive gains of 1.7%, but the markets are braced for a weak gain of 0.1% in February.

- Services PMI: Wednesday, 9:30. Services PMI has been steady in recent readings, and the January reading of 55.6 points was very close to the forecast of 55.4 points. The estimate for February stands at 55.1 points.

- BOE Chief Economist Andy Haldane Speaks: Thursday, 19:45. Haldane will speak at an event in Manchester. The markets will be looking for hints regarding possible monetary moves by the BOC.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.4261 and quickly touched a high of 1.4297, as resistance held at 1.4346 (discussed last week). It was downhill from there for the pound, which dropped all the way to 1.3851. The pair closed the week at 1.3857.

Technical lines from top to bottom

With GBP/USD recording sharp losses last week, we start at lower levels:

There is resistance at 1.4346. This was an important support level in mid-February.

1.4227 is the next support level.

1.4135 marked a low point in December 2001.

The symbolic level of 1.40 is next. It was last breached in March 2009.

1.3809 is providing weak support and could see action early in the week.

1.3678 was a cushion back in June 2001.

1.3514 has provided support since January 2009. It is the final line for now.

I am bearish on GBP/USD.

In the US, recent figures have shown improvement, so the economy may be back on track after a lukewarm start to 2016. The British economy has not kept up, hobbled by very low inflation and hurt by a languishing Eurozone economy.

Our latest podcast is titled Time for Regrets? Referendum and Rates version

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.