It was a bad week for the pound, as GBP/USD dropped over 100 points last week, closing at the 1.44 line. Here is an outlook on the major events moving the pound and an updated technical analysis for GBP/USD.

In the US, there was good news on the employment front, as Unemployment Claims dropped to 262 thousand. CPI and Core CPI edged above their estimates, reviving speculation about a March rate hike. Over in the UK, unemployment rolls were sharply lower and retail sales jumped, but this wasn’t enough to stem the tide of a strong US dollar.

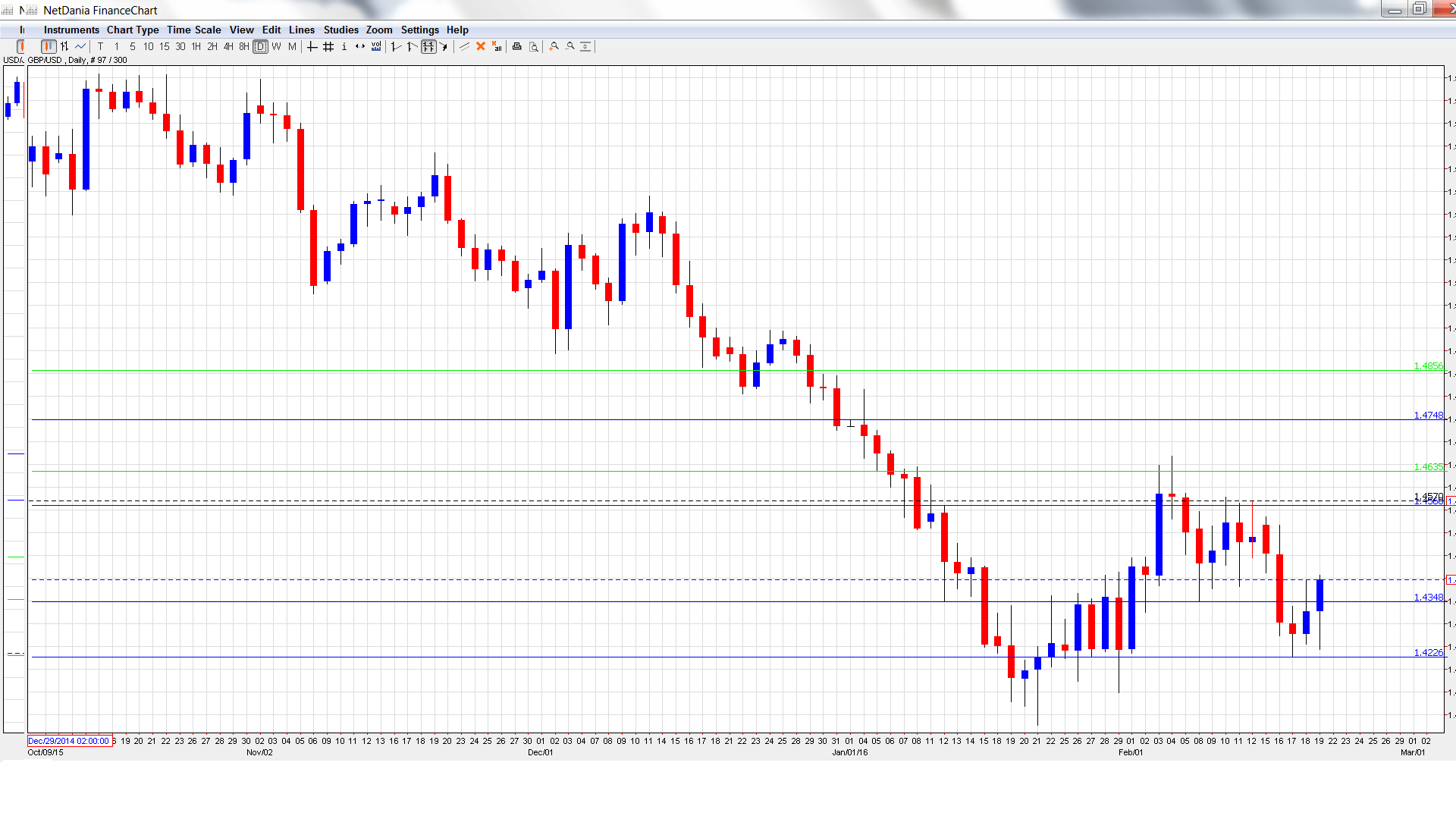

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- CBI Industrial Order Expectations: Monday, 11:00. This manufacturing indicator plunged in January to -15 points, marking a 3-month low. Another sharp decline is expected in February, with an estimate of -12 points.

- BBA Mortgage Approvals: Wednesday, 9:30. This indicator provides a snapshot of the health of the UK housing sector. In January, the indicator dipped to 44.0 thousand, short of the estimate of 45.5 thousand. The estimate stands at 45.2 thousand.

- CBI Realized Sales: Wednesday, 11:00. The indicator has posted two strong readings, and came in at 16 points in January. No change is expected in the February report.

- Nationwide HPI: Thursday, 25th-29th. The index slipped to 0.3% in January, short of the forecast of 0.6%. Will the indicator rebound in February?

- Second Estimate GDP: Thursday, 9:30. GDP reports are among the most important data and should be treated as market-movers. Preliminary GDP posted a gain of 0.5% in Q4, matching the forecast .Second Estimate GDP is expected to come in at 0.5%.

- Preliminary Business Investment: Wednesday, 9:30. This indicator is released each quarter, magnifying the importance of each release. The indicator dipped to 2.2% in Q3, but this was well above the estimate of 1.5%. The markets are expecting a softer reading in Q4, with the estimate standing at 0.6%.

- GfK Consumer Confidence: Friday, 00:05. The indicator improved to 4 points in January, its best showing in five months. Little change is expected in the February report, with an estimate of 3 points.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.4517 and touched a high of 1.4535, as resistance held firm at 1.4562(discussed last week). The pair then reversed directions and dropped to a low of 1.4426. GBP/USD closed the week at 1.4403.

Technical lines from top to bottom

We start with resistance at 1.4856. This line has held firm since late December.

1.4752 is next.

1.4635 has strengthened in resistance following the pound’s losses.

1.4562 was tested in resistance as the pair moved higher before reversing directions.

1.4346 is a weak support line.

1.4227 is the next support level.

1.4135 marked a low point in December 2001.

The symbolic level of 1.40 is the final support line. It was last breached in March 2009.

I am bearish on GBP/USD.

Although the US economy has slowed down in 2016, last week’s employment and inflation numbers beat expectations, so a March rate hike is again on the table. This monetary divergence between the Fed and the BOE is good news for the US dollar.

Our latest podcast is titled Oil’n’gold merry go round

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.