Expectations were low and reality even worse: prices dropped 0.2% in the euro-zone in February according to the preliminary release. In addition, there is no comfort in the core number: it fell from 1% to 0.7%, below 0.9% expected. This certainly adds pressure on Mario Draghi’s shoulders.

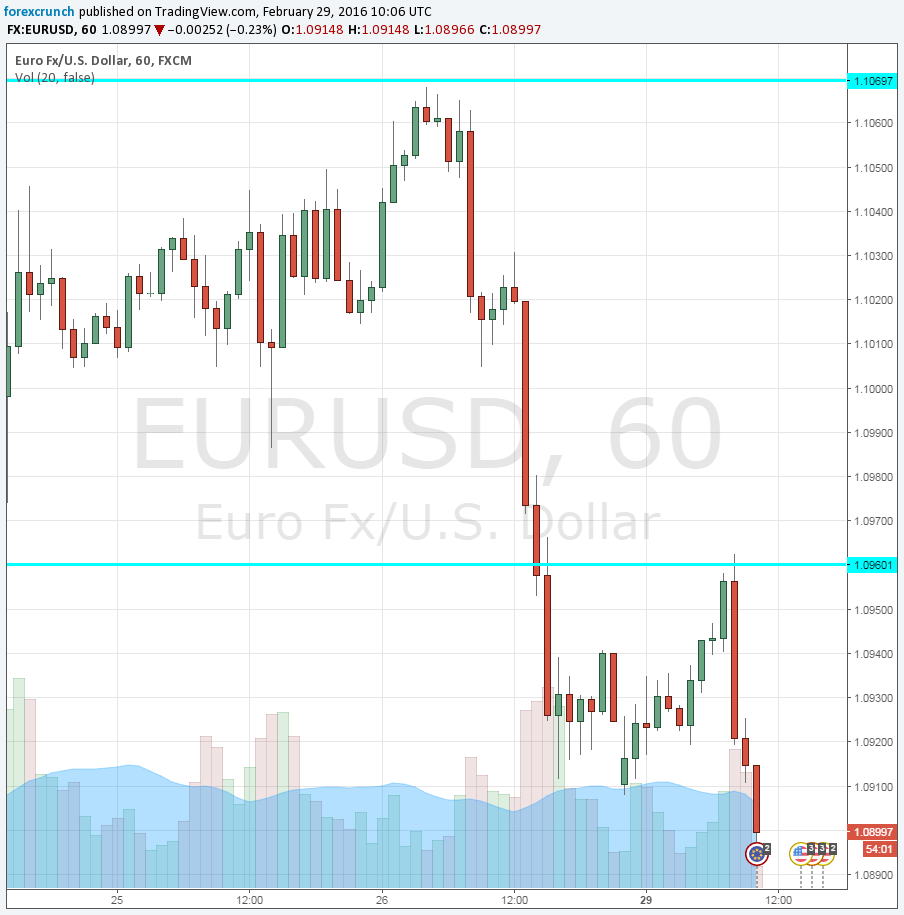

EUR/USD extends its falls and dips below 1.09. The low so far is only 1.0898. Support awaits at 1.0850 followed by 1.0770 and 1.0710. Resistance is at 1.0960.

The euro-zone was expected to report no change in prices, year over year in February. This is down from the final read of 0.3% for January (downgraded from 0.4% originally reported). Core inflation was expected to stand at 0.9% after 1% beforehand The figures feed into the ECB decision on March 10th.

EUR/USD was trading lower towards the release, around 1.0920, after being rejected at 1.0960.

On Friday, we learned that Germany fell back to deflation, with the preliminary HICP read standing at -0.2%. Also Spain’s figure fell short of expectations.

Also in Europe, the elections in Ireland resulted in a hung parliament, adding more uncertainty to Spain’s hung one. The G-20 summit resulted in worries about a Brexit but no real practical decisions.

More: Time To Sell EUR/USD? – SocGen