The Canadian dollar showed some strong movement last week but closed with slight gains. USD/CAD closed the week at 1.2980. This week’s key events are the Overnight Rate and Manufacturing Production. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

In the US, ISM Non-Manufacturing PMI beat the estimate, and the Fed minutes indicated that an April hike was very unlikely. The Canadian dollar lost ground early in the week but recovered following excellent employment numbers.

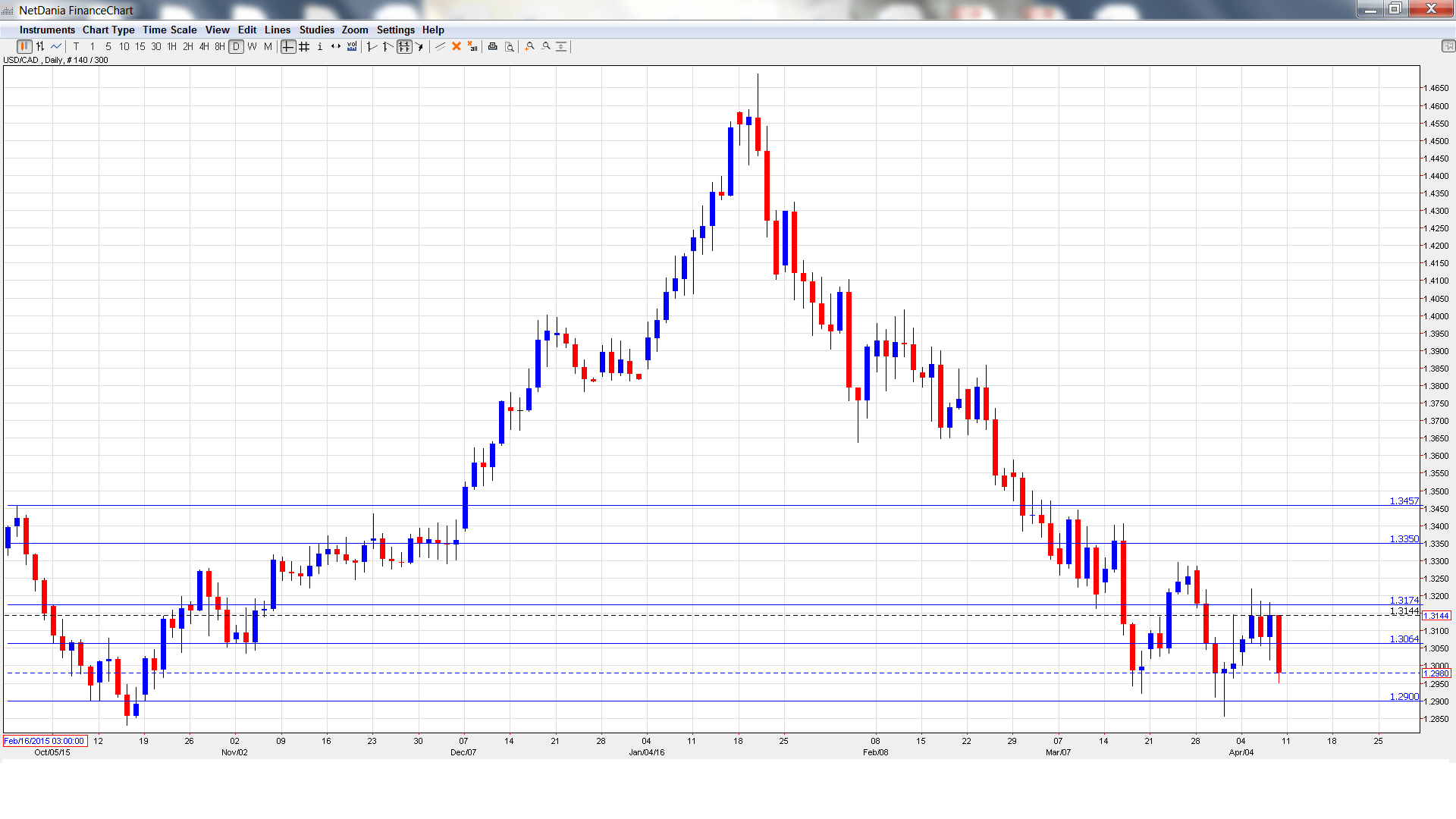

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- BOC Monetary Policy Report: Wednesday, 14:00. This quarterly report provides the BOC’s view on current economic conditions and inflation. Analysts will be following closely, looking for clues as to the BOC’s future monetary policy. The report will be followed by a press conference.

- BOC Overnight Rate: Wednesday, 14:00. The BOC will announce this month’s benchmark rate in a rate statement. The rate has been pegged at 0.50% since July 2015 and no change is expected in the April rate.

- NHPI: Thursday, 12:30. NHPI provides a snapshot of the level of activity in the housing sector. The index has posted two straight gains of 0.1%, missing the estimate each time. The markets are expecting the indicator to edge up to 0.2% in the February report.

- Manufacturing Sales: Friday, 12:30. The week wraps up with this key release.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3037 and reached a high of 1.3219. The pair then posted sharp losses late in the week, dropping all the way to a low of 1.2952, as support held at 1.2900 (discussed last week). USD/CAD closed the week at 1.2980.

Live chart of USD/CAD: [do action=”tradingviews” pair=”USDCAD” interval=”60″/]

Technical lines, from top to bottom

We start with resistance at 1.3457. This line has held firm since the first week in March.

1.3353 is the next line of resistance.

13174 was a cap in October 2015.

1.3064 is an immediate resistance line.

The round number of 1.2900 is providing support. This line was a cushion in October.

1.2780 is the next support level.

1.2646 has held steady in support since late June 2015.

1.2538 is the final support level for now.

I am neutral on USD/CAD

The Fed minutes poured cold water on speculation about an April rate hike, which would be bullish for the US dollar. Still, the US economy is on solid ground, and investors may continue to prefer the safe-haven greenback unless the Canadian economy posts strong numbers.

In our latest podcast we explain why the doves do NOT cry.

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.