Low inflation is not enough to move the Bank of Japan. Despite lowering growth forecasts and pushing back on inflation targets, the BOJ did not meet expectations to introduce more significant stimulus. They only introduced specific loans to earthquake hit areas, but the results of their inaction are aftershocks in markets, at least with everything yen related.

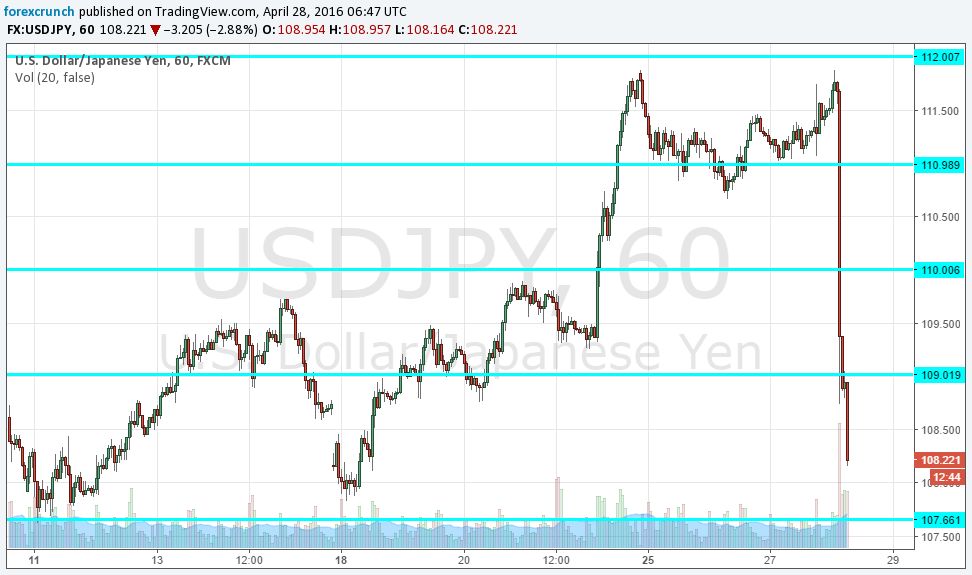

USD/JPY collapsed from nearly 112 to the 108 handle. Basically, it is erasing the gains seen last Friday when reports came out about the idea of paying banks to lend out money. This idea, formally known as “applying negative rates to loans” certainly made an impact. And after markets bought the rumor, there was no fact: smoke without fire, and the move is fully undone.

This came out on the same night that inflation dropped to negative ground. Yet again, the solution for the BOJ was postponing the inflation targets rather than using more means to accelerate it.

The moves are also seen on other currency pairs, but the strongest effect is in the major pair. That is because the Fed did not hint about a hike in June. They showed optimism and acknowledged the improvement in global and financial conditions, but their talk about “the next meetings” and not the singular next meeting in June (like they did in October) is quite telling.