The New Zealand dollar had a positive week, enjoying higher milk prices and a collapse of the greenback. It now faces a key test with the rate decision from the RBNZ. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

The Global Dairy Trade advanced for the second consecutive auction. The 3.4% gain certainly helped the kiwi. In addition, New Zealand’s Terms of Trade also surprised to the upside with a rise of 4.4% in Q1 2016, providing further support. In the US, the data came out more or less as expected until it totally bombed: the NFP came out a very lousy 38K, far worse than many had expected and hit the dollar hard.

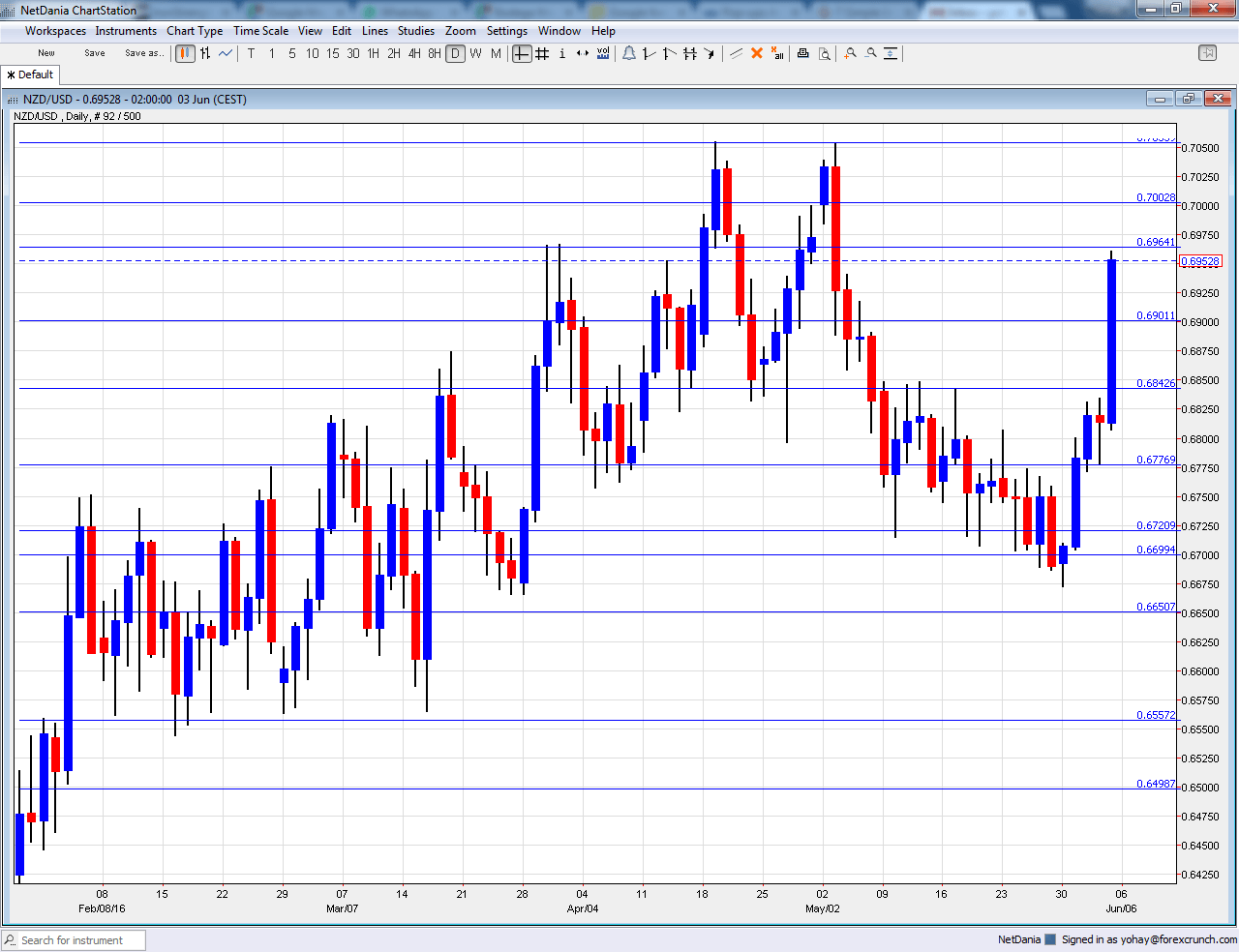

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Manufacturing Sales: Tuesday, 22:45. This indicator disappointed with a drop of 1.9% in Q4 2015. Will it rise now? A stronger manfuacturing sector is vital to diversify away from soft commodities.

- Rate decision: Wednesday, 21:00. The RBNZ convenes in a critical juncture, as worries about global growth persist and also inflation is looking mediocre. On the other hand, the employment situation remains OK and we have seen milk prices rising. The RBNZ could cut to weigh on the kiwi, that has been strengthening against the US dollar and also against the Australian dollar. The current interest rate is 2.25% and a slash to 2% could be seen now. However, nothing is 100% certain and the outcome also depends on the prospects for the next moves. This will certainly be an interesting decision. Note that RBNZ Governor Graeme Wheeler will also speak in a press conference at 23:00 and then two hours later at 1:00 GMT on Thursday, so there may be further reactions.

NZD/USD Technical Analysis

Kiwi/dollar found support in the new week and gradually advanced, tackling the 0.6840 level (mentioned last week). When it broke higher, the pair stopped exactly at 0.6940.

Technical lines, from top to bottom:

0.7160 worked as support when the kiwi was trading on much higher ground in 2014. 0.7050 was the high in April 2015.

The round level of 0.70 is still important because of its roundness but it isn’t really strong. The low of 0.6940 allowed for a temporary bounce.

The round 0.69 level has switched positions to resistance. 0.6840 capped the pair during May 2016 and tops the range. 0.6720 is the low seen in May 2016 more than once providing the lower bound.

The round level of 0.67 that works nicely as support. Another line worth noting is 0.6640, which capped the pair in November.

The post crisis low of 0.6560 is still of importance. Below, the round 0.65 level is of high importance now, serving as support.

I remain bearish on NZD/USD

The RBNZ could take the opportunity to weaken the kiwi, trying to curb the current strength.

Our latest podcast is titled Payroll Problem and Rate Readiness