Euro-zone inflation is not going anywhere fast: 0.2% is the headline. This is identical to the figure in July and leaves CPI far away from the 2% target the ECB has. Core inflation also fell short of predictions by actually falling to 0.8% from 0.9% last time. The unemployment rate stays at 10.1%, also behind projections for a fall to 10%.

EUR/USD is not budging for now.

The euro-zone was expected to report an annual rise of 0.3% in the Consumer Price Index for the month of August, up from 0.2% in the final figure for July. Core inflation was predicted to remain at 0.9%. Early releases were mixed: Spanish deflation was shallower than projected while Germany’s inflation measure missed expectations. French data came out in line with initial forecasts.

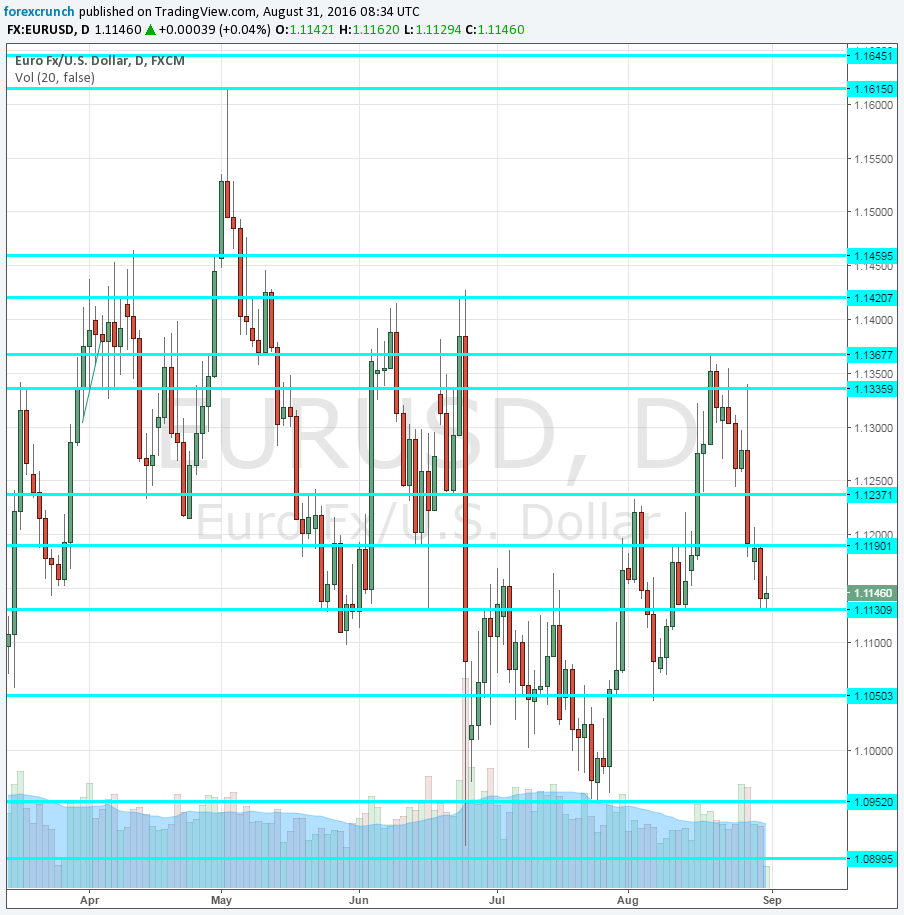

EUR/USD was trading steadily at around 1.1140, up from the low of 1.1130. The strength of the US dollar has dominated trading in recent days, following the Jackson Hole appearances by Fed Chair Janet Yellen and Vice Chair Stanley Fischer.

With no recent speeches from ECB President Mario Draghi, this data point, as well as comments from his colleagues, take center stage. The Bank convenes next week to make decisions on rates and other monetary policy measures. No big changes are expected despite the release of new forecasts. Perhaps the current QE program will be extended beyond March 2017.

More: EUR/USD Monthly Close Key For What’s Next For USD Rally – BofA Merrill