USD/CAD reversed directions and posted modest losses last week. The pair closed at 1.3471. This week’s highlights are the retail sales reports. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

US inflation numbers were mixed, while unemployment claims dropped to a 43-year low. In Canada, Manufacturing Sales beat the estimate, while CPI readings were within expectations. Update: WTI leaps on reports of progress in the technical OPEC talks in Vienna. The Canadian dollar follows, but hesitates.

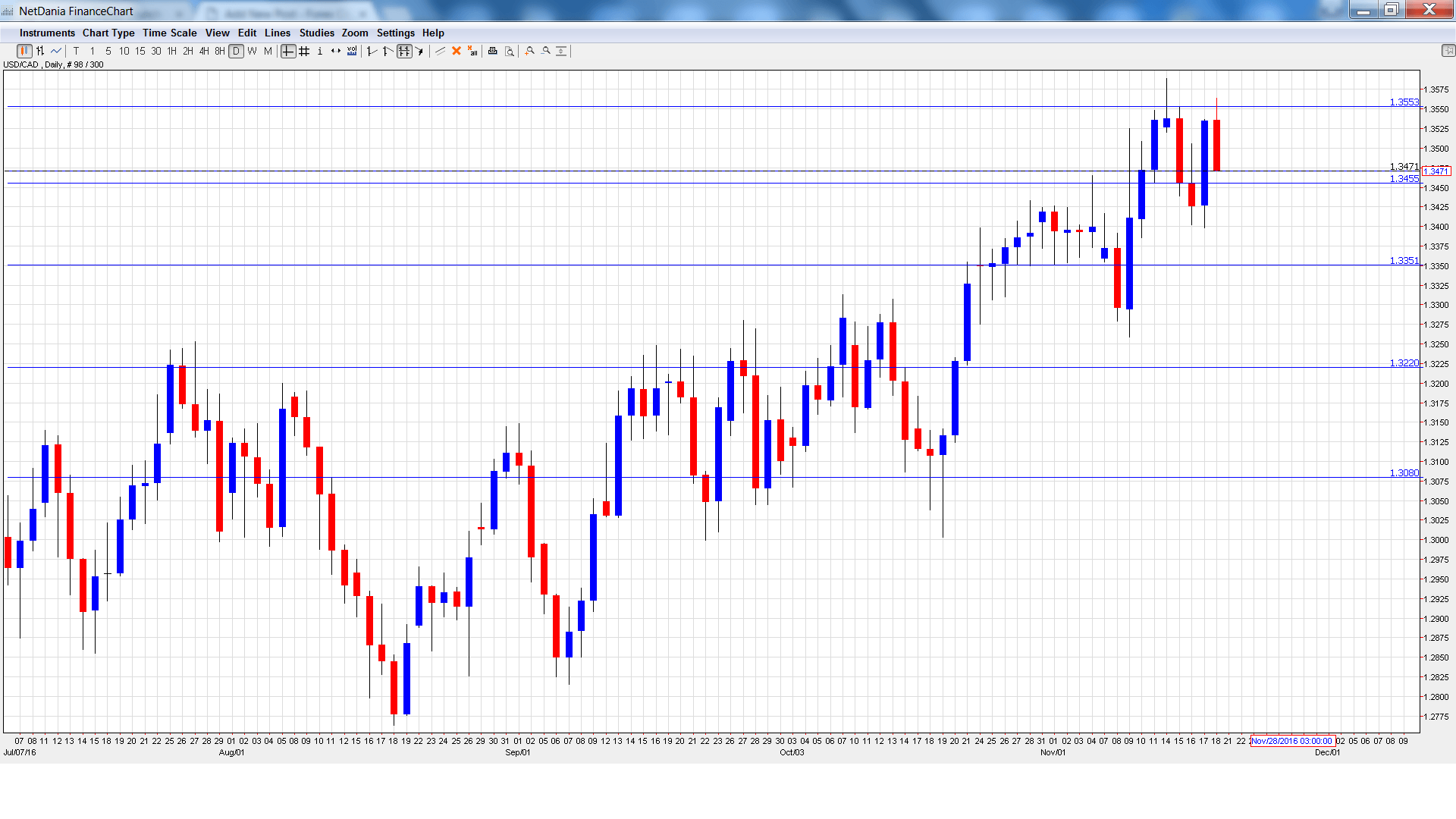

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Wholesale Sales: Monday, 13:30. The indicator jumped 0.8% in August, crushing the forecast of 0.2%. The estimate for the September report stands at 0.3%.

- Core Retail Sales: Tuesday, 13:30. This is the key event of the week. The indicator has failed to post a gain since June. However, the indicator is expected to rebound in September, with a forecast of 0.6%

- Retail Sales: Tuesday, 13:30. Retail Sales has posted three straight readings of -0.1%, all of which missed expectations. The markets are expecting a strong turnaround in September, with an estimate of 0.7%.

- Corporate Profits: Thursday, 13:30. Continuing declines in this indicator point to trouble in the business sector. In September, the indicator posted a decline of 3.4%.

USD/CAD opened the week at 1.3526 and touched a high of 1.3589, testing support at 1.3551 (discussed last week). USD/CAD then reversed directions and dropped to a low of 1.3398. The pair closed the week at 1.3471.

Live chart of USD/CAD:

Technical lines, from top to bottom

We start with resistance at 1.3911.

1.3813 was a cushion in January and February.

1.3672 is next.

1.3551 was tested early in the week as the pair moved higher before retreating.

1.3457 is a weak support level. This line was a cap in September 2015.

1.3351 is next.

1.3219 was a cap in April.

1.3081 is the final support line for now.

I remain bullish on USD/CAD

The US dollar has enjoyed broad gains since the Donald Trump won the US election. With the Fed expected to raise rates in December, sentiment towards the greenback is very favorable, and risk currencies like the Canadian dollar could take a hit.

Our latest podcast is titled Not all financial assets are Trump-ed equally

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.