The Canadian dollar reversed directions and posted modest losses last week. USD/CAD closed the week at 1.3076. This week’s key event is Manufacturing Sales. Here is an outlook on the major market- movers and an updated technical analysis for USD/CAD.

US numbers were mixed, as unemployment claims dropped and beat expectations. However, UoM Consumer Sentiment fell to a 3-month low, and missed the estimate. Canada added 48.3 thousand jobs, crushing the estimate of -10.1 thousand.

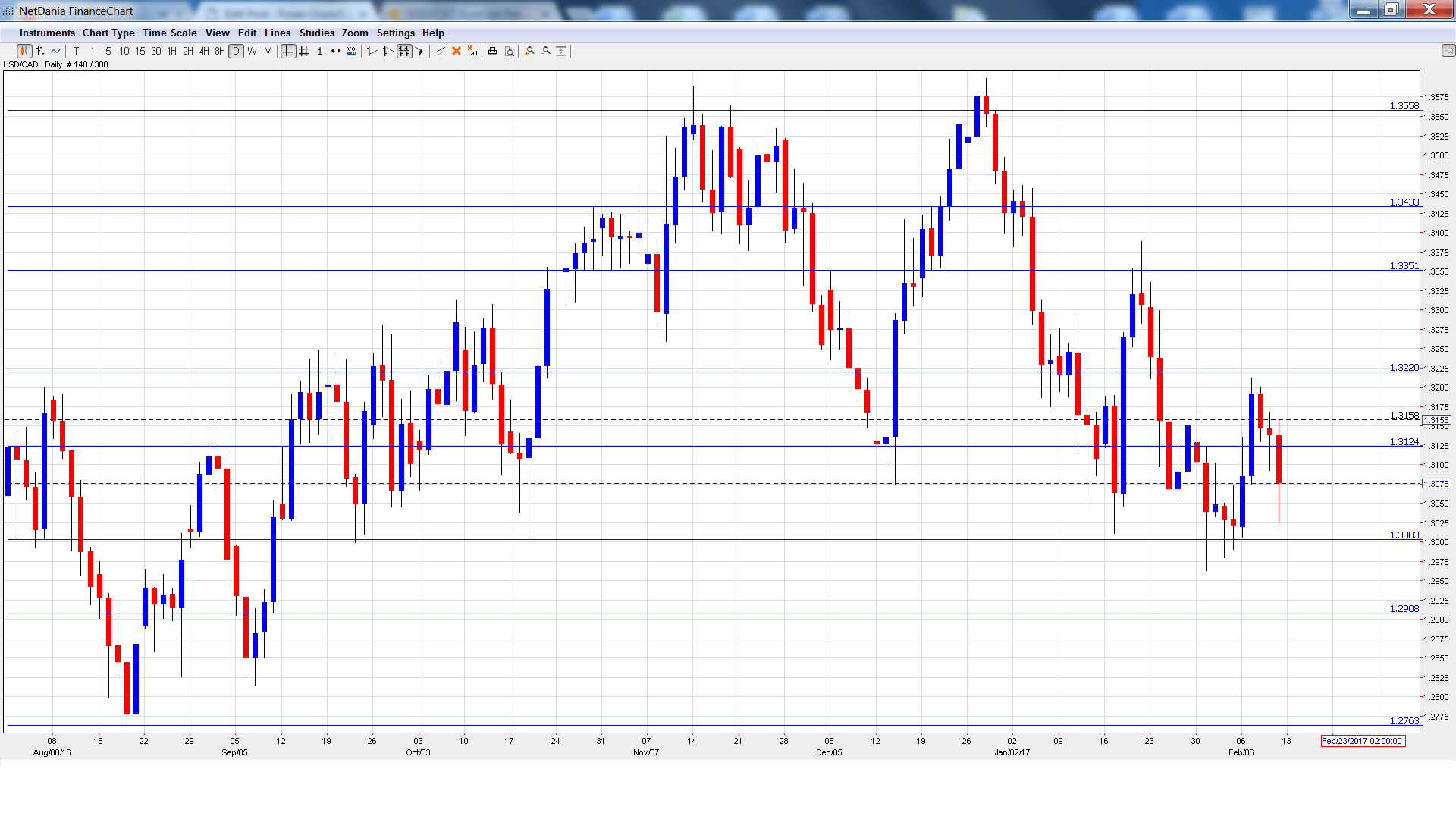

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Manufacturing Sales: Wednesday, 13:30. This is the key indicator of the week. In November, the indicator rebounded with a strong gain of 1.5%, crushing the estimate of 0.2%. Another strong gain is expected in December, with a gain of 1.4%.

- Foreign Securities Purchases: Friday, 13:30. The indicator fell to C$7.24 billion in November, short of the forecast of C$10.23 billion. Will we see a rebound in December?

* All times are GMT

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3019 and quickly touched a low of 1.3006. The pair then reversed directions and climbed to a high of 1.3212, as 1.3219 held firm (discussed last week). USD/CAD again lost ground and closed the week at 1.3076.

Live chart of USD/CAD:

Technical lines, from top to bottom

1.3433 was the high point in October.

1.3351 is next.

1.3219 has some breathing room following losses by USD/CAD.

1.3124 has switched to a resistance role.

1.3003 is protecting the symbolic 1.30 level. It is a weak support level.

1.2908 has held in support since September 2016.

1.2763 is next.

1.2653 has provided support since June 2016.

1.2562 is the final support line for now.

I am bullish on USD/CAD

The US economy remains in good shape, but Donald Trump’s theatrics and lack of an economic plan have led to uneasiness in the markets. Trump continues to make protectionist statements, and his promise to renegotiate NAFTA could hurt the Canadian economy.

Our latest podcast is titled Oil upside and euro underperformance

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.