EUR/USD managed to rebound from the lows ahead of Easter, getting back to the range. Will it stay there? Inflation figures and PMIs stand out ahead of the French elections. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Tension is rising towards the French elections, with the emergence of radical-left candidate Melenchon worrying many investors. Data has been mixed in the euro-zone: the German ZEW indicator beat expectations with 19.5 points and so did the Sentix Investor confidence with 23.9. Higher confidence was met with a disappointing drop in the industrial output by 0.3%. In the US, Trump trumped the dollar by saying it is too strong and that he likes low rates. In addition, Yellen’s future could be brighter under the President. He is no longer certain that she will be replaced.

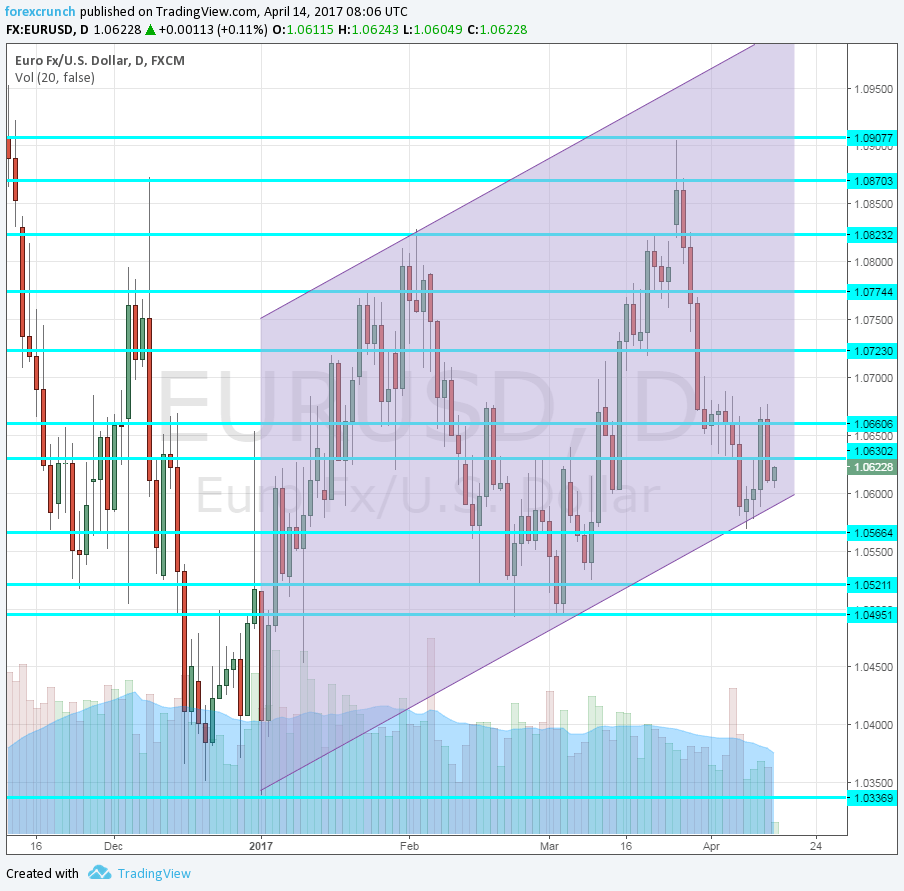

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- CPI (final): Wednesday, 9:00. Inflation is cooling down. According to the initial data for March, prices have risen by 1.5% y/y against 2% in February. Also, core inflation provided a setback: 0.7%, the lowest level since April last year. The numbers will probably be confirmed.

- Trade Balance: Wednesday, 9:00. The euro-zone enjoys a trade surplus thanks to German exports. However, this surplus squeezed in January to 15.7 billion, the lowest since late 2014. A higher surplus is likely now: 18.6 billion euros.

- German PPI: Thursday, 6:00. Producer prices make it into consumer prices, so this figure is watched. A monthly rise of 0.2% was recorded in February, below expectations. Another increase of 0.2% is on the cards.

- Flash PMIs: Friday morning: 7:00 for France, 7:30 for Germany and 8:00 for the whole euro-zone. According to Markit’s final numbers for March, France’s manufacturing PMI stood at 53.3 points, reflecting OK growth. A tick down to 53.2 is expected. The services sector was doing much better with 57.5 and is now predicted to slide to 57.2. In Germany, manufacturing came out on top with 58.3 and 58.1 is projected for April. Services lagged behind with 55.6 and 55.5 is on the cards. For the whole euro-zone, manufacturing was at 56.2 and services at 56. 56.1 and 56 are expected for the manufacturing and services sectors respectively.

- Current Account: Friday, 8:00. Similar to the trade balance, the euro-zone enjoys a current account surplus. And also here, it narrowed in January and stood at 24.1 billion after 30.8 beforehand. A bounce back to 26.3 billion is forecast.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar was on the back foot initially and slid to 1.0565. From there, it shot higher, but struggled with 1.0630 (mentioned last week) once again.

Technical lines from top to bottom:

The round number of 1.10 is the high line for now. The new 2017 high of 1.0905 is the next line.

The swing high of 1.0870 is the swing high in December and remains fierce resistance. 1.0830 was the 2017 high and follows closely.

1.0775 capped the pair in January and remains of importance. 1.0720 was also a high in January.

The pair was unable to crack 1.0660 in February and it remains the high end of the range. 1.0630 is the next level, holding back the pair in February and March.

1.0520 is a relic of the past but still serves as a cap. The more recent low of 1.0490 follows very closely.

Further below, we find the multi-year low of 1.0340. Only 1.0150 separates the pair from parity at this point.

Uptrend channel

EUR/USD has had three significant and rising lows in 2017: 1.0340 in the wake of the year, 1.0490 in March and 1.0565 in April. Also on the topside, we can see higher highs. If this is the case, there is more room to the upside than to the downside.

I am neutral on EUR/USD

Trump seemed to have ended the rally of the US dollar that was previously driven by a more upbeat Fed. In the euro-zone, the focus is on the French elections and tensions could keep things balanced until the common currency picks a direction, depending on the results.

Our latest podcast is titled Brexit Bad and “Clean Coal”

Follow us on Sticher or iTunes

Safe trading!