EUR/USD made its way to lower ground, struggling to gain ground. The week including Good Friday features business surveys and also some inflation figures. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Purchasing managers’ indices continued showing solid growth. The ECB left us a bit in the dark with contradicting comments, but the man at the top made things clearer. Draghi was dovish, leading to a triple bottom in EUR/USD. Opinion polls in France still favor Macron over Le Pen, but Fillon could still sneak into the second round. In the US, data was mixed, with a beat on the ADP but a miss in the services sector. The Non-Farm Payrolls report was bad with only 98K jobs gained, but wages were OK and so were the unemployment and underemployment measures. The dollar stabilized after the initial fall.

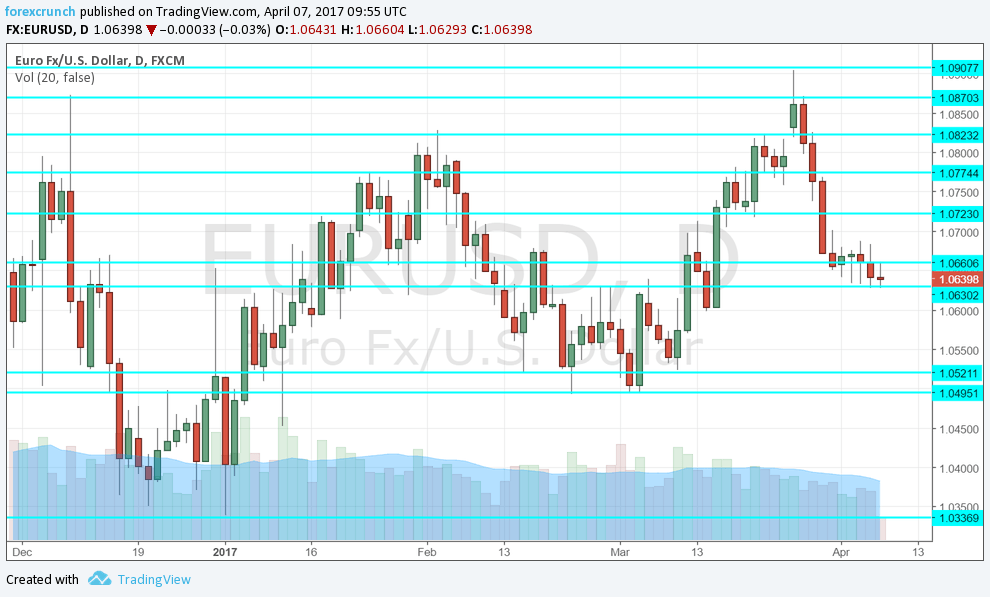

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Sentix Investor Confidence: Monday, 8:30. This survey of around 2800 analysts and investors is on the up and up, reaching 20.7 points in March. The number for April could continue the positive trend. A score of 20.1 is expected.

- German ZEW Economic Sentiment: Tuesday, 9:00. This business survey, that is released early in the month, fell short of expectations in the past four months. It hit 12.8 points in March, still in positive territory. An improvement to 13.2 is projected. The all-European figure scored 25.6 points last time. A small slide to 25 is on the cards.

- Industrial Production: Tuesday, 9:00. Industrial output is somewhat volatile. In addition, the all-European number is published after the data for France and Germany has already been released. Nevertheless, it still carries some weight. A rise of 0.9% was seen in January. A more modest rise of 0.2% is expected.

- German CPI (final): Thursday, 6:00. According to the preliminary release, prices rose 0.2% in March m/m. The number reflects a slowdown in advances and will likely be confirmed now.

- French CPI (final): Thursday, 6:45. CPI in the continent’s second-largest economy advanced by 0.6% according to the first release. A confirmation is on the cards now.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar struggled on low ground, but found support at the 1.0630 level (mentioned last week).

Technical lines from top to bottom:

The round number of 1.10 is the high line for now. The new 2017 high of 1.0905 is the next line.

The swing high of 1.0870 is the swing high in December and remains fierce resistance. 1.0830 was the 2017 high and follows closely.

1.0775 capped the pair in January and remains of importance. 1.0720 was also a high in January.

The pair was unable to crack 1.0660 in February and it remains the high end of the range. 1.0630 is the next level, holding back the pair in February and March.

1.0520 is a relic of the past but still serves as a cap. The more recent low of 1.0490 follows very closely.

Further below, we find the multi-year low of 1.0340. Only 1.0150 separates the pair from parity at this point.

I remain bullish on EUR/USD

With growing chances for Macron to enter the Elysee Palace and a better-looking euro-zone economy, the consolidation may be over for now. In the US, politics remains a mess.

Our latest podcast is titled Brexit Bad and “Clean Coal”

Follow us on Sticher or iTunes

Safe trading!