The Canadian dollar posted gains for a second straight week, as USD/CAD lost 80 points. The pair closed the week at 1.3440. This week’s key event is GDP. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

The Bank of Canada maintained rates, and said that inflation remains within the BOC’s projections. Over in the US, the Fed rate statement was more cautious than expected, which weighed on the US dollar. In the US, revised GDP report posted a respectable gain of 1.2%, beating the estimate.

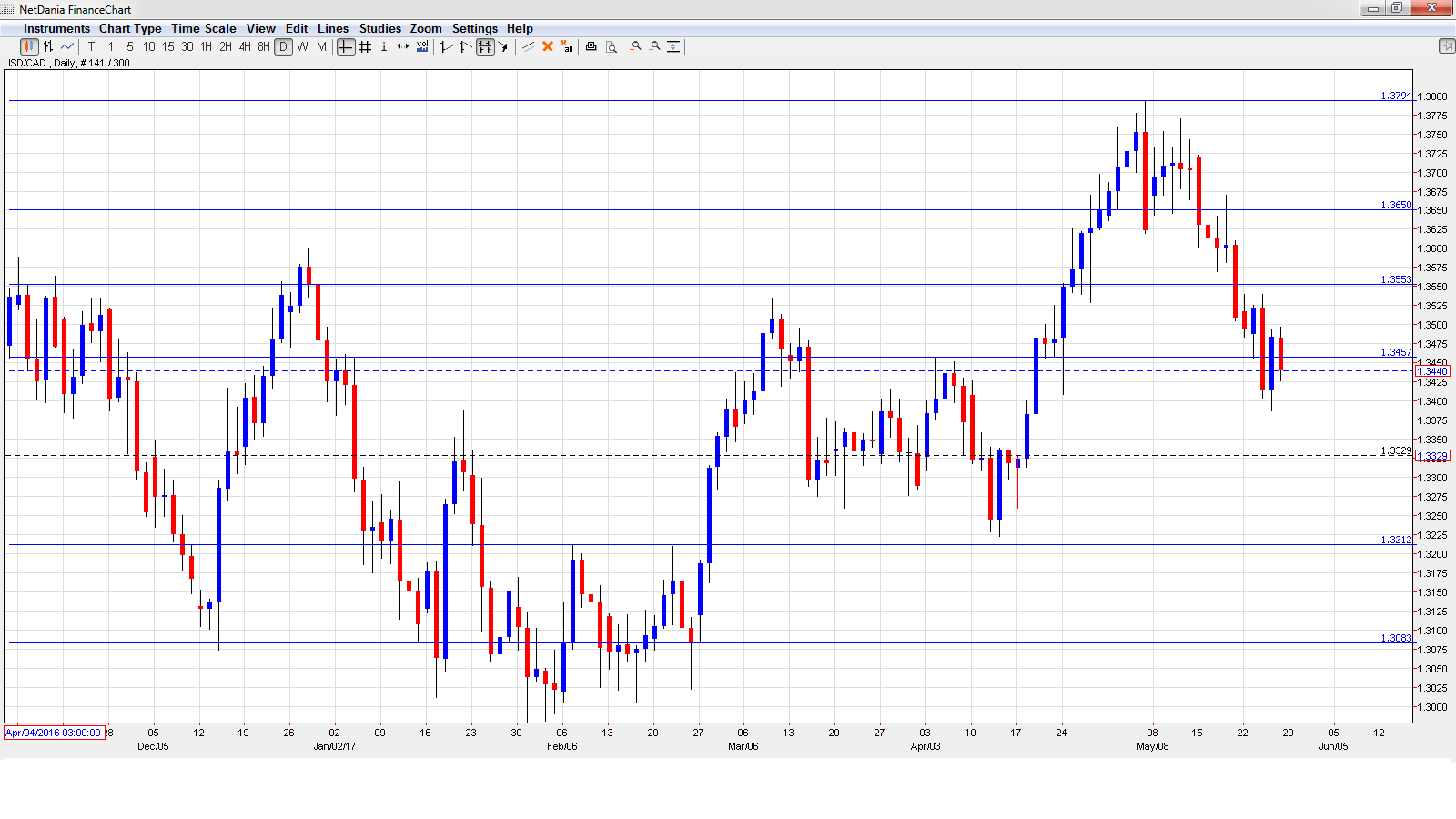

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Current Account: Tuesday, 12:30. Canada’s current account deficit narrowed significantly in Q4 of 2016, dropping to C$10.7 billion. However, this was still above the forecast of C$9.6 billion. The deficit for Q1 is expected to rise to C$11.4 billion.

- RMPI: Tuesday, 12:30. This index measures inflation in the manufacturing sector. The indicator continues to weaken and came in at -1.6% in March, a sharper drop than expected. Will the downward trend continue in the April report?

- GDP: Wednesday, 12:30. Canada releases GDP on a monthly basis, and this key indicator should be treated as a market-mover. In February, GDP came in at a flat 0.0%, within expectations. The March estimate stands at 0.3%.

- Manufacturing PMI: Thursday, 13:30. This index is an important gauge of the strength of the manufacturing sector. The indicator continues to point to expansion, and improved to 55.9 in the April release.

- Trade Balance: Friday, 12:30. Canada posted a negligible trade deficit of C$0.1 billion in March, shy of the estimate of C$0.3 billion. Little change is predicted for the April release, with a forecast of C$0.0 billion.

- Labor Productivity: Friday, 12:30. This indicator is released on a quarterly basis. In Q4 of 2016, the indicator softened to 0.4%, matching the forecast. The estimate for Q1 stands at 0.2%.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3517 and quickly touched a high of 1.3540. Late in the week, the pair touched a low of 1.3387, as support held at 1.3351 (discussed last week). USD/CAD recovered and closed the week at 1.3440.

Technical lines, from top to bottom

We start with resistance at the round number of 1.39.

1.3794 is the high for the month of May.

1.3648 is next.

1.3551 held firm as USD/CAD climbed early in the week before retracting.

1.3457 was a high point in September 2015.

1.3351 has held in support since mid-April.

1.3212 is next.

1.3083 is the final support level for now.

I am bullish on USD/CAD

The Fed is likely to raise rates at the June meeting, barring a nosedive in inflation, and this is bullish for the greenback. The Canadian dollar has received a boost from higher oil prices, but the currency could soften if oil heads the other way.

Our latest podcast is titled Poking holes in the FOMC and OPEC

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.