At times, a big bulk of US data is confusing, with the figures offsetting each other. This is not one of these cases. None of the figures beat expectations: retail sales numbers all missed and inflation data was mediocre at best. This is a bitter disappointment hurting the US dollar.

On the other side of the ring, we find the euro, encouraged by some taper optimism. Draghi will speak at Jackson Hole and is set to mark the beginning of the end of QE.

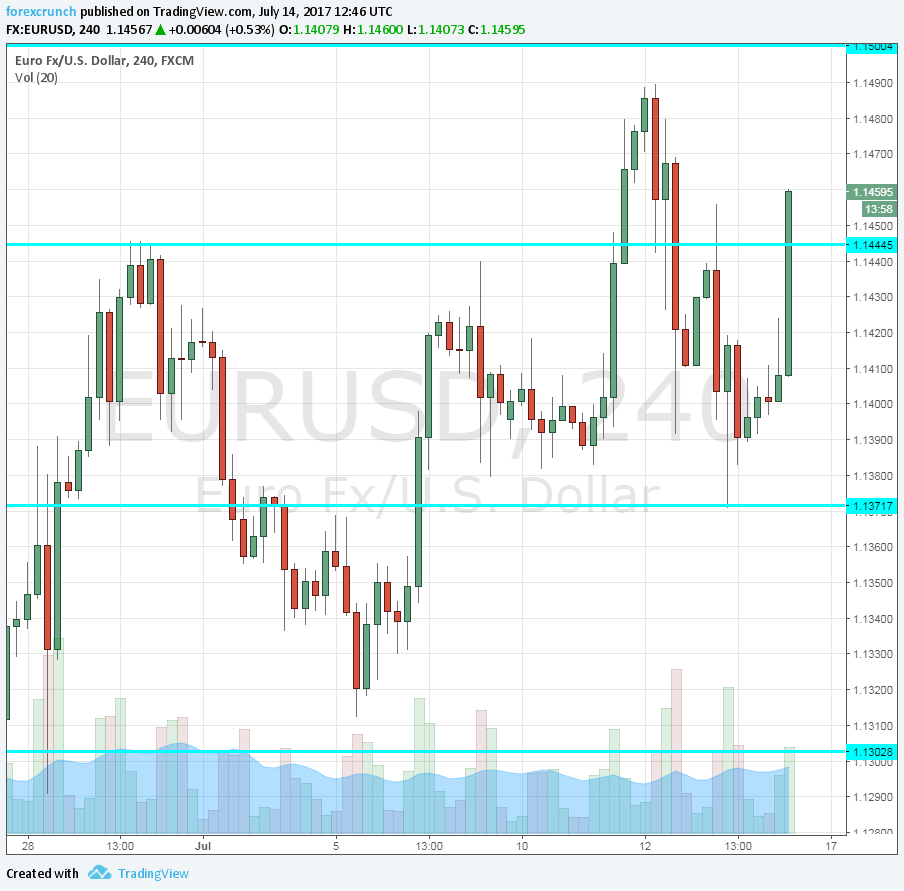

The result is a rise of EUR/USD above the previous high of 1.1445. The pair is breaking and has reached 1.1460, but the struggle continues. Earlier this week, the troubles of Trump Junior had already sent it to higher ground, but it was short-lived.

Is this move real? We will know soon enough.

1.1485 is the next level of resistance, just under 1.15. The 2016 high was 1.1620, which is the next level to watch. The 2015 high of 1.1712 is still far.

Support awaits at 1.1370, which was a low point earlier this week.

More: EUR/USD: ‘Mess Around’ Here Before Positioning Lighten Up To Trigger A Break Higher – SocGen

Here is how it looks on the 4-hour chart.