The US dollar recovered on Friday after the Non-Farm Payrolls came out slightly better than expected. And also today, the greenback enjoys a positive jobs report.

The JOLTs job openings report for June jumped to 6.163 million, far better than around 5.7 million expected. While this is a lagging report (the NFP was for July), the Fed focuses on this report and sees it as a wider measure of employment.

This is not only above the round 6 million level but also a new record high. The level of quits, seen as a sign of confidence

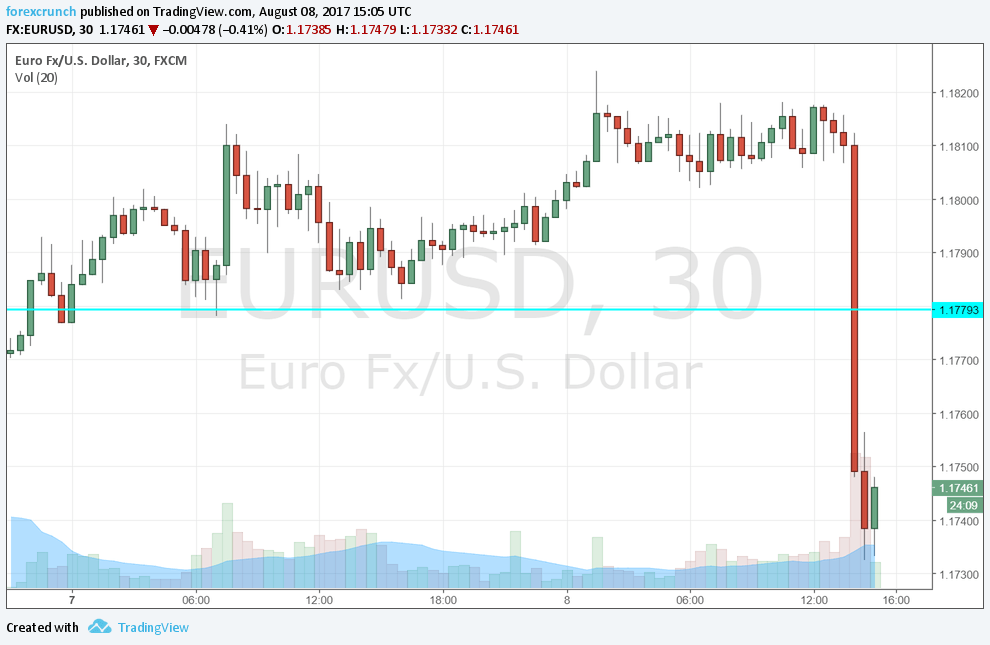

After a quiet start to the week, this report triggers further dollar buying.

- EUR/USD, which was flirting around 1.18 is down to 1.1735. Some still see EUR/USD reaching 1.20.

- GBP/USD finally loses the 1.30 level. The pound has been on the back foot since the BOE’s relatively dovish decision.

- USD/JPY is on the rise once again, edging closer to 111.

- USD/CAD is getting closer to 1.27. Canada’s own jobs report was quite positive. However, the tables have turned against the loonie.

- AUD/USD, which tried climbing earlier in the day, is down under 0.79.

A correction was necessary after the big dollar sell-off. Is this still a correction or a change of course?