The Australian dollar had a positive week, reversing previous losses. The upcoming week features the jobs report and Chinese GDP among other important figures. Here are the highlights of the week and an updated technical analysis for AUD/USD.

Business confidence is up according to NAB: 7 points after 5 last time. Consumer sentiment has also advanced, by 3.6% according to Westpac. China’s trade balance came out slightly below expectations, but it did not hurt the A$. In the US, the figures were relatively upbeat, but doubts about inflation weighed on the greenback.

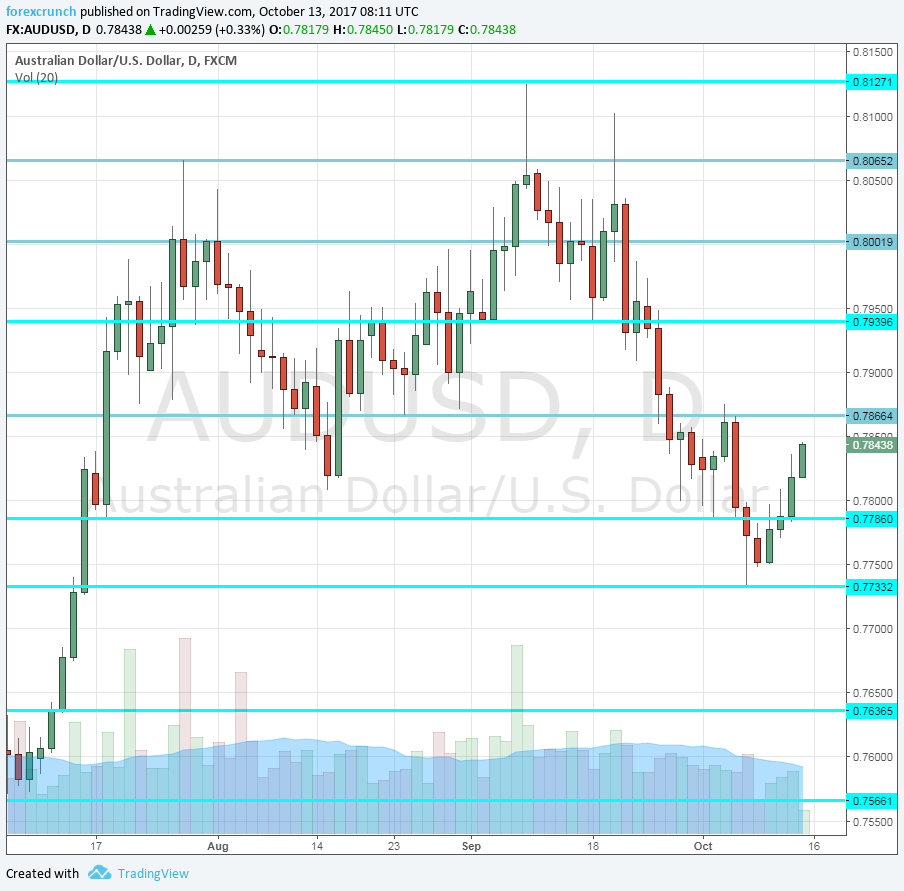

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Monetary Policy Meeting Minutes: Tuesday, 00:30. Two weeks after the RBA decided to leave the interest rates unchanged, we will get further details about their views on the economy and their deliberations. An RBA member recently opened the door to a potential rate cut. Will we see something of that sort in the minutes?

- Luci Ellis talks: Tuesday, 00:30. The RBA Assistant Governor will speak at a conference in Sydney. She could hint about the next steps in monetary policy but will likely hint at ongoing inaction.

- New Motor Vehicle Sales: Tuesday, 00:30. Sales of cars and trucks provide a gauge to the wider economy. Sales stalled in August after falling beforehand. Will we see a rise now?

- MI Leading Index: Tuesday, 23:30. The Melbourne Institute showed a drop of 0.1% in this wide measure of the economy, that uses 9 other economic indicators. It could bounce now.

- Jobs report: Thursday, 00:30. Australia enjoyed a whopping leap in employment back in August: no less than 54.2K. All in all, most jobs reports have exceeded expectations in 2017. The unemployment rate stands at 5.6%, a gradual slide. A more modest growth rate is expected in jobs: only 15.2K this time. The unemployment rate is expected to remain unchanged at 5.6%.

- NAB Quarterly Business Confidence: Thursday, 00:30. This wide survey of 1000 businesses has shown a gradual climb in the recent quarter, with the figure standing at 7 points in Q2 2017. We now get the measure for Q3.

- Michele Bullock talks: Friday, 1:10. The RBA Assistant Governor will be speaking in Sydney and closes a week that began with other RBA talk.

- Chinese GDP: Friday, 2:00. The world’s No. 2 economy advanced by 6.9% annualized in Q2 2017. A similar figure is on the cards. China is Australia’s No, 1 trade partner and any changes in Chian impact the land down under. China is predicted to report a growth rate of 6.8%.

- Industrial Production: Friday, 2:00. Industrial output slowed down to 6% y/y in China, and this figure also moves the Aussie dollar. The fluctuations in industrial output are wider than in GDP numbers, so this monthly number could steal the show. A rise of 6.4% is on the cards.

AUD/USD Technical Analysis

The Australian dollar initially dropped but escaped the 0.7740 (mentioned last week) and advanced higher throughout the week.

Technical lines from top to bottom:

The high of 2017 at 0.8125 is the top level. 0.8065 is the previous 2017 high.

It is followed by the psychological round level of 0.80. Below, we find 0.7940, which capped the pair in August.

0.7860 served as support during September and is another line to watch. 0.7785 was a stepping stone on the way up.

Below, we find 0.7740, that was a high point in June 2017 and also beforehand. 0.7635 was a stepping-stone on the way up, also in June.

Even lower, we find 0.7565 was a low point before the pair shot higher in July. The last line, for now, is 0.7515.

I am bearish on AUD/USD

After the recovery, the Aussie could resume the downtrend. The RBA talk could be joined by a correction in the jobs report: another big jump seems improbable.

Our latest podcast is titled Good, bad and ugly NFP, Catalan crisis update

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!