EUR/USD extended its gains and challenged the 2017 highs in the first week of 2018. Will this continue? The upcoming week consists of the ECB meeting minutes among other events. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

We received further positive signs about the euro-zone economies. Spain and Germany saw a drop in the number of the jobless, PMIs continued looking good and even inflation was OK. In the US, the greenback received a balanced FOMC meeting minutes and good news from the ISM manufacturing PMI and the ADP NFP. Nevertheless, the US dollar remained on the back foot, extending the losses that we have seen in late 2017.

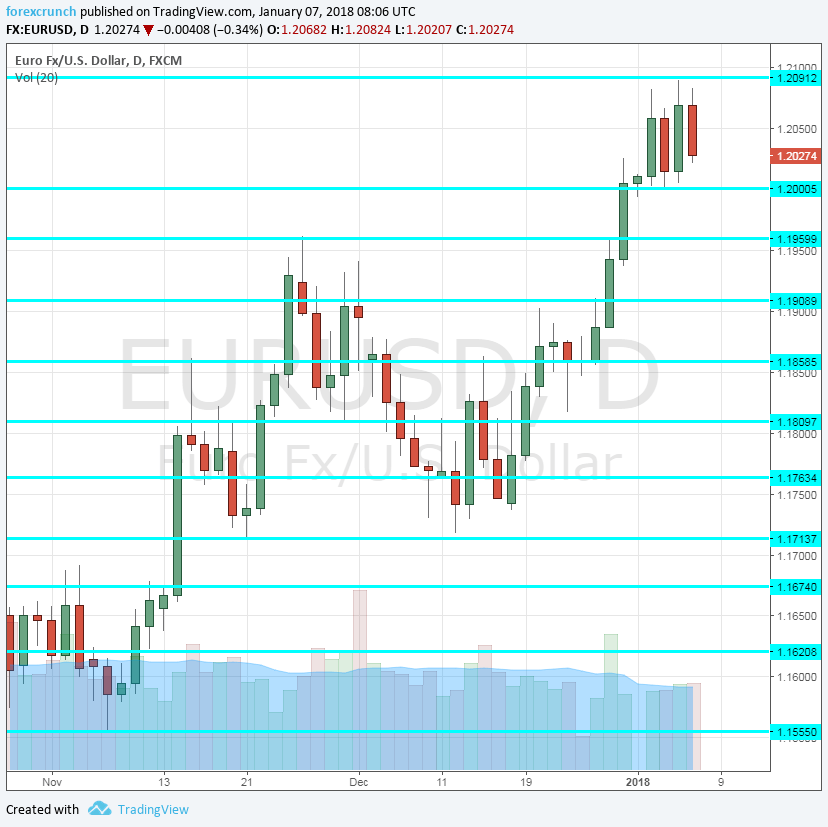

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Factory Orders: Monday, 6:00. Europe’s largest economy saw a rise of 0.5% in factory orders in October, better than had been exacted, the third surprise in a row. We will now get the report for November. A rise of 0.1% is expected.

- Sentix Investor Confidence: Monday, 9:30. The survey of around 2800 analysts and investors has been on the rise throughout the most of 2017. However, December’s score disappointed with a drop from 34 to 31.1 points. A small increase to 31.5 is projected.

- Retail Sales: Monday, 10:00. While Germany and France have already released their own retail sales reports, the all-European number can still provide surprises. Sales fell by 1.1% in October. We will now get the data for November. A jump of 1.4% is predicted.

- German Industrial Production: Tuesday, 7:00. Contrary to the factory orders numbers, industrial output fell in the past two months. After a fall of 1.4% in October, we could see a rise now. An increase of 1.9% is forecast.

- German Trade Balance: Tuesday, 6:00. Germany’s trade balance surplus results in a surplus for the whole euro-zone and keeps the euro bid. Back in October, Germany had a surplus of 19.9 billion euros. A similar figure is likely now: 20.7 billion.

- French Trade Balance: Tuesday, 7:45. Contrary to Germany, the second-largest economy in the euro-zone has a trade deficit. This deficit widened to 5 billion euros in October. A deficit of 4.8 billion is estimated.

- Unemployment Rate: Tuesday, 10:00. The jobless rate has been on the fall in the past few years since topping 12% in 2013 and reached 8.8% in November. Will we see another drop? A slide to 8.7% is on the cards.

- French industrial production: Wednesday, 7:45. France saw a surprising rise of 1.9% in October, providing a lot of hope for the sector. A slide of 0.4% is expected.

- Industrial Production: Thursday, 10:00. With a slide in Germany, a rise in France and various other figures from the other countries, output advanced by 0.2% in October. While the number is published after the large countries will have released their own figures, surprises are not uncommon. A rise of 0.6% is forecast.

- ECB Meeting Minutes: Thursday, 12:30. The European Central Bank began reducing its bond-buying scheme in January, in a decision made already in October. However, there are differences between the members of the ECB about the next moves and the level of worry about low inflation. In the December meeting, Draghi made an attempt of sorts to push the euro lower, but this clearly failed. The minutes from that meeting may reveal where the wind is blowing within the ranks of the Frankfurt-based institution about the potential end to QE in September, or perhaps only later on.

- French Final CPI: Friday, 7:45. The initial read for December showed a rise of 0.1% in prices. The final French figure will likely confirm the initial one.

- Jens Weidmann talks: Friday, 16:30. The president of the German central bank, the Bundesbank, speaks in Bavaria. His views on ending QE will be of interest.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar held onto the 1.20 level (mentioned last week). It then continued to higher ground.

Technical lines from top to bottom:

1.2240 was a stepping stone on the way down for the pair in late 2014. Further below, 1.2185 also held the pair back at that time.

The cycle high of 1.2090 looms above. 1.20 is the obvious round level and also worked as resistance in September.

1.1950 was the high level seen in November and a stepping stone towards 1.20. 1.1860 capped the pair in August and in October while working as support in September.

1.1820 worked as a cushion to the pair in late November and works as weak support. 1.1760 served as a cushion in November and also played a role beforehand.

1.1710 was the high of August 2015 and also worked as support in November. 1.1670 was a swing low in October. and hasn’t worked too well.

The 2016 high of 1.1620 slowed down the pair also in October. 1.1555 was the low point in November and works as a cushion. It is followed by the round number of 1.15.

I remain bullish on EUR/USD

Things are looking good in the euro-zone and the meeting minutes are unlikely to stop the rise. The US economy also looks good, but the greenback is sensitive to low inflation.

Our latest podcast is titled Wages not winning, tax cuts to cut it?

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!