Dollar/yen fell sharply, reaching the lowest since September at one stage, as stock markets crashed. Good news for the US economy turned into bad news for the pair. The upcoming week will test this new reaction function with the all-important inflation report.

USD/JPY fundamental movers

Stocks crash – that determined (almost) everything

The US stock market crashed on Monday, there is no better word to describe it. Another downfall was seen on Thursday and volatility continued throughout the week. The pair rose and fell with stocks as the yen is a safe-haven currency.

The initial trigger for the fall was the excellent NFP report and it was followed by a great report for the services sector. The good news for the US economy implies higher inflation, higher interest rates, and thus causing a revaluation of stocks.

However, bond yields were mixed: an increase in yields supported the greenback while a drop meant added to the downfall. Fed officials did not seem too worried about stocks, but President Trump certainly complained about them.

The reports about the reappointment of Haruhiko Kuroda as the Governor of the BOJ somewhat weighed on the yen, as he has been extremely dovish.

Inflation and also the consumer

The big event of the week is undoubtedly the US CPI report on Wednesday, overshadowing the retail sales publication at the same time. Inflation has been the missing piece: with robust growth, higher employment and most recently higher wages, inflation should, in theory, finally rise. Core CPI is expected to remain at 1.8% y/y and any deviation could trigger significant moves. Higher inflation implies faster rate hikes and another stock market crash, thus sending the pair lower. A slide could send the pair higher alongside equities.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

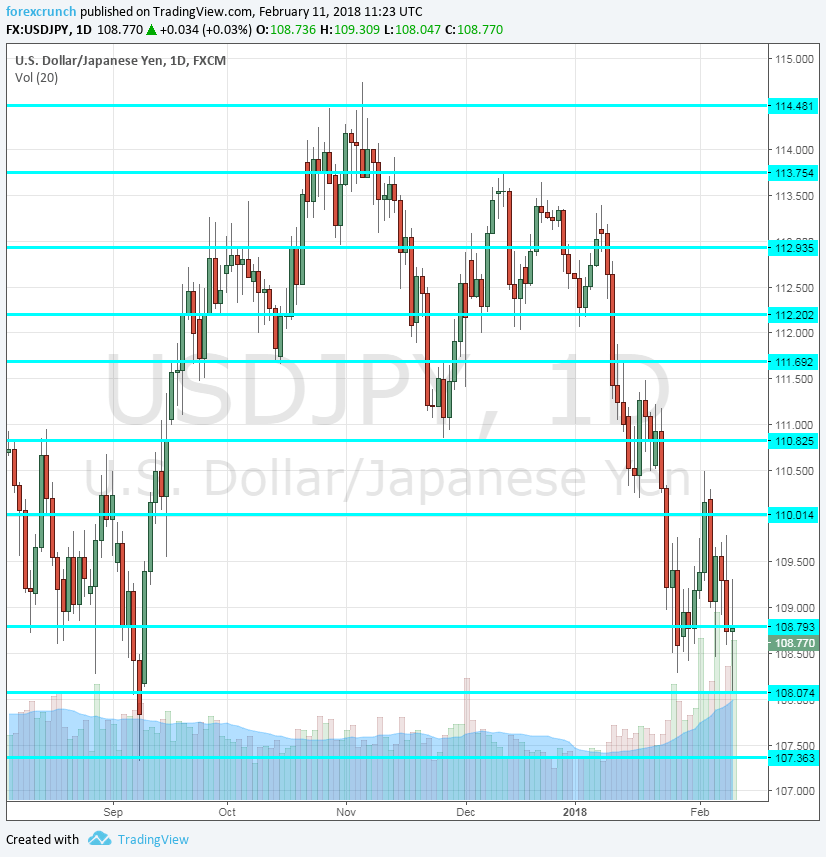

114.50 remains the top line of the range despite a quick breach in the autumn. It is followed by the high of 113.75.

112.90 served as support in December and is a pivotal line in the range. 112.20 used to be important in the past.

It is closely followed by 111.70, which provided support back in October. The round level of 111 worked as a cushion to the pair in November.

Looking down, 110.70 was a separator of ranges in June and remains important. The round number of 110 serves as a psychological level.

109 was a pivotal line within the range. 108.30 was the low seen in late January. Even lower, we find 107.10 as the ultimate level.

If the pair falls even lower, the round number of 105 will come into play, followed by 103.30.

USD/JPY Daily Chart

USD/JPY Sentiment

I am bearish on USD/JPY

We could see yet another positive week for US data, sending the dollar higher against most currencies, but not against the yen.

Our latest podcast is titled When everything sells off, where is the money going to?

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!