GBP/USD was rocking and rolling on endless Brexit headlines. What’s next? The GDP report stands out in the new week. Here are the key events and an updated technical analysis for GBP/USD.

UK PM Theresa May gave a successful speech at the Tory Conference and shrugged off the potential challenge from Boris Johnson. While she insisted that the UK is ready to leave the EU without a deal, reports about potential UK concessions on the Irish border circulated and supported the pound. Upbeat US data, rising US yields, and a optimistic words from Fed Chair Powell supported the greenback.

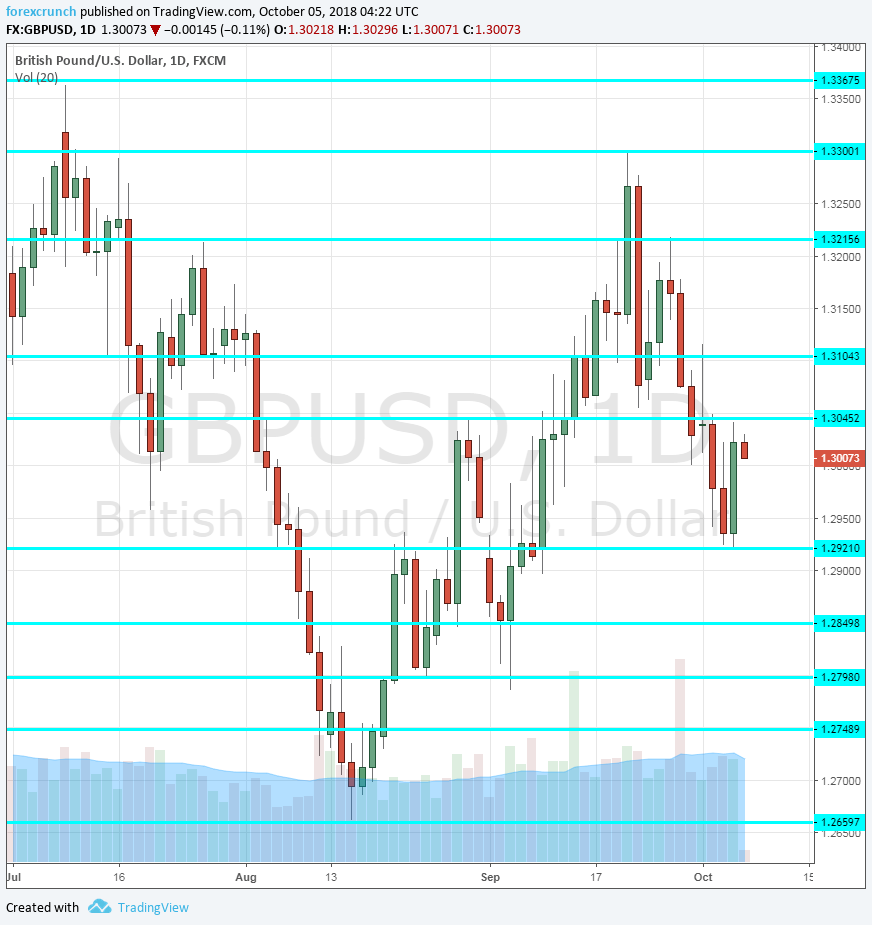

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- BRC Retail Sales Monitor: Monday, 23:01. The British Retail Consortium’s Retail Sales Monitor shows a minor increase of 0.2% in the volume of sales back in August. We will now get the numbers for September. The report precedes the official retail sales report.

- FPC Statement: Tuesday, 8:30. The Bank of England is responsible for financial stability in addition to monetary policy. The quarterly report by the Financial Policy Committee provides insights not only on the financial system but also on the underlying economic conditions that impact this stability.

- GDP: Wednesday, 8:30. This is a monthly GDP report for August, which provides more insights into Q3. The UK economy grew by 0.3% in July, the first month of Q3 and growth is set to slow down in August: 0.1%. Any slowdown may be attributed to worries about Brexit.

- Manufacturing Production: Wednesday, 8:30. Manufacturing output dropped by 0.2% in July, countering expectations for an increase of 0.2% projected. Britain’s manufacturing sector enjoys the weaker pound for its exports but Brexit weighs. We will now get the figures for August. The broader industrial production measure increased by 0.1% in July. Manufacturing Production is expected to rise by 0.1%.

- Goods Trade Balance: Wednesday, 8:30. The UK has a chronic trade deficit that reached 10 billion pounds in July. The figures for August will likely be similar. The deficit weighs on the pound in the long run. The deficit is projected to widen to 10.9 billion pounds.

- RICS House Price Balance: Wednesday, 23:01. This gauge of the housing sector remained unchanged in the latest publication for August by standing at 2%, marginally in positive territory. The figure reflects the percentage of surveyors that saw an increase in prices. A repeat of 2% is on the cards.

- BOE Credit Conditions Survey: Thursday, 8:30. The Bank of England’s quarterly report details lending conditions. Higher levels of debt may pose a risk but also imply confidence in the growth of the economy. The survey provides projections for the next three months.

* All times are GMT

GBP/USD Technical analysis

Pound/dollar made an attempt to recover but hit the 1.3215 level mentioned last week. It then fell sharply and stopped only at 1.3000.

Technical lines from top to bottom:

1.3375 was a high point in July. It is followed by 1.3300 was the high point in September and also a psychologically important round number.

1.3215 was the high point for the pair in mid-July and a lower high on the chart. The round number of 1.3100 supported the pair earlier in September.

1.3045 provided support in September and beforehand capped the pair in August. The round number of 1.3000 is important after providing support to the pair in late September.

1.2920 was a low point in early October. 1.2850 separated ranges in the last days of August and the first days of September.

Further down, 1.2790 served as support late August and also beforehand. 1.2750 held the pair down when the pair was on the back foot.

The current 2018 trough at 1.2660 is the next level. 1.2590 was a swing low in September 2017.

Even lower, 1.25 is a round number and also worked as support in early 2017.

I am bullish on GBP/USD

The Conservative Party conference is over and it’s time to cut a deal on Brexit. The EU Summit on Brexit is only on the following week, but we may hear more positive words that can lift Sterling from its misery. In addition, an OK GDP can also support the pound.

Our latest podcast is titled Too hot or too cold? The world is watching the Fed

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!