Dollar/yen moved higher in a week that was not that great for safe-haven currencies. Stocks rose, mostly on optimism for a deal between China and the US, and the US Dollar came out on top. The upcoming week features the Mid-Term Elections and also a Fed decision.

USD/JPY fundamental movers

New month, new mood

Global equity markets had a terrible October and things seemed to change at the turn of the month. The Japanese yen was doing quite well up to that point, and its fate turned around afterward.

US President Donald Trump tweeted about a successful conversation with XI Jinping, China’s President. This was followed by a report about Trump instructing his cabinet to prepare a trade deal, later denied. This was the main driver of stocks.

The greenback had reasons to rise on its own. Data was mostly upbeat. The Non-Farm Payrolls beat expectations with 250K and wages finally topped 3% annual growth. Other data remained promising.

And the yen had reasons of its own to lose ground. The Bank of Japan left its policy unchanged, but lowered inflation forecast, basically acknowledging reality: prices are not picking up. The BOJ’s loose monetary policy may continue running for a very long time.

Mid-terms, the Fed, and news about trade

Americans go to the polls on Tuesday and recent polls show that Democrats are projected to win the House. A divided government could limit Trump’s policies, which have proven positive for the US Dollar in 2018. A surprising Republican win could send the greenback higher. The votes are counted during the Asian session, with lower trading volume and this could result in significant moves.

The Fed makes its decision on Thursday for a change, the last decision without a press conference. Fed Chair Jerome Powell and his colleagues are projected to hint about a rate hike in December, which will be the fourth one in 2018.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

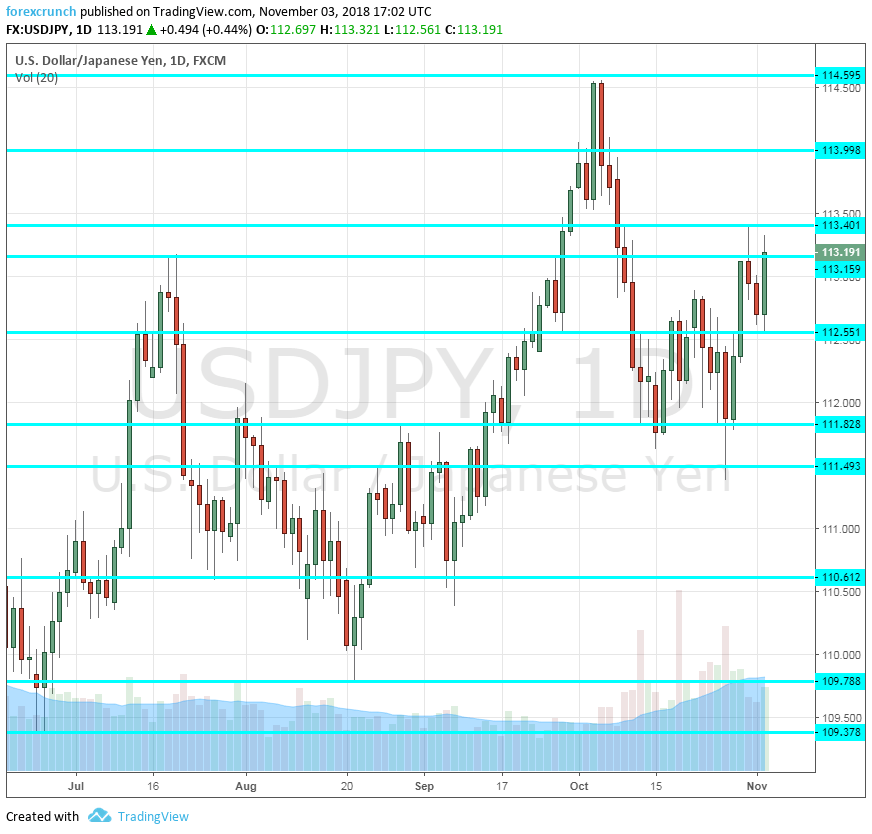

115.55 was a high point in the first half of 2017 and is an upside target. 114.60 was the high point in early October and serves as resistance.

114 is a round number and was a stepping stone on the way down. 113.40 capped the pair in late October and is immediate resistance.

113.15 was a swing high back in July. 112.55 served as support in September and resistance in October, making it a significant level.

111.80 was the low point after the fall in mid-October. 111.50 capped the pair in August.

110.60 was a swing low in late July and then again in late August. 109.70 was a swing low in late August and provides extra support below the round 110 level.

Close by, 109.35 was a cushion in mid-July. 108.70 was a cushion early in the summer and 108.10 a swing low in late May.

Lower, we find 107.50 capped the pair in early April and is a strong line.

USD/JPY Daily Chart

USD/JPY Sentiment

I am bearish on USD/JPY

The Mid-Term elections could result in an upset for the US Dollar. In addition, the talk about a trade deal between the US and China may be premature.

Our latest podcast is titled Are stocks free falling or is it a buying opportunity?

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!