EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Sentix Investor Confidence: Monday: 9:30. The indicator jumped to 6.1 in January, up from 0.7 a month earlier. This beat expectations and was the strongest reading since November 2018. Another strong reading is expected in February, with an estimate of 6.1 points.

- Industrial Production: Wednesday, 10:00. This manufacturing indicator improved to 0.2% in November, up from -0.5%. However, this missed the forecast of 0.3%. Analysts are braced for a decline of 1.8% in December.

- German Final CPI: Thursday: 7:00. The first-estimate for German CPI in the fourth quarter declined by 0.6% and the final release is expected to confirm this figure.

- German GDP: Friday, 7:00. German GDP came in at 0.1% in Q3 and is expected to show an identical gain in the fourth quarter.

- Flash GDP: Friday, 10:00. The first estimate for fourth-quarter GDP came in at 0.1%, indicative of weak growth in the eurozone. The second estimate is expected to confirm the initial estimate.

EUR/USD Technical analysis

EUR/USD posted considerable gains at the end of the week, coming close to the 1.11 level.

Technical lines from top to bottom:

1.1390 has held firm in resistance since June.

1.1290 was last tested in early July. 1.1215 is next.

1.1119 has some breathing room in resistance.

1.1025 (mentioned last week) has switched to resistance after sharp losses by EUR/USD last week.

1.0925 is an immediate support level.

1.0829 has held in support since April 2017. 1.0690 is next.

The round number of 1.0600 is the final support level for now.

.

I remain bearish on EUR/USD

The eurozone economy has been churning out lukewarm data, and is much weaker than the U.S. economy. The euro has broken below the key 1.10 line and the negative momentum could send EUR/USD to lower ground.

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

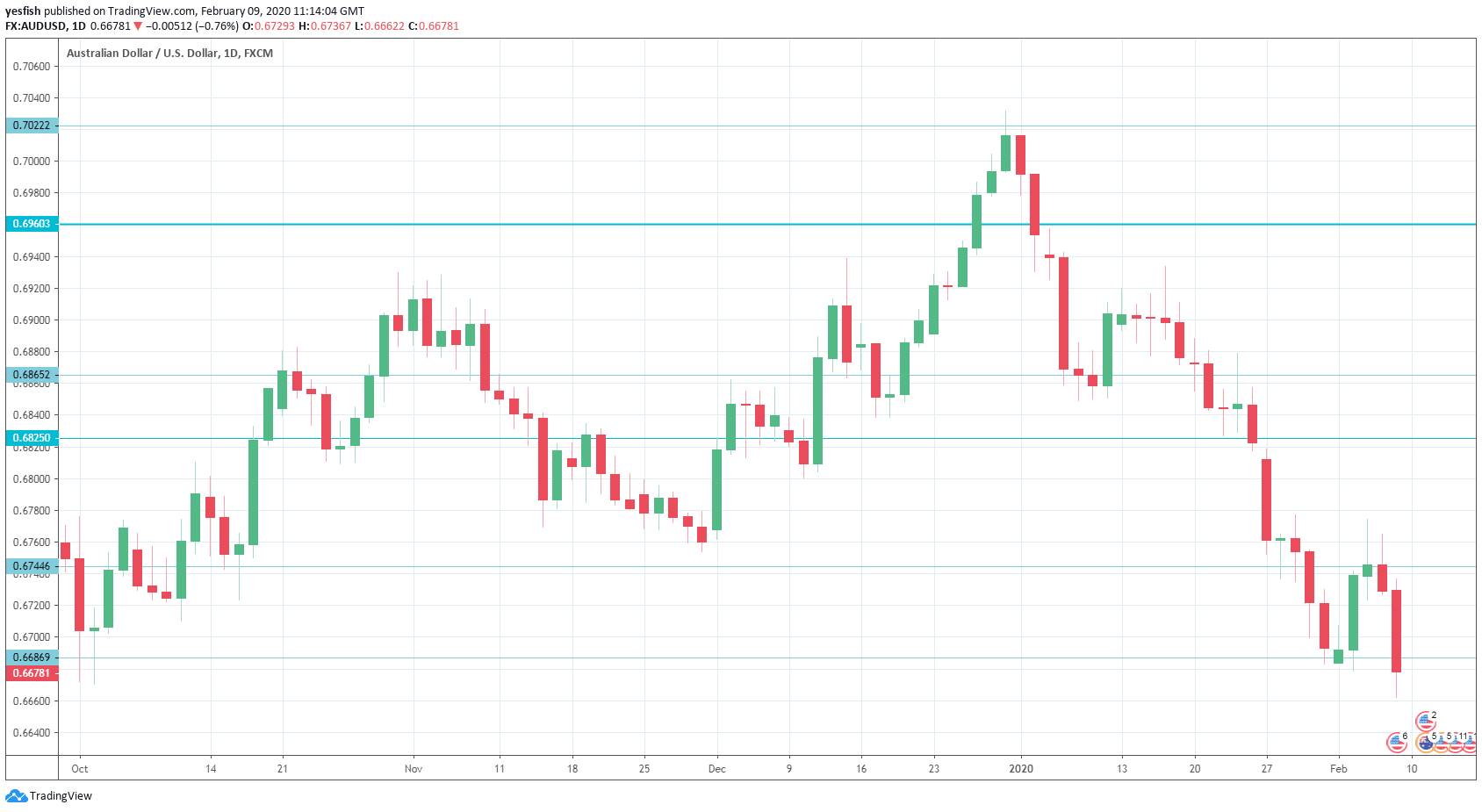

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week

Safe trading!