GBP/USD posted strong gains last week, climbing 0.8%. The upcoming week has four events, including employment data. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

UK Construction and Services PMIs both showed strong expansion with readings above the 56-level. This is well above the 50-mark, which separates contraction from expansion. The economy expanded by 2.1% in August, missing the estimate of 4.6%. The NIESR GDP Estimate showed a sharp gain of 15.2% in September, up from 7.0% in the previous release. Manufacturing Production posted a negligible gain of 0.7% in August, down from 6.3% beforehand.

In the US, the ISM Services PMI improved to 57.8, up from 56.9 points. The FOMC minutes expressed concern that the lack of a federal fiscal stimulus package could hinder the US recovery, which members said was moving faster than expected. A stimulus bill has been stuck in Congress and it is unlikely that a deal will be reached before the US election. The US dollar showed little reaction to the minutes, as policymakers did not provide any forward guidance on interest rate hikes.

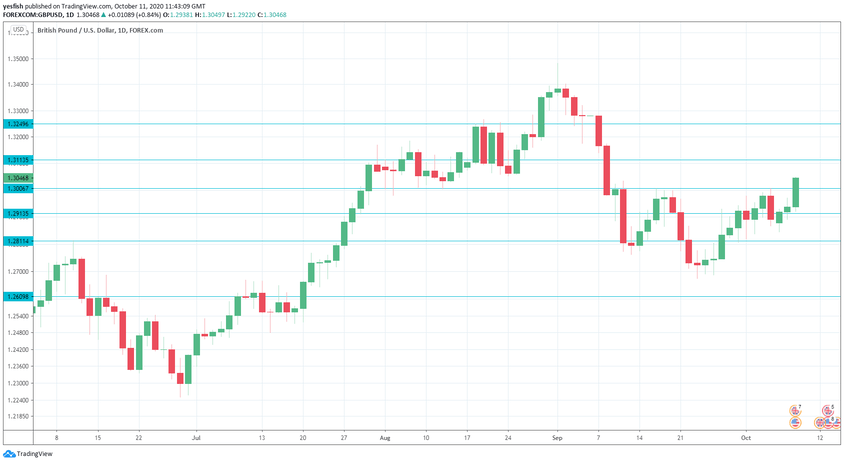

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- BRC Retail Sales Monitor: Monday, 23:01. The British Retail Consortium’s Retail Sales Monitor showed a solid gain of 4.7% in August. We will now receive the numbers for September. The report precedes the official retail sales report.

- Employment Report: Tuesday, 6:00. Unemployment rolls rose by 73.7 thousand in August, lower than the estimate of 99.5 thousand. Will we see an improvement in the September data? Wage growth posted a third straight decline in July, with a reading of -1.0%. The forecast for August stands at -0.6%. The unemployment rate, which rose to 4.1% in July, is expected to climb to 4.3% in September.

- BOE Credit Conditions Survey: Thursday, 8:30. The Bank of England’s quarterly report details lending conditions and investors will be interested to know the impact of Covid-19 on credit levels. The survey provides projections for the next three months.

- CB Leading Index: Thursday, 13:30. The index, which is based on 7 economic indicators, declined by 0.3% in July. Will we see an improvement in the upcoming reading?

Technical lines from top to bottom:

We start with resistance at 1.3249, an important monthly line.

1.3113 (mentioned last week) is next.

1.3006 is the first support level.

1.2914 has some breathing room in support after GBP/USD moved higher last week.

1.2811 is next.

1.2689 is the final support line for now.

I am bearish on GBP/USD

The pound has looked strong against the US dollar, but the UK economy is grappling with Covid-19 as well as the uncertainty surrounding Brexit. This could weigh on the British pound, whose recent strength is more a testament to US dollar weakness.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!