GBP/USD gained 1.4% last week, recovering the losses of a week earlier. The upcoming week has four events, including GDP for the second quarter. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

UK credit levels for individuals dropped to GBP 3.4 billion in August, down from GBP 3.9 billion. The UK’s current account deficit narrowed to just GBP 2.8 billion in Q2, down sharply from the Q1 reading of GBP 21.1 billion. This marked the smallest deficit since 2010. GDP for the second quarter was upwardly revised to -19.8%, up from -20.4%.

In the US, the Conference Board Consumer Confidence jumped to 101.8 in September, up from 86.3. This easily beat the forecast of 90.0 points. Third-estimate GDP for the second quarter was upwardly revised to 31.4%, up from 31.7%. On the manufacturing front, the ISM Manufacturing PMI remained well in expansionary territory, with a reading of 55.4 points, down slightly from 56.0. The neutral 50-mark separates contraction from expansion.

Job growth slowed sharply in September, as Nonfarm Payrolls fell to 661 thousand, down from 1.37 million beforehand. This was much weaker than the estimate of 900 thousand. Wage growth dropped from 0.4% to 0.1%, missing the forecast of 0.5%. Manufacturing continues to expand, as the second estimate for Manufacturing PMI came in at 54.1, down slightly from the initial estimate of 54.3 points.

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Services PMI: Monday, 8:30. The index remains in expansionary territory, as the initial reading came in at 55.1. This is expected to be confirmed in the second estimate. The neutral 50-reading separates contraction from expansion.

- Construction PMI: Tuesday, 8:30. The index has been in expansionary territory for three straight months, but slipped from 58.1 to 54.6 in August. The September forecast stands at 54.0 points.

- RICS House Price Balance: Wednesday, 23:01. The indicator is pointing to stronger activity in the housing sector. In August, 44% more surveyors reporting price increases than those that reported declines. This was the highest figure since February 2016. The forecast for September looks bright, with an estimate of 39%.

- GDP: Friday, 6:00. The monthly GDP report showed that the economy gained 6.6% in July, marking a third successive month of growth. Another gain is projected for August, with an estimate of 4.6%.

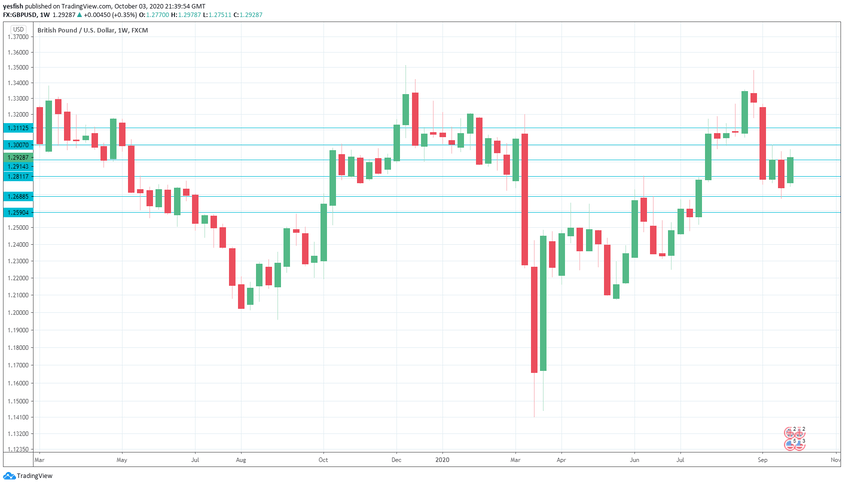

Technical lines from top to bottom:

We start with resistance at 1.3205, an important resistance line last week.

1.3113 (mentioned last week) is next.

1.3006 is protecting the symbolic 1.30 level.

1.2914 is an immediate support line.

1.2811 switched to a support role after strong gains by GBP/USD last week.

1.2689 is next.

1.2590 was a swing low in September 2017. It is the final support line for now.

I am neutral on GBP/USD

The pound has been volatile in recent weeks, and the strong movement could continue. Both the US and UK remain gripped by the stubborn Covid-19 virus. Any developments on the Brexit front could have a significant impact on the movement of GBP/USD.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!