- US inflation data boost the dollar sentiment.

- Global inflation is on focus.

- Canadian central bank announcement is on the watch on Wednesday.

The USD/CAD forecast remains bullish as the pair saw a quick rise of more than 50 pips after the upbeat US CPI data. The US consumer price index figures came better than expected at 5.4%, boosting the inflation fear. Moreover, in June, US inflation surged to record highs in the past 13 years.

June inflation, as compared with a year earlier, came at the largest monthly high since 2008.

-Are you looking for automated trading? Check our detailed guide-

Core consumer price index increase means that all other consumer prices surged up except foods and energy prices.

The US economy continues to rebound in the travel and services sectors from the pandemic level and is also gathering the economic recovery momentum.

The Fed announced in the last month that they could cut stimulus as early as possible and made decisions holding lower interest rates until the end of 2022. But in the last meeting, they announced a cut quite sooner and declared that they would lower bonds buying programs quickly.

The last meeting threw the sentiment of the US Dollar higher. We also see the US Dollar has boosted in the recent weeks despite a new virus variant rising all over the world.

Traders and investors are also focusing on Powell testifying on Wednesday and Thursday for any signal on the timing of potential US tapering.

Powell has repeated that higher inflation will be transitory, nothing that he expected.

On Wednesday, the Bank of Canada’s interest rates and policy statement will be published. We expect nothing will be changed in this forecast. But we expect fresh clues about the QE program.

Canadian Dollar being correlated with the oil price movement remains supported as the oil prices surged above $75 per barrel.

Despite oil prices soaring, the global economy tends to lower oil prices as the demand for higher oil prices may be decreased shortly.

-If you are interested in forex day trading then have a read of our guide to getting started-

Again, there are important events that need to be considered in the upcoming OPEC+ meeting. For example, if the oil output cut takes more time, the oil prices may rise higher, or the increased output can lower prices.

From all of the fundamental aspects, the US Dollar is stronger than the Canadian Dollar.

USD/CAD technical forecast: Indicators yelling a buy

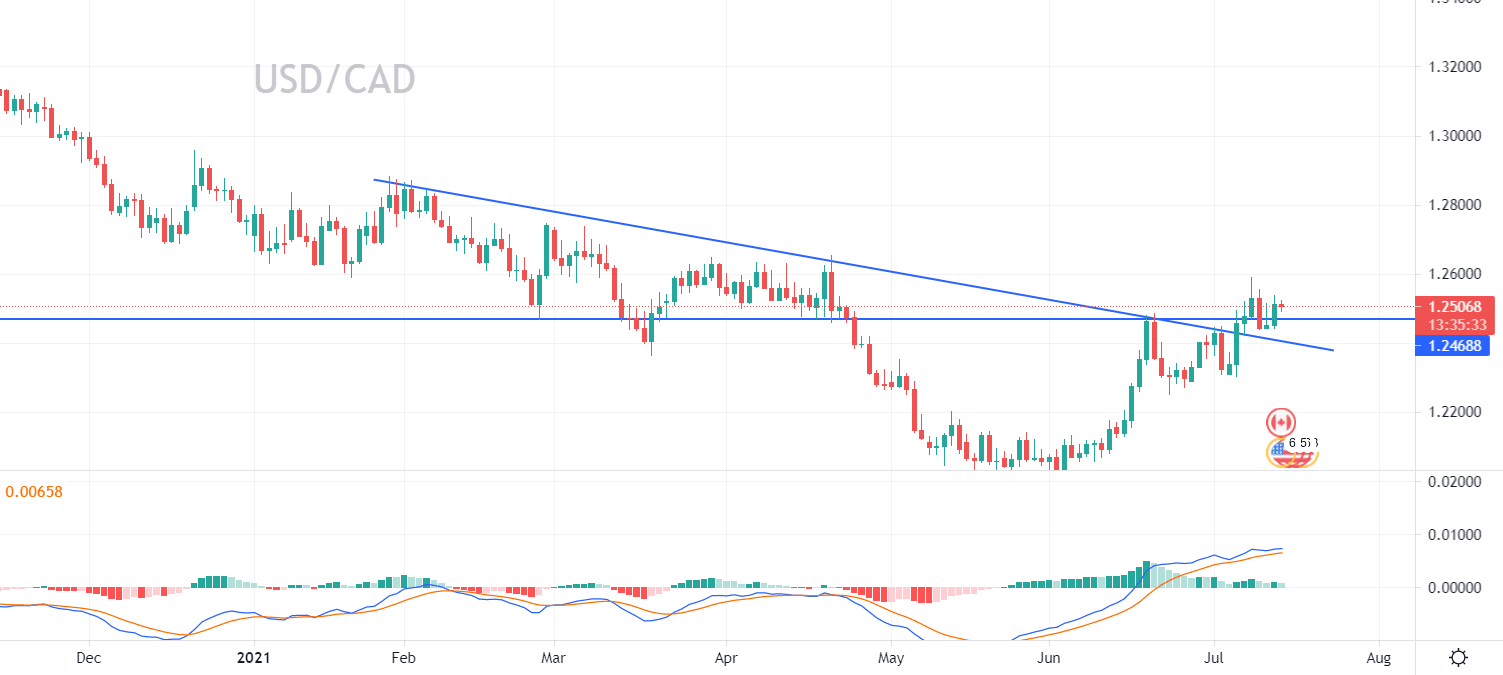

If we observe the chart daily, we can see a bullish cup and handle chart pattern, which means more gains for the pair.

Another indicator of the bullish momentum is that the price broke a long-term descending trendline. The MACD indicator showed a positive upward direction. The bulls can target the 1.2672 level in the upcoming days or even weeks.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.