US dollar outlook has turned decidedly bullish after the release of minutes from late July’s Federal Open Market Committee (FOMC) meeting.

A majority of FOMC participants are now in favour of starting tapering of asset purchases of US Treasuries and mortgage-backed securities (MBS) this year.

Asset purchases by the US Federal Reserve have acted a back stop in the market for risk assets such as equities by helping to keep interest rates low.

In addition, the Delta variant is putting a dampener on hopes of the recovery in the global economy being sustained and economic data from China suggests that the rebound in the country may be slowing down also.

JPY/USD and CHF/USD higher too, commodities lower

JPY/USD and CHF/USD are also trading higher today as forex traders turn to haven buying. US bond yields have also fallen as investors buy up longer-dated US bonds.

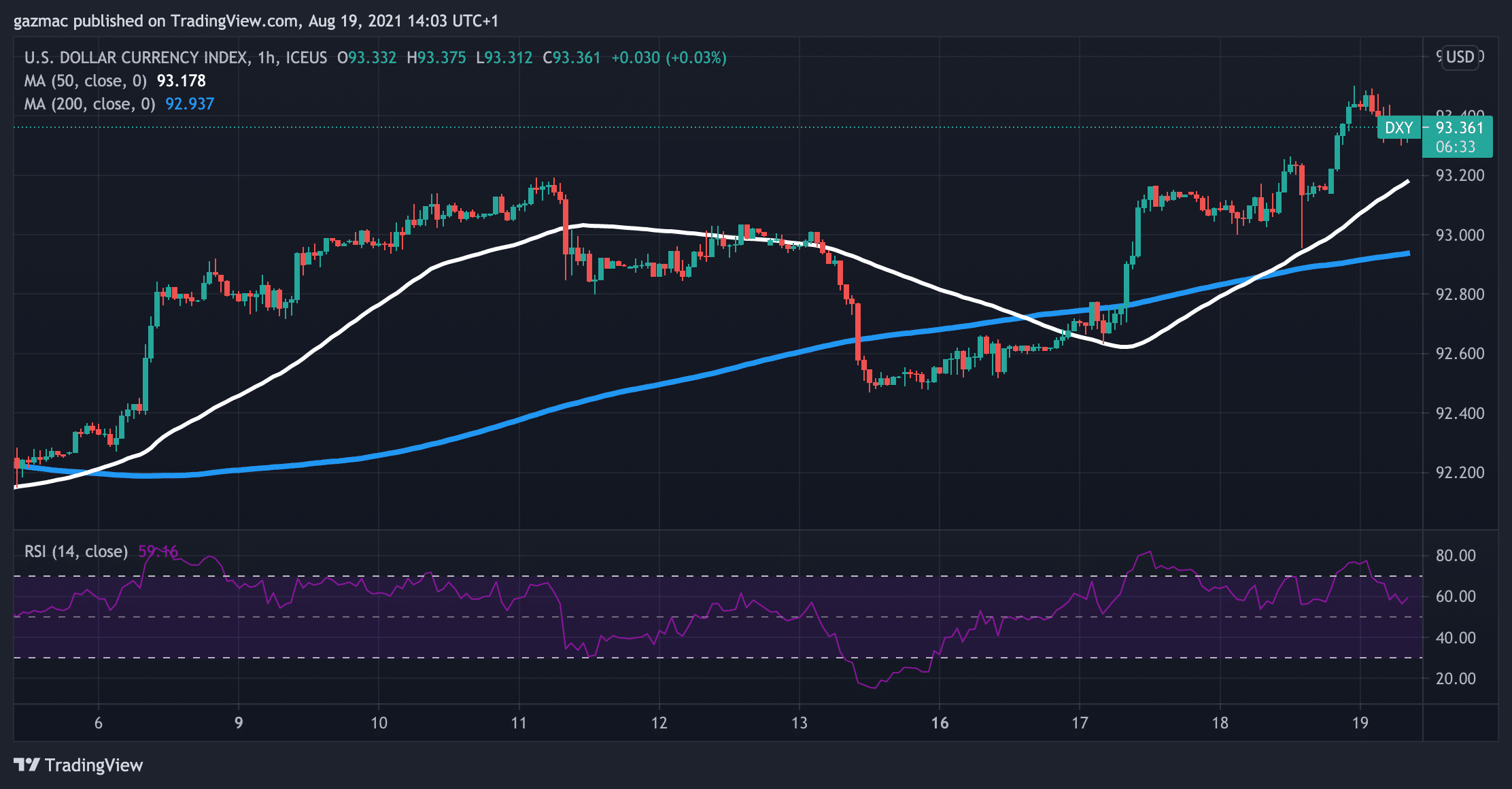

The strengthening dollar against a basket of internationally traded currencies, known as the Dollar Index (DXY), continues to strengthen, and that has dded to the pressure on commodity prices which tend to fall as dollar prices rise. Commodities agree also being majorly pressured lower by the prospect of slowing demand, with oil, copper, iron ore and silver all in the red.

Gold stands out from the commodity crowd as the ultimate safe haven asset and is catching a bid today, but only up $2 at $1,789.

Global equities are also selling off. S&P 500 futures are down 1.1% at 4394 and European markets are all down heavily, with the FTSE 100 losing 2% at 7028.

Forex movements are ideal for programmatic approaches to trading. If you want to try your hand at automated forex trading, check out our guide.

US dollar outlook – FOMC majority to start tapering “this year”

The minutes from the 27-28 July meeting, which were released yesterday (Wednesday), in part stated that a majority participants “judged that it could be appropriate to start reducing the pace of asset purchases this year.”

Other parts of the minutes spoke to the timing of a reduction in asset purchases with reference to “coming months”: “Various participants commented that economic and financial conditions would likely warrant a reduction in coming months.”

Nevertheless, there were others who wanted to hold off until the first quarter of next year: “Several others indicated, however, that a reduction in the pace of asset purchases was more likely to become appropriate early next year.”

In as far as the FOMC was making “progress” on it price stability and labour market goals, there were sharper divisions, with some participants. pointing to continued weaknesses in the employment picture, which would imply slowing tapering and timing pushed back further than Q1 2022 perhaps.

“Several participants emphasised that employment remained well below its pre-pandemic level and that a robust labor market, supported by a continuation of accommodative monetary policy, would allow further progress toward [labour market goals].”

Yesterday’s FOMC minutes release may have presented a good trading opportunity, so if you are looking for a good forex broker, read our comprehensive guide.

US weekly jobless claims fall 348,000 as labour market strengthens

The minutes support an interpretation that many on the FOMC still see plenty of room for improvement in labour market conditions.

But today’s jobless claims should have encouraged the FOMC of the labour front. Jobless claims dropped 348,000 his week, for the fourth consecutive weekly decline, which would indicate that the labour market continues to strengthen.

For example, although payroll gains have strengthened recently, averaging 617,000 a month in July, metrics favoured by some FOMC members, such as the employment-to-population ratio for workers, stood at 77.8% last month compared to 80.5% at the beginning of 2020 for individuals between 25 and 54 years old.

Also unemployment among minorities still outpaced that fr the rest of the population, with Hispanic rate at 6.6% and African-American on 8.2%.

Overall unemployment rate has been coming down and in July was 5.4%.

FOMC consensus: Price stability goal has been achieved

As far as the price stability goal goes, “most participants” at the FOMC meeting believed this has been reached, according to the minutes.

Also, participants still hold to a consensus position that the elevated levels of inflation will be temporary.

“Several participants also commented that price increases concentrated in a small number of categories were unlikely to change underlying inflation dynamics sufficiently to overcome the possibility of a persistent downward bias in inflation.”

Does decoupling tapering and rates signal more hawkish bias?

The minutes arguably provided evidence of a more hawkish bias at the FOMC, as there was discussion about decoupling asset purchase tapering from interest rate hikes. The minutes stated that “many participants saw potential benefits” in taking such an approach.

On the question of the exact balance between when it comes to tapering Treasury and MBS assets “most participants remarked that they saw benefits in reducing the pace of net purchases of Treasury securities and agency MBS proportionally.”

Notable hawk James Bullard, St. Louis Fed President, who currently doesn’t have voting rights on the committee, said yesterday asset purchase taper should ideally have been completed by the end of Q1 2022. If the FOMC were to adopt that timeline, it would be much faster than wind-downs hitherto.

Currently the Fed is buying $80 billion worth of Treasuries and $40 billion of MBS every month and has committed to do so “until substantial further progress has been made toward its maximum employment and price stability goals”.

Traders will be looking to next week’s meeting of central bankers at the Jackson Hole symposium (26-28 August) for further monetary policy clues.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.