- GBP/USD falls in the last hour despite poor US GDP data.

- Covid spread in the US seems diminishing, giving support to the Greenback.

- Delta variant is spreading in the UK, weighing on the Pound.

During the last hour, the GBP/USD price analysis fell to fresh daily lows at around 1.3720, extending its decline early in the New York session.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Despite the strong rebound gains this week over the past three trading days, the pair saw some selling on Thursday. In the recent session, the US dollar has experienced some good surges in demand, putting some pressure on the GBP/USD pair, which has reversed the previous day’s gains.

Despite concerns about the economic impact of the Delta variant, investors appear convinced the Fed may still lift its pandemic-era stimulus. The yield on US Treasury bonds has continued to grow as a result. Moreover, the yield on US 10-year Treasuries reached an almost two-week high.

The US Food and Drug Administration (FDA) approved the Pfizer/BioNTech COVID-19 vaccine with full approval, reducing market fears and building a case for accelerating vaccination in the US. Additionally, a US infectious diseases expert predicts COVID-19 could be under control by early next year, further boosting investor confidence.

US macroeconomic data showing 6.6% annualized growth in the second quarter did not appear to affect the market tone for the US dollar. A smaller decrease than expected, but an improvement over the 6.5% reported in the preliminary report. On the other hand, US unemployment claims rose this week from 349,000 to 353,000.

Meanwhile, recent concerns about Coronavirus cases in the UK have undermined the sterling, giving the GBP/USD pair a more negative tone. However, as the Jackson Hole symposium draws to a close, the downward trend is expected to stay toned down for a while.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

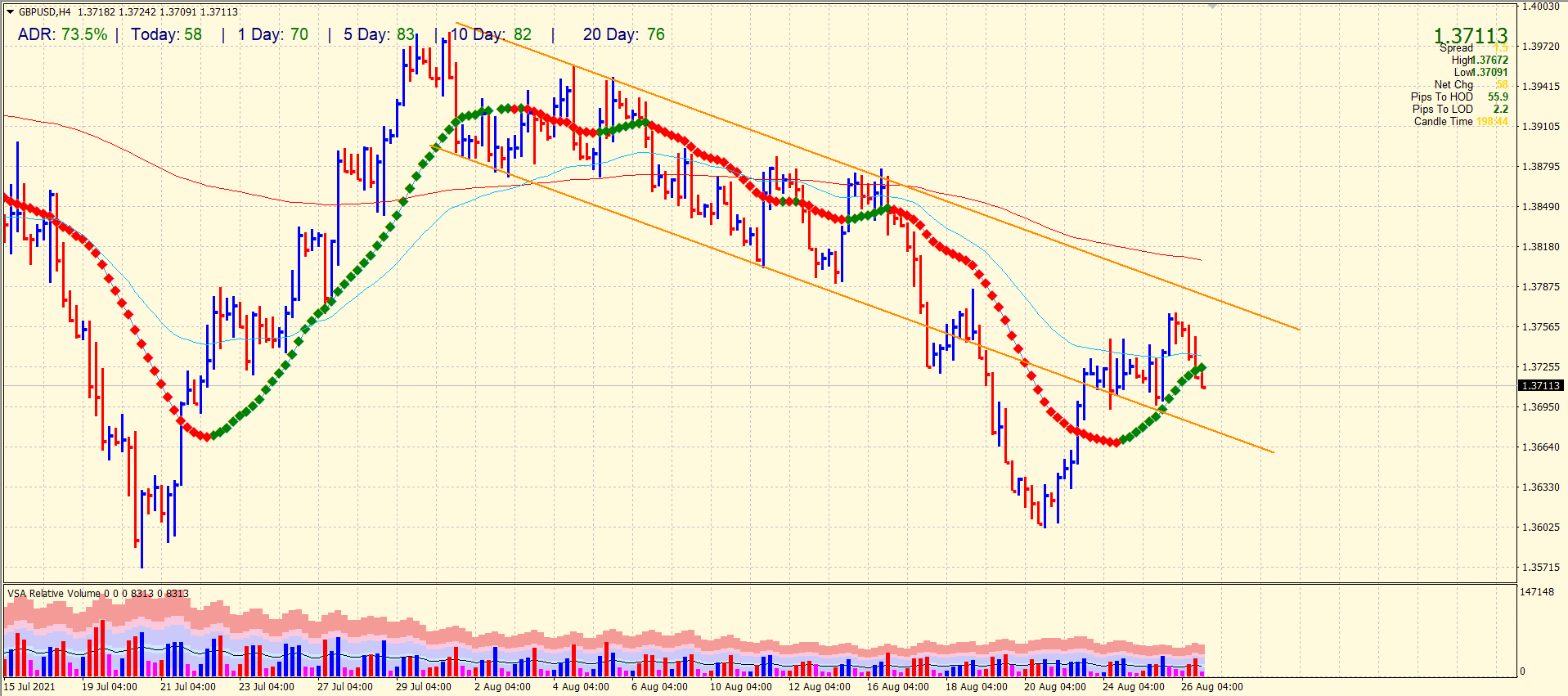

GBP/USD price technical analysis: 20, 50 SMA broken

The 4-hour chart shows the price falling below the 20-period and 50-period SMAs. However, the price is still in the descending trend channel and is supported by the lower band. More important support lies at the 1.3700 level, which looks feeble now. Nevertheless, the probability of testing 1.3660 still exists.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.