- AUD/USD prices are pushing higher today, remaking an intraday high and reversing yesterday’s decline from a four-month high.

- NAB Business Confidence and Business Conditions improved in February.

- The market sentiment remains poor, gold and oil remain near multi-year highs, and nickel returns to record highs.

- When it comes to releasing the brake on rate hikes, RBA Gov Lowe’s speech might offer tentative clues.

The AUD/USD forecast remains slightly bearish despite a recent recovery as the prices are still far below the 4-month top seen on Monday.

–Are you interested in learning more about copy trading platforms? Check our detailed guide-

During Tuesday’s Asian session, the AUD/USD price reached an intraday high of 0.7342, up 0.38% on the day as it pared its losses to start the week with a multi-day high. Higher commodity prices and recent upbeat house data could be credited with the recent rebound in the Australian pair.

Upbeat NAB data

The National Australian Bank (NAB) reported a recent rise in AUD/USD rates recently. The NAB business conditions index rose 7 points to +9 in February, reversing all of January’s declines. In addition, despite the low of -12 in December, the confidence index rose 9 points to +13.

Commodity prices soar

In the recent past, commodities and antipodes have been affected by growing fears of disruption in the global supply chain due to the standoff between Ukraine and Russia. As a result, WTI crude oil climbed to levels last seen in 2008 the day before, while gold prices rose to a 19-month high. On the London Metal Exchange (LME), nickel hit an all-time high of around $50,550 as supply concerns cheered buyers.

Recently, it has emerged that UK and EU opposition to a US-backed total ban on oil imports from Russia will be complemented with World Bank (WB) humanitarian aid to Kyiv to reduce risk aversion. Although the human corridor is about to resume, Reuters headlines indicate a lack of progress in the Ukraine-Russia peace talks.

US yields outperform, equities slip

Due to these games, the US 10-year Treasury yield extends the previous day’s two-month recovery to 1.77%, a gain of no more than 2.5 basis points. As of press time, Japan’s Nikkei 225 is down more than 1.0%, while futures on the S&P 500 are down no more than 0.3%.

What’s next for AUD/USD forecast?

Shortly, risky catalysts will likely remain in control. Still, the speech by Reserve Bank of Australia (RBA) Governor Philip Lowe will be closely monitored as a broad push is made to move away from the government’s wait-and-see approach.

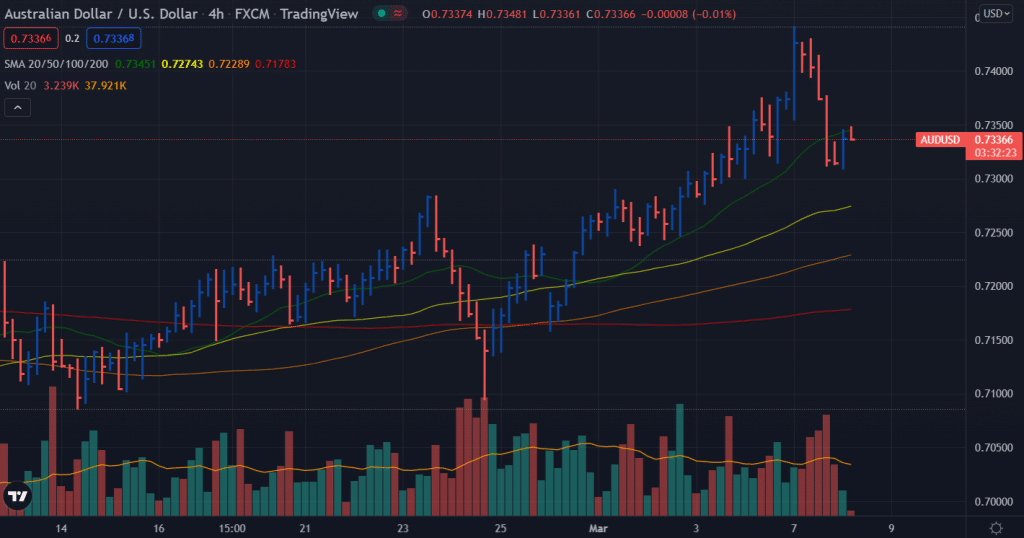

AUD/USD price technical forecast: Bulls combatting with 20-SMA

The AUD/USD price broke below the 20-period SMA on the 4-hour chart for the first time after seven trading days. The pair is still struggling to overcome the 20-period SMA. The volume for the down wave increased while the volume for a recent minor up wave declined. It shows that bears keep an upper hand.

–Are you interested in learning more about scalping forex brokers? Check our detailed guide-

On the downside, immediate support lies at 0.7300 ahead of horizontal level and 50-period SMA at 0.7285. Meanwhile, on the upside, 0.7400 will be immediate resistance ahead of 4-month highs at 0.7440.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money