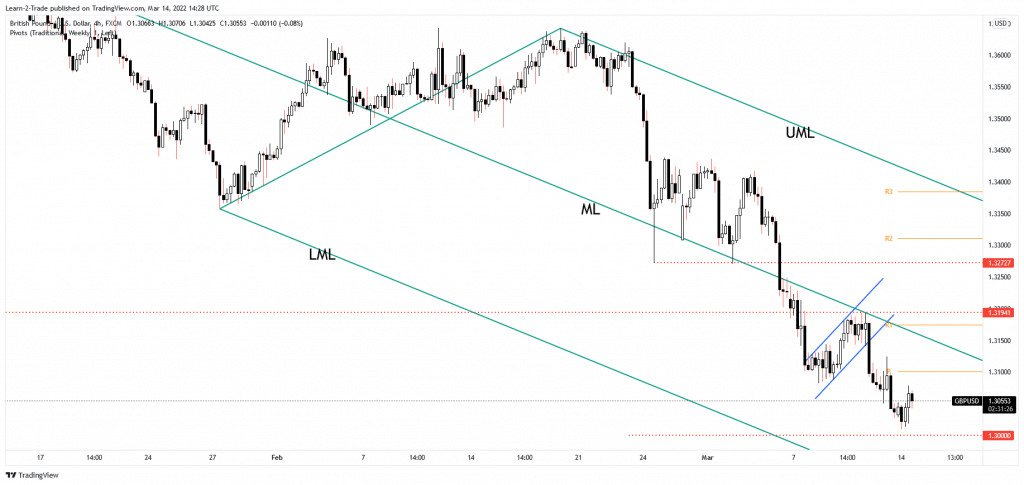

- The GBP/USD pair rebounded, but the price could drop deeper anytime.

- The rate could still approach the 1.3 psychological level as long as it stays under the median line (ML).

- Only a major reversal pattern might indicate that the downwards movement is over.

The GBP/USD price dropped as low as 1.3009 today, finding mild support. Technically, the bias remains bearish despite a temporary rebound. The pair could test the near-term upside obstacles before dropping deeper.

–Are you interested in learning more about making money with forex? Check our detailed guide-

The currency pair turned to the upside in the short term as the Dollar Index retreated after its strong rally. However, surprisingly or not, the GBP/USD pair dropped towards fresh lows even if the United Kingdom reported positive economic figures on Friday. The GDP, Manufacturing Production, Industrial Production, Index of Services, and the Construction Output reported better than expected data. On the contrary, the US Prelim UoM Consumer Sentiment was reported at 59.7 points below 61.4 expected on Friday.

Personally, I believe that the GBP/USD pair resumed its sell-off as the Federal Reserve is expected to hike rates on Wednesday. Earlier, the UK CB Leading Index rose by 0.2% in January versus 0.1% in December.

Tomorrow, the US PPI is seen as a high-impact indicator and is expected to report a 1.0% growth, while the Core PPI may report a 0.6% growth in February versus 0.8% in January. Also, the UK Unemployment Rate, Claimant Count Change, and the Average Earnings Index could bring some action as well.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

GBP/USD price technical analysis: Shallow rebound

As you can see on the 4-hour chart, the GBP/USD pair is fighting hard to go higher. Still, the bearish bias remains intact as long as it stays below the weekly pivot point of 1.3100 and under the descending pitchfork’s median line (ML). The price failed to reach the 1.3 psychological level, which is seen as a major downside target. Technically, the rebound could be only a temporary one. The current throwback helps the sellers to identify new short opportunities. As long as we don’t have a reversal pattern, we cannot talk about a strong upwards movement.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money