- The EUR/USD pair remains bullish after ending its temporary correction.

- Consolidating above the R1 may signal further growth.

- 0200 stands as a potential target.

The EUR/USD price turned to the upside again after ending yesterday’s mild drop. The pair is trading at 1.0153 at the time of writing. It seems determined to rally further.

-If you are interested in knowing about ETF brokers, then read our guidelines to get started-

In the short term, the bias remains bullish as the US dollar is in a corrective phase. Still, it remains to see how it will react as the US inflation data could shake the markets. As you already know, the US Consumer Price Index is expected to report a 0.1% drop in August versus the 0.0% growth in July, while the Core CPI may report a 0.3% growth in the last month versus the 0.3% growth in the previous reporting period.

Unfortunately for the Euro, the German ZEW Economic Sentiment came in at -61.9 points versus -59.4 points, while the Eurozone ZEW Economic Sentiment was reported at -60.7 points compared to -57.9 forecasts. In addition, the German Final CPI and the Italy Quarterly Unemployment Rate came in line with expectations.

Tomorrow, the PPI and the Core PPI could bring life to the EUR/USD pair, while on Thursday, the US retail sales could have a big impact.

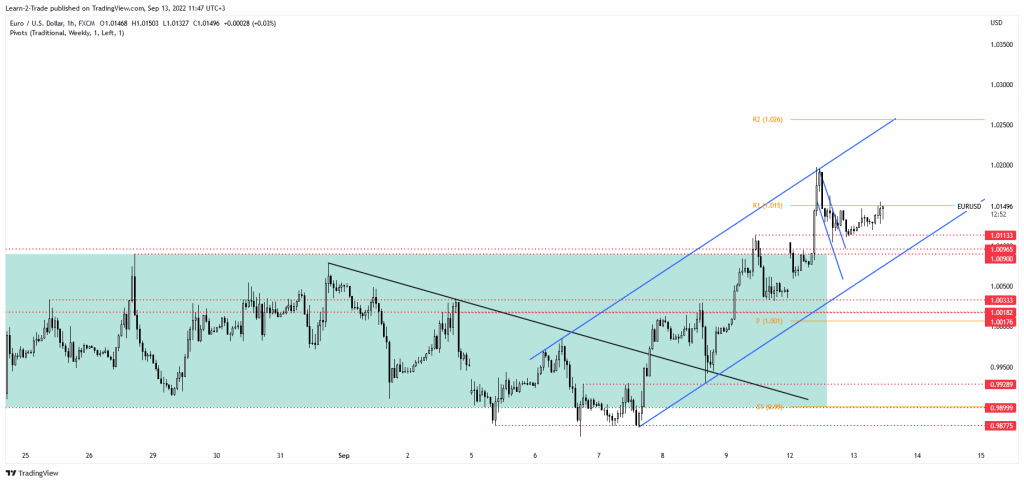

EUR/USD price technical analysis: Uptrend channel

Technically, the currency pair retreated a little after its strong rally. It tested the 1.0113, which is strong support for now. The price escaped from a minor flag pattern signaling a new bullish momentum.

-Are you looking for high leveraged forex brokers? Take a look at our detailed guideline to get started-

Now, it has jumped above the weekly R1 (1.0150), representing stiff resistance. Stabilizing above this broken obstacle may signal further growth towards 1.0197, yesterday’s high, and up to the 1.0200 psychological level. The channel’s upside line and the weekly R2 (1.0260) also represent upside obstacles.

The bias remains bullish as long as it stays above the ascending trendline. Its failure to reach and retest the uptrend line signaled strong upside pressure. Consolidating above the R1 could attract more buyers. Still, as long as the fundamentals will move the market, you must be careful. Anything could happen after the US inflation data is released.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.