- Traders reduced their expectations of immediate US interest rate cuts.

- The dollar benefited from its safe-haven status due to US debt ceiling uncertainties.

- Japan’s economy grew 1.6% annually in the January-March period.

Today’s USD/JPY price analysis is bullish. The dollar rose as traders reduced their expectations of immediate US interest rate cuts due to robust consumer spending data. Additionally, the dollar benefited from its safe-haven status as the risk of a US debt default persisted.

–Are you interested in learning more about day trading brokers? Check our detailed guide-

President Joe Biden and top congressional Republican Kevin McCarthy have made progress toward an agreement to raise the US debt ceiling, although nothing has been finalized.

While Biden cautioned that a default could lead to an economic recession, investors are concerned about the negative global impact. They. therefore, view the dollar as a haven. The solid growth in consumer spending in April and hawkish remarks from Federal Reserve officials have tempered expectations of imminent US interest rate cuts.

Chicago Fed President Austan Goolsbee stated that it was premature to discuss rate cuts. Cleveland Fed President Loretta Mester highlighted that the central bank could not hold rates steady at the current point due to persistent inflation.

According to government data released on Wednesday, Japan’s economy experienced a growth of 1.6% on an annualized basis in the January-March period. This growth was driven by strong private consumption and a surprising increase in capital expenditure, which counterbalanced the decline in external demand.

The first-quarter gross domestic product (GDP) figures exceeded economists’ median estimate of 0.7% annualized growth. The data also revealed a quarterly increase of 0.4% due to this expansion.

USD/JPY key events today

Investors will get the building permits report from the US, showing the state of the housing market. This report could add to recent data showing a slowdown in the US economy.

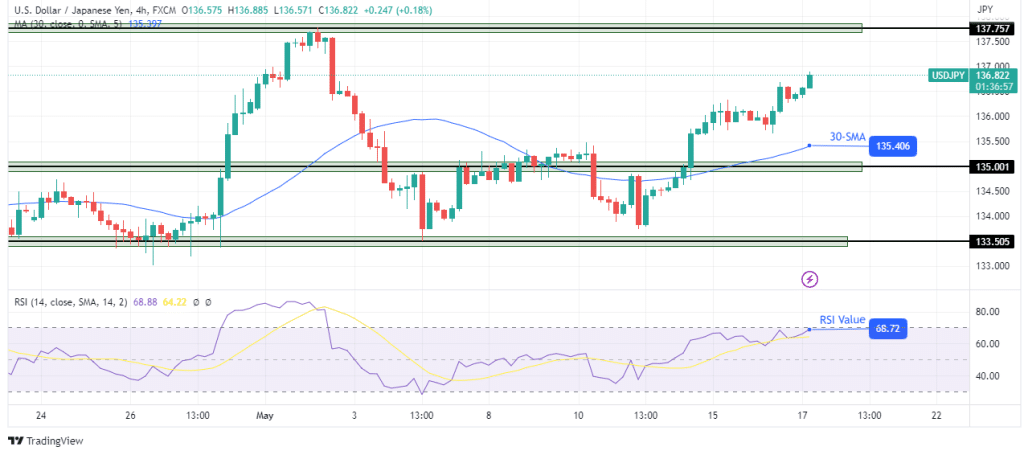

USD/JPY technical price analysis: Price targeting 137.75 resistance level

USD/JPY is rising quickly in the 4-hour chart. The price trades firmly above the 30-SMA after breaking above the 135.00 key level. The RSI is heading for the overbought region, indicating strong bullish momentum.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

Bulls are now looking to retest the 137.75 resistance level, and because of the bullish momentum, we might see the price break above this resistance to make new highs. The bullish bias will hold if the price stays above the 30-SMA.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.