- The dollar lost its safe-haven appeal as the US averted a debt default.

- Money markets currently assign a probability of around 29% for a June Fed hike.

- The Bank of Canada will likely maintain its key interest rate at 4.50%.

The USD/CAD weekly outlook is bearish as expectations of a pause in Fed rate hikes could put downward pressure on the dollar in the coming week.

–Are you interested in learning more about copy trading platforms? Check our detailed guide-

Ups and downs of USD/CAD

USD/CAD had a bearish week because the dollar lost its safe-haven appeal as the US averted a debt default. Additionally, the dollar fell as expectations for a Fed rate hike in June fell sharply. This came after Fed officials indicated that the Fed would pause this month.

Money markets currently assign a probability of around 29% for a June hike, which has decreased from nearly 70% earlier in the week. On Thursday, Philadelphia Fed President Patrick Harker stated that it was appropriate to pause for one meeting and assess the situation.

Furthermore, Fed Governor Philip Jefferson suggested pausing would enable the committee to gather more data. The dollar, however, recovered slightly on Friday after a jump in US employment figures.

Next week’s key events for USD/CAD

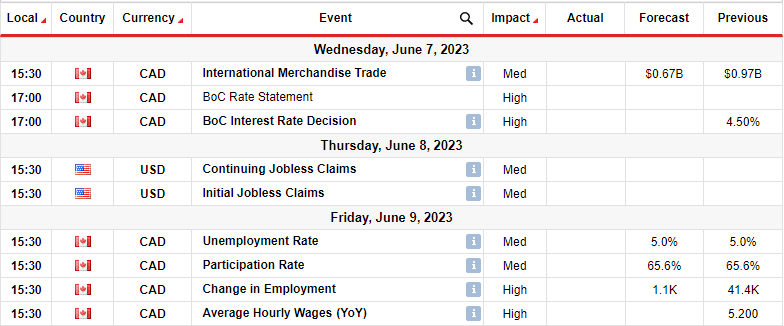

Next week, investors will watch the Bank of Canada policy meeting and employment data from Canada and the US. The focus will be on the policy meeting.

Notably, most economists surveyed by Reuters predict that the Bank of Canada will maintain its key interest rate at 4.50% throughout this year. However, they acknowledge a high possibility of at least one additional rate hike.

USD/CAD weekly technical outlook: Sticking close to 1.3500

The bias for USD/CAD on the daily chart is bearish because the price is below the 22-SMA, while the RSI shows solid bearish momentum below 50. However, the price moves sideways on a larger scale, oscillating between the 1.3351 support and the 1.3651 resistance levels. This is likely because the price is sticking close to the 1.3501 key level.

–Are you interested in learning more about scalping forex brokers? Check our detailed guide-

Currently, the price is trading below the 1.3501 level and the 22-SMA. Therefore, it will likely retest the range support at 1.3351. If bears are still strong at this level, we could see them break below the range support to continue the previous bearish trend.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money