- The Bank of Canada (BoC) maintained its key overnight rate at 5%.

- Canadian economic activity grew at its fastest pace in seven months in November.

- Canada recorded a larger-than-expected trade surplus of C$2.97 billion in October.

The USD/CAD forecast suggests a positive shift favoring the pair as the Canadian dollar weakens after the BoC’s decision to maintain rates. On Wednesday, the Bank of Canada (BoC) kept its key overnight rate at 5%. Still, the bank indicated the possibility of another hike. Additionally, the BOC expressed ongoing concerns about inflation.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Inflation in Canada fell to 3.1% in October, down from a peak of over 8% last year. However, it is still above the bank’s 2% target. Furthermore, the bank’s policy statement no longer included language from the previous policy about slow progress toward price stability and increased inflationary risks. Instead, the BOC highlighted that labor market pressures had gone down. Moreover, growth slowed in the middle of the year, indicating a drop in demand.

Meanwhile, the dollar has stabilized this month following a 3% decline in November. It is stronger because of increased speculation of rate cuts by other central banks. The dollar index was just below Wednesday’s two-week peak of 104.23.

On Wednesday, data revealed that US private payrolls rose less than anticipated in November, indicating a gradual cooling in the labor market.

Meanwhile, according to data released on Wednesday, Canadian economic activity grew at the fastest pace in seven months in November. Additionally, Statistics Canada reported a larger-than-expected trade surplus of C$2.97 billion ($2.19 billion) in October.

USD/CAD key events today

- US unemployment claims

USD/CAD technical forecast: Bearish trend gives way to bullish momentum

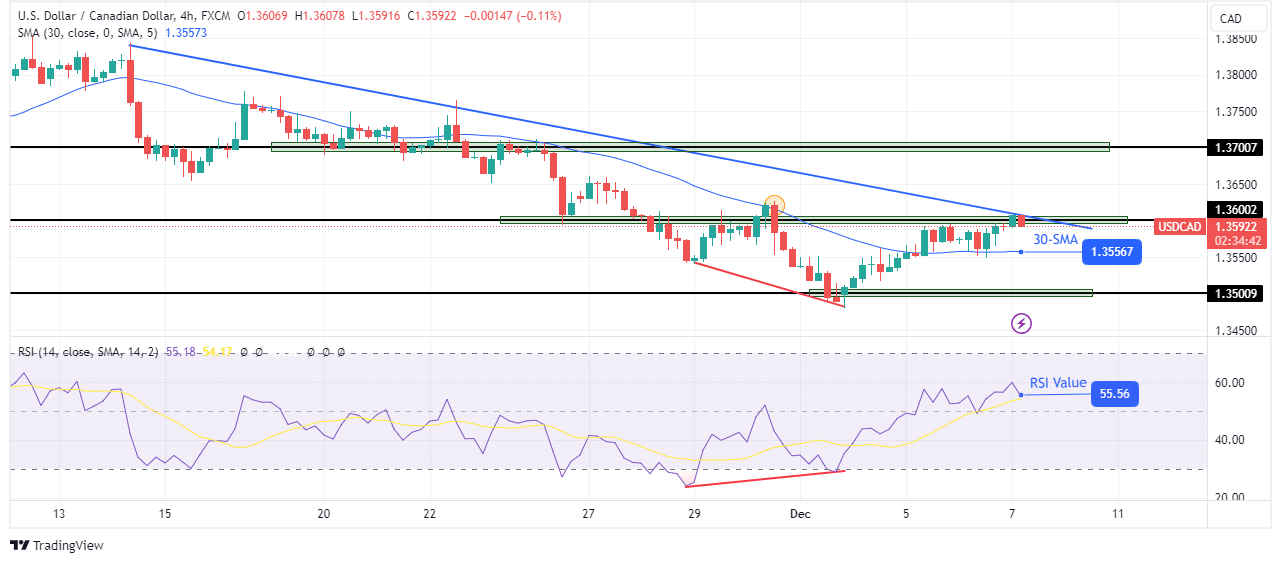

On the technical side, there has been a trend reversal from bearish to bullish. Buyers took charge at the 1.3500 support level after the RSI made a bullish divergence. Still, they did not show much strength at first. However, the price broke above the 30-SMA with a solid bullish candle. At the same time, the RSI crossed into bullish territory above 50.

-If you are interested in knowing about scalping forex brokers, then read our guidelines to get started-

However, the bullish move quickly paused at the 1.3600 key resistance level, leading to a consolidation. Moreover, the price is facing a strong resistance trendline. A break above this resistance zone would allow bulls to retest the 1.3700 key level. However, if the resistance holds, sellers might resume the downtrend.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.