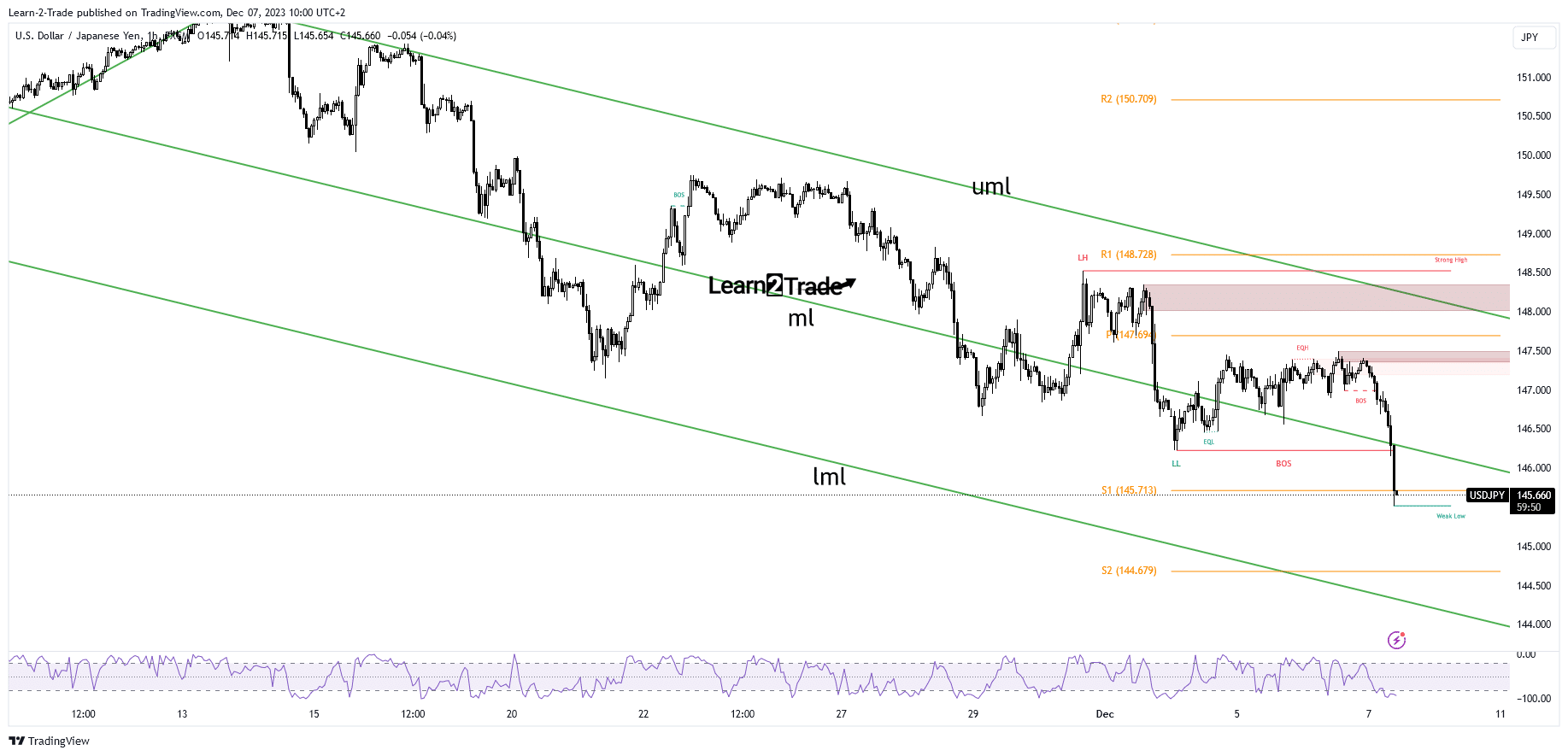

- The bias is bearish as long as it stays below the median line.

- The US and Japanese data should be decisive tomorrow.

- The S2 stands as a static support.

The USD/JPY price slumped well below yesterday’s low of 146.89. Fundamentally, the US dollar’s depreciation was expected after the US ADP Nonfarm Employment Change came in at 103K in November versus 131K expected, compared to 106K in October.

–Are you interested to learn more about forex options trading? Check our detailed guide-

In addition, the Trade Balance, Revised Nonfarm Productivity, and Revised Unit Labor Costs also reported poor data in the last session.

Today, the JPY received a helping hand from the Japanese Leading Indicators indicator, which came in at 108.7%, above the 108.2% expected.

Later, the US data could move the markets. The Unemployment Claims could jump from 218K to 221K in the last week. The data on Challenger Job Cuts, Consumer Credit, and Final Wholesale Inventories will also be released.

The fundamentals will be critical to watch as the US releases the NFP, Unemployment Rate, and Average Hourly Earnings tomorrow. At the same time, Japan publishes the Economy Watchers Sentiment, Final GDP, Current Account, Household Spending, and Average Cash Earnings data.

USD/JPY Price Technical Analysis: Key Level Breakout

From the technical point of view, the USD/JPY price plunged after failing to approach the weekly pivot point of 147.69 or the upper median line (uml). It came back below the median line (ml) and seems determined to hit new lows.

-If you are interested in knowing about scalping forex brokers, then read our guidelines to get started-

The 145.00 psychological level stands as the first downside target. In addition, the weekly S2 of 144.67 represents potential static support. As long as it stays below the median line (ml), the rate could approach and reach the lower median line (LML).

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.