- Robust economic indicators affirmed the strength of the US economy.

- There was a surge in business activity in the US services sector.

- Powell said rate cuts would be delayed until there was a clear indication that inflation was dropping.

In the GBP/USD outlook, the narrative unfolds with a bearish tone. Fueled by positive data, the dollar’s surge has cast a shadow over the pound. Monday witnessed a persistent downturn in the value of the pound as robust economic indicators affirmed the strength of the US economy.

–Are you interested in learning more about ETF brokers? Check our detailed guide-

Recent data from the US, including Friday’s jobs report, have led to a decline in expectations for early rate cuts in the US. As a result, the dollar has soared, putting pressure on the pound.

The decline in the currency finally pushed it out of consolidation. Therefore, if the dollar rally continues, this might start a bear market for the pair. Initially, the pound had strengthened as investors had expected earlier rate cuts in the US compared to the UK. However, that narrative has changed as the US plans to delay rate cuts.

On Monday, data from the US showed a surge in business activity in the services sector. Notably, the ISM non-manufacturing PMI recorded another month of expansion.

Furthermore, on Sunday, Powell said rate cuts would be delayed until there was a clear indication that inflation would fall to the 2% target. These remarks contributed to a surge in the dollar and Treasury yields.

In the UK, the Bank of England maintained interest rates last week. However, policymakers signaled the possibility of cutting rates if inflation drops as expected.

GBP/USD key events today

Traders do not expect any major economic reports from the UK or the US today. Therefore, they will keep digesting recent reports.

GBP/USD technical outlook: Solid bearish momentum ends price consolidation

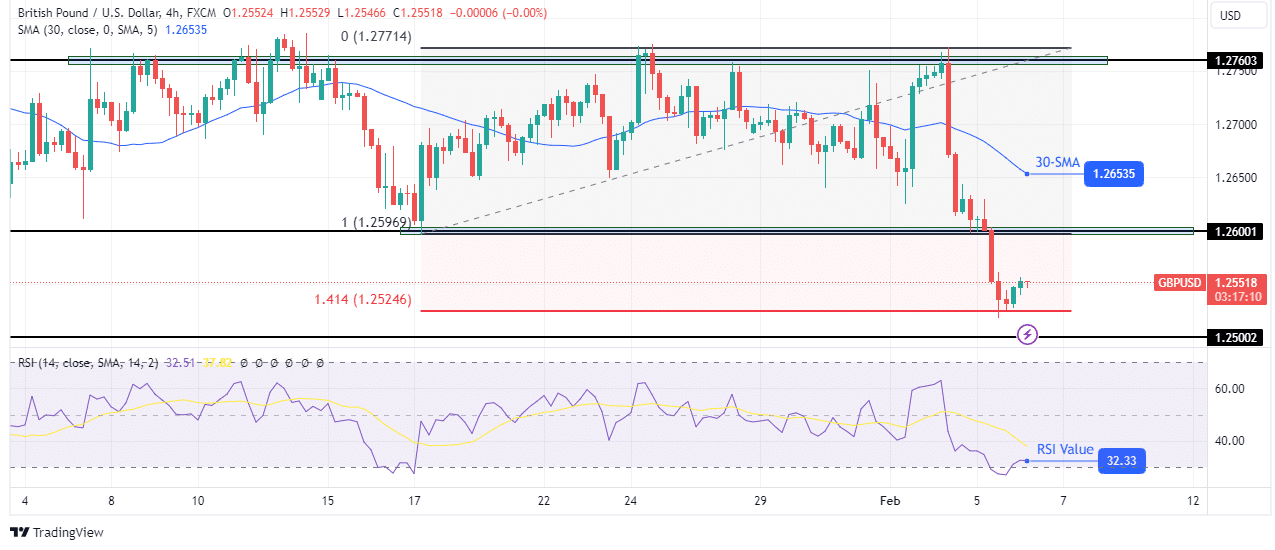

On the technical side, the pound has plummeted from the 1.2760 key resistance level to the 1.414 fib extension level. The decline saw the price break below the key 1.2600 support level, indicating solid bearish momentum.

–Are you interested in learning more about Canada forex brokers? Check our detailed guide-

For a long time, the price has traded between the 1.2760 resistance level and the 1.2600 support. Therefore, the solid bearish momentum has finally pushed the price out of this consolidation area. Moreover, this might be the beginning of a bearish trend. Currently, the price has paused at the 1.414 fib level and might pull back to retest the 1.2600 level before the downtrend continues.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money