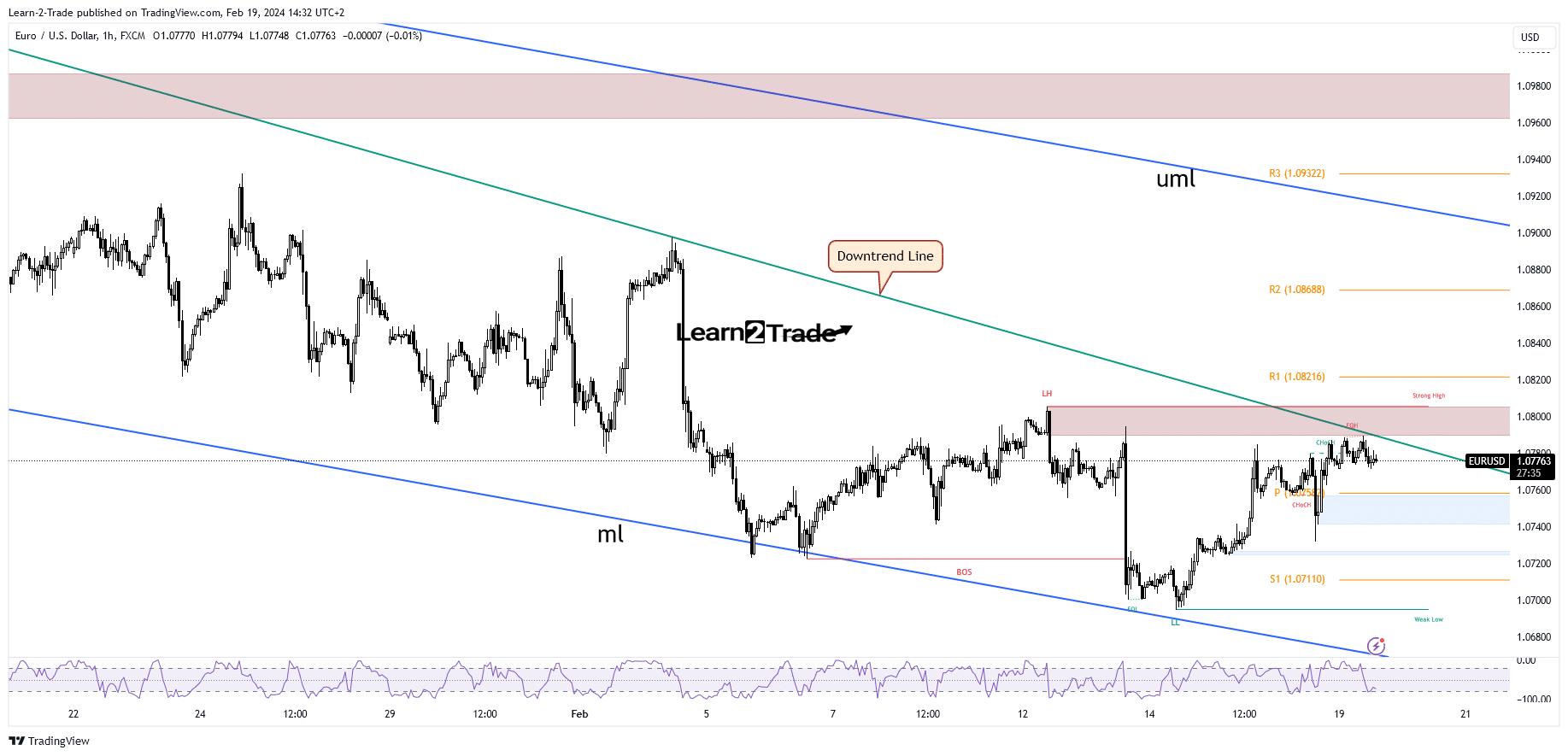

- Taking out the downtrend line activates larger growth.

- The Canadian inflation data should have an impact tomorrow.

- The bias remains bearish as long as it stays below the downtrend line.

The EUR/USD price rebounded in the short term as the US dollar entered a corrective phase. The pair is trading at 1.0771 at the time of writing.

The bias remains bearish despite the current leg higher. The pair moved down after a rally amid profit-taking. On Friday, the PPI rose by 0.3%, beating the 0.1% growth expected, Core PPI reported a 0.5% growth, exceeding the 0.1% growth forecasted, and the Prelim UoM Consumer Sentiment came in at 79.6 points compared to 80.0 points estimated.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

Today, the Canadian IPPI came in line with expectations while the RMPI rose by 1.2%, more compared to the 0.7% growth estimated.

Tomorrow, the Canadian inflation data should have a big impact on the USD. The CPI is expected to report 0.4% growth. On the other hand, the Eurozone Current Account could drop from 24.6B to 20.3 B.

Furthermore, the FOMC Meeting Minutes could change the sentiment on Wednesday, while the manufacturing and services figures should move the price on Thursday.

EUR/USD Price Technical Analysis: Downtrend Intact

Technically, the EUR/USD price developed a new leg higher after failing to retest the median line (ml), and now it was almost reaching the downtrend line.

–Are you interested to learn more about forex signals? Check our detailed guide-

As long as the pair stays below it, the bias remains bearish. Testing it or registering false breakouts may announce a new downside movement. Also, failing to reach this dynamic resistance indicates exhausted buyers.

The weekly pivot point of 1.0758 stands as a static support. Taking out the downtrend line validates a larger swing higher. The 1.08 psychological level represents a key upside obstacle as well.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.