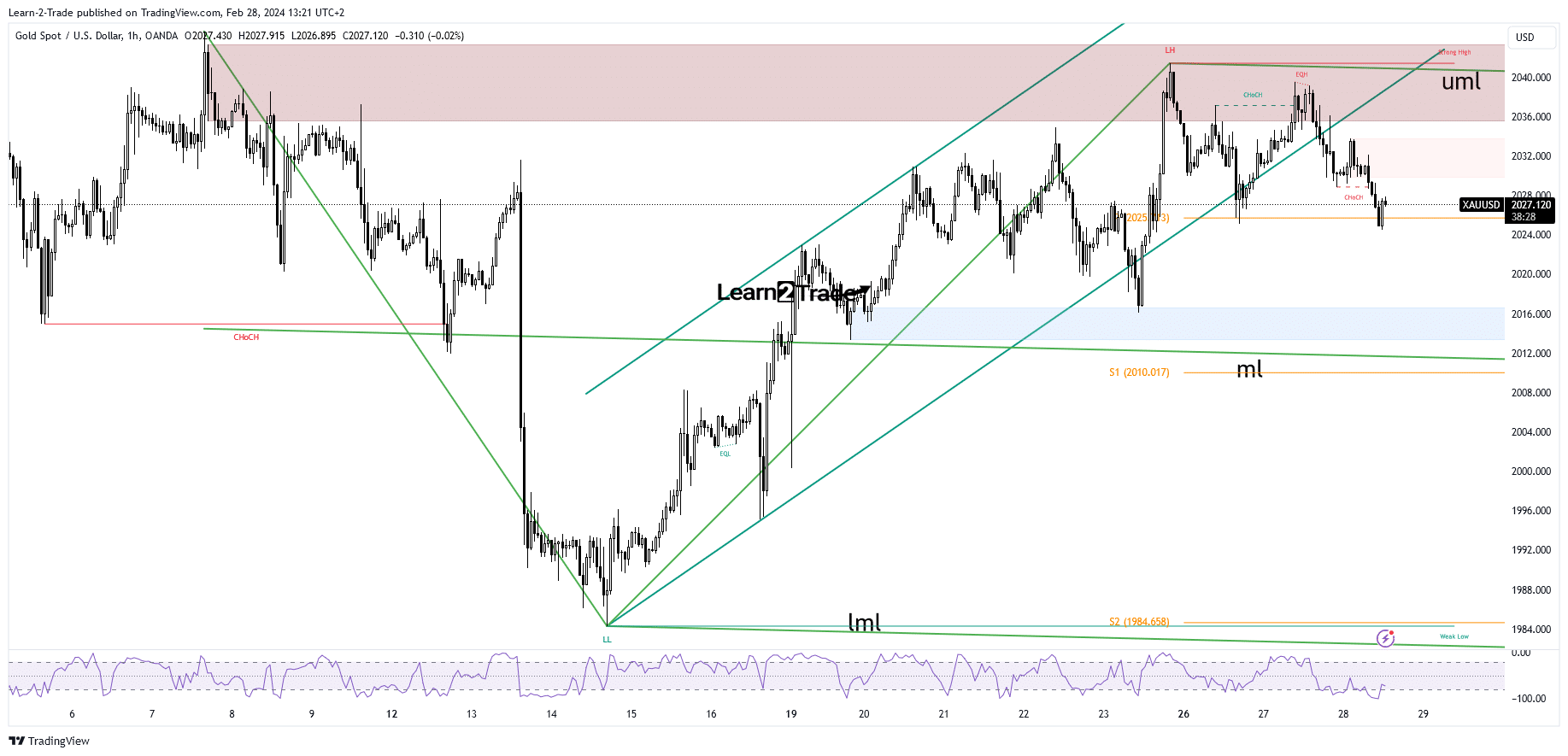

- A new lower low activates a deeper drop.

- The US data could bring some action.

- Escaping from the up channel signaled a new leg down.

The gold price turned down and is trading at $2027 at the time of writing. The US dollar’s rally weighed down the precious metal. The yellow metal dropped even though the US reported poor economic data.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

The Durable Goods Orders, Core Durable Goods Orders, Richmond Manufacturing Index, and CB Consumer Confidence were worse than expected in the last session. Also, today, the Australian Consumer Price Index reported a 3.4% growth, even though analysts had expected a 3.6% growth.

In addition, the RBNZ left the Official Cash Rate at 5.50%, as expected. Later, the United States’ economic figures should shake the markets.

The Prelim GDP is expected to report a 3.3% growth, the Prelim GDP Price Index may reveal a 1.5% growth, the Goods Trade Balance could drop to -88.4B, while Prelim Wholesale Inventories should result in a 0.1% growth.

Positive economic data can help the greenback appreciate and may push the XAU/USD toward new lows. Only poor data should help gold to hit new highs.

Gold Price Technical Analysis: Leg Down

XAU/USD climbed as high as $2041, where it found resistance. It has escaped from the up channel pattern (flag formation), signaling a new leg down.

–Are you interested to learn more about forex signals? Check our detailed guide-

The price could come back down to test the support levels, trying to accumulate new bullish energy before jumping higher.

The weekly pivot point of $2025 paused the sell-off, and now it is trying to rebound and recover. The false breakdown announced exhausted sellers. So, only a new lower low could activate a significant downside movement.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.